The transaction fee represents the cost of the service that users pay for the use of network power. Here’s how Bitcoin fees work.

The Bitcoin blockchain with its current 115 EtaHash/sec (i.e. 115 billion billion hashes per second) makes sure that it is too expensive to carry out an attack on the network.

This networking power is maintained by miners, who receive a reward (mining reward or block reward) whenever they find a valid block and add it to the Bitcoin blockchain. Transaction fees are the second form of profit for miners.

The transaction fee is not a predetermined value but is decided by the sender of the transaction depending on the network traffic at that time. Although from the point of view of Bitcoin’s code, providing transaction fees is not required for the completion of a transaction, they give miners an incentive to consider one transaction rather than another.

The mempool

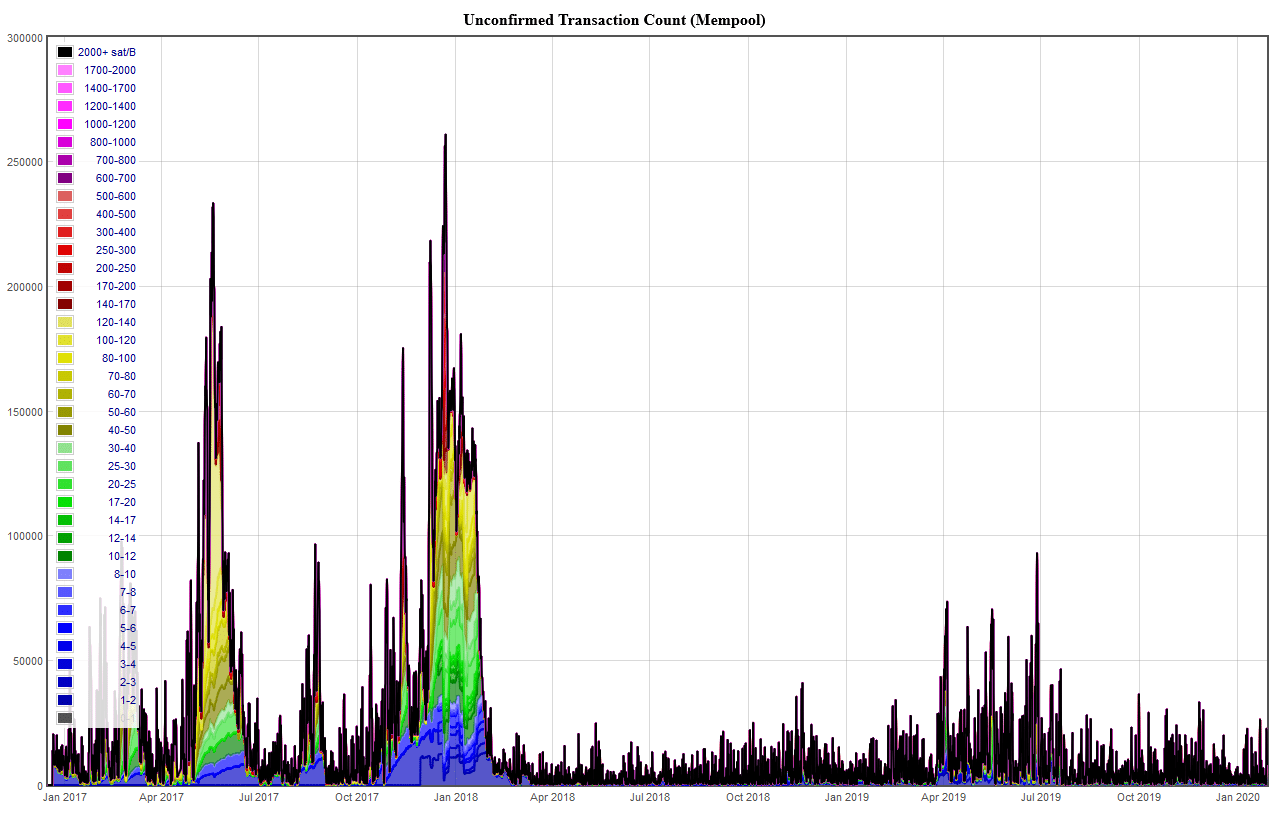

When a transaction is transmitted to the network, it is first verified by all available nodes. Once a node has passed verification, the transaction is placed within the mempool, short for memory pool, a kind of waiting room for unconfirmed transactions.

Since Bitcoin blocks are limited in size, it is the miners who choose which transactions to fill the block with. In order to maximize profits, the transactions that pay the highest fees are chosen, while those with lower fees are left in the mempool. As the number of transactions transmitted to the network increases, the size of the mempool increases.

Why do Bitcoin fees increase?

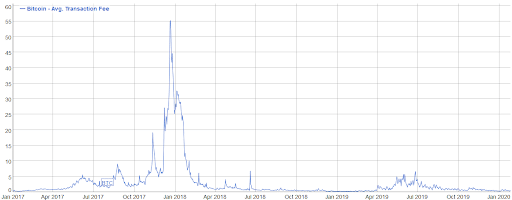

In essence, Bitcoin’s transaction fees increase as the number of transactions increases.

The fees for a Bitcoin transaction reached $55 at the end of 2017 when Bitcoin peaked at almost $20,000.

Each node has a different mempool capacity and when it gets overloaded, it starts prioritizing transactions by setting a minimum transaction fee threshold. New transactions can only enter the mempool if they meet the new limit.

How are Bitcoin fees calculated?

Bitcoin wallets calculate the fee by looking at the amount of “traffic” (the number of transactions in the mempool) and the speed at which they are placed in a block based on the transaction fee.

Since blocks are limited in size, fees are calculated in Satoshi per byte, thus multiplying the average fee at the time of the transaction by the byte size of the transaction (e.g., multiple bytes are required for multisig transactions).

For example: With a transaction size of 250 bytes and an average fee of 400 Satoshi/bytes, the fee will be 250 X 400 or 100,000 Satoshi. This allows a good chance to be included in the next block.

Bitcoin fees and the halving

It is worth remembering that when the block reward decreases, transaction fees may increase if the miners are aiming for the same profit. With the next halving scheduled for May 9th, 2020, which will reduce the block reward from BTC 12.5 to BTC 6.25, there could then be an increase in transaction costs.

Halving after halving, as block rewards approach zero, transaction fees will become the main source of revenue for miners.

This also raises concerns about the negative impact that second-tier scaling solutions could have. These solutions include Lightning Network and Liquid, which do not pay transaction fees on the Bitcoin network except for opening/closing a channel or for peg-in and peg-out transactions.