Crypto assets are taxed in the UK, but how?

Tax evasion is a serious crime. However, you can only pay your tax when you know you should.

Crypto investors and traders in the UK have been required to pay taxes in recent years. Her Majesty’s Revenue and Customs (HMRC) – the tax collection body in the UK – released a policy paper on how these taxes are to be paid and in what cases they apply.

Due to recent happenings, HMRC certainly takes a serious view of crypto taxes. Sometime in 2018, the Crypto Assets Task Force submitted a special report to the HMRC, and that led to a release of the tax guidance.

Also, the body made various inquiries from Coinbase and other top cryptocurrency exchanges in 2019 requesting for details of crypto investors from the UK.

How does the HMRC view crypto assets

Cryptocurrencies are digital currencies that exist on a blockchain. But, the HMRC views cryptocurrencies as assets (crypto-assets), and to them, it is a relatively new type of asset. The body does not view cryptocurrencies as money or any form of currency.

Tax focus is placed on three types of crypto-assets, which are utility tokens, security tokens, and exchange tokens. This covers almost any form in which cryptocurrencies exist, can be used or transferred.

However, the tax treatment is currently available for only exchange tokens, which are the coins you know – BTC, ETH, XRP, LTC, etc. Besides, the taxation processes are not based on what type of token but rather the way it is used.

When do you need to pay taxes?

According to the HMRC, you only need to pay capital gain taxes when you sell off your cryptocurrencies. This involves exchanging cryptocurrencies for fiat currencies (USD, GBP, EUR, etc.) and exchanging a particular cryptocurrency for another (BTC to ETH, BTC to LTC, ETH to XRP, etc.).

It also involves sending cryptocurrencies to other people whom you are not affiliated with in any way (they are not your civil partner, spouse, or family member). In such a transaction, it is assumed that an offline payment for the cryptocurrency has been made. You do not need to pay tax when you gift cryptocurrencies to family members or spouses. Tax payment is also exempted when making crypto donations for charity or similar situations.

Businesses whose objectives involve trading cryptocurrency are also liable for tax payment based on their profits. This includes crypto exchanges and trading platforms operating in the UK. The taxation is somewhat synonymous to businesses whose business is to trade financial instruments such as shares and securities.

Other instances when you need to pay taxes include mining, staking, and receiving airdrops. This implies that you get to pay taxes if you are getting any income from cryptocurrency exchanging, especially when the value changes.

Factors That Determine Tax Amount

In the UK, two factors determine the tax amount that you pay. These are the marginal tax rate and your income tax bracket. However, an £12,500 exemption limit is imposed whether from your earnings or the profits you make from selling cryptocurrencies.

Nevertheless, crypto transactions with capital gains less than £12,500 require no tax payment. But, selling multiple cryptocurrencies (with actual capital gains less than the exemption limit individually) resulting in an amount about four times of £12,500 will require capital gains tax payment. Please note that you if you do not buy directly cryptocurrencies but just merely speculate on their prices via CFDs (for instance like what offers a popular CFD broker IQ Option UK), other taxation methods may apply to you.

How is tax amount calculated?

Pooling ensures a simplified process for calculating crypto capital gains tax amount under the UK section 104 Taxation of Capital Gains Act 1992. This calculating method is usually associated with any assets that are dealt with anonymously i.e., the particular assets acquired or disposed of are not identified.

Pooling involves separating each crypto asset type a person might own into different pools. Assuming you invest in BTC, LTC, and ETH, that is three pools. Each pool has an allowable cost that changes as the crypto-assets are exchanged. The allowable cost is deducted from the total asset amount derived at the end of a tax year to reveal the gain. Tax is charged from this gain.

Example 1:

In March 2020, Mr. X from the UK purchases 3 BTC for £18,500. By January 2023, he sells off the 3 BTC for £25,500. His £7,000 profit will not be taxed considering that the amount is under the tax exemption limit – less than £12,500.

Example 2:

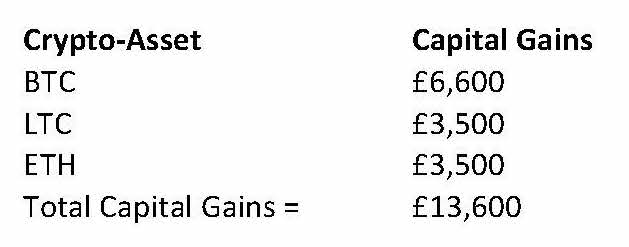

In April 2018, Miss Ann an entrepreneur based in London purchases 4 BTC for £24,400, 400 LTC for £15,000, and 200 ETH for £28,000. By December 2020, she sold 4 BTC for £31,000, 200 LTC for £11,000, and 150 ETH for £24,500.

Here are her capital gains:

Therefore, her tax payment will be 20% of £13,600 which is £2,720.

Note: The same crypto-assets can be separated from the main pool following the same day and 30 days of special pooling rules. As such, they are calculated separately with different allowable costs.

What Should You Do?

As a crypto trader or investor, it is imperative that you correctly record all transactions you make with digital currencies. The tax amounts are mainly based on the value of the cryptocurrency when it was transacted. Cryptocurrency value is very volatile, and without initial recording, calculating the tax value when it’s time for payment can be difficult. Consequently, you might end up paying higher than you are supposed to.

Crypto exchange platforms often record and save all users’ crypto transactions for such references. You can rely on them, or you do the recording yourself using any convenient record-keeping tool.

Bottom line – how are cryptocurrencies taxed in the UK

Gone are the days when the government had no interest in what happened in the crypto world. In the UK, it is necessary to pay taxes for cryptocurrencies that you sell for profit.

Traders and investors are liable for tax payment in the UK and other countries in Europe. If you engage in crypto transactions in the UK, your tax returns should be up-to-date to avoid facing government sanctions.