SPONSORED POST

Unless you’ve been hiding under a rock over the last year then you will have heard of Decentralized Finance, often abbreviated to DeFi, the next step in the evolution of digital banking that already accounts for more than $6 billion in crypto assets.

Put simply, it is an electronic financial ecosystem that runs on a smart contract blockchain. In contrast to traditional banking institutions blockchain-based DeFi solutions are fully automated. As a result, they require no human intervention, as the smart contracts allow for instant execution, the second pre-programmed conditions are met.

Utilizing blockchain for Decentralized Finance applications ensures that the technology is accessible to everyone with access to the internet.

DeFi represents a genuine democratization of finance, but how does this differ from other blockchain-based initiatives over the last few years?

The answer is that DeFi applications, or dapps, are able to make new contributions to the global financial sector. They are incredibly versatile, enabling you to perform multiple functions, including:

- borrowing,

- loaning capital to earn interest,

- exchanging assets,

- insurance,

- storing assets,

- trading,

- more.

Dapps are highly cost effective, requiring no middlemen or needless bureaucracy. Safeguarded by heavy encryption, they are able to provide financial services at incredible speed. They offer financial autonomy to populations that have historically had no access to banking services, since without all the intermediaries Defi applications can afford to reach and service the previously unbanked.

Dapps are most commonly used for lending and borrowing digital currencies. The process is exceptionally straightforward, as you can interface directly with the smart contract from your crypto wallet. Using open source code, DeFi solutions are completely transparent, with transactions published on the blockchain, enabling you to verify the reserves of DeFi banks and find the best loan rates.

The tradability of DeFi is another beneficial characteristic. Through tokenization, DeFi applications can enable you to invest even if you don’t have hundreds of thousands of dollars in spare capital, as you can simply purchase tradable tokens that represent a portion of a larger high value investment.

The use of blockchain for Decentralized Finance also means that there is no single, centralized entity, such as a governmental body, corporation, bank or other financial institution controlling transactions between parties or the movement of assets.

How can DeFi help me earn sizable passive profits?

One of the most exciting developments in DeFi is the way in which decentralized applications can be harnessed by yield farmers to generate unparalleled returns. Dapps offer a speed and flexibility that enable you to make profits far higher than those offered by almost any other investment opportunity. While traditional means of growing your capital such as real estate or the stock market may provide healthy returns, the annual percentage yield from DeFi solutions can be far greater. So too, for those who already hold cryptocurrencies, dapp products and protocols can offer substantially higher returns than a regular crypto wallet that simply secures your funds, while they sit idle.

As opposed to simply investing in Bitcoin, Ripple or Ethereum, yield farmers are leveraging the technological advantages of blockchain for Decentralized Finance to become liquidity providers.

They allow DeFi applications to borrow their crypto capital at exceptionally high rates of interest and the company will then use those funds to trade or to offer loans to other users. Everybody wins, as the company gains liquidity and the user earns sky-high returns on their crypto.

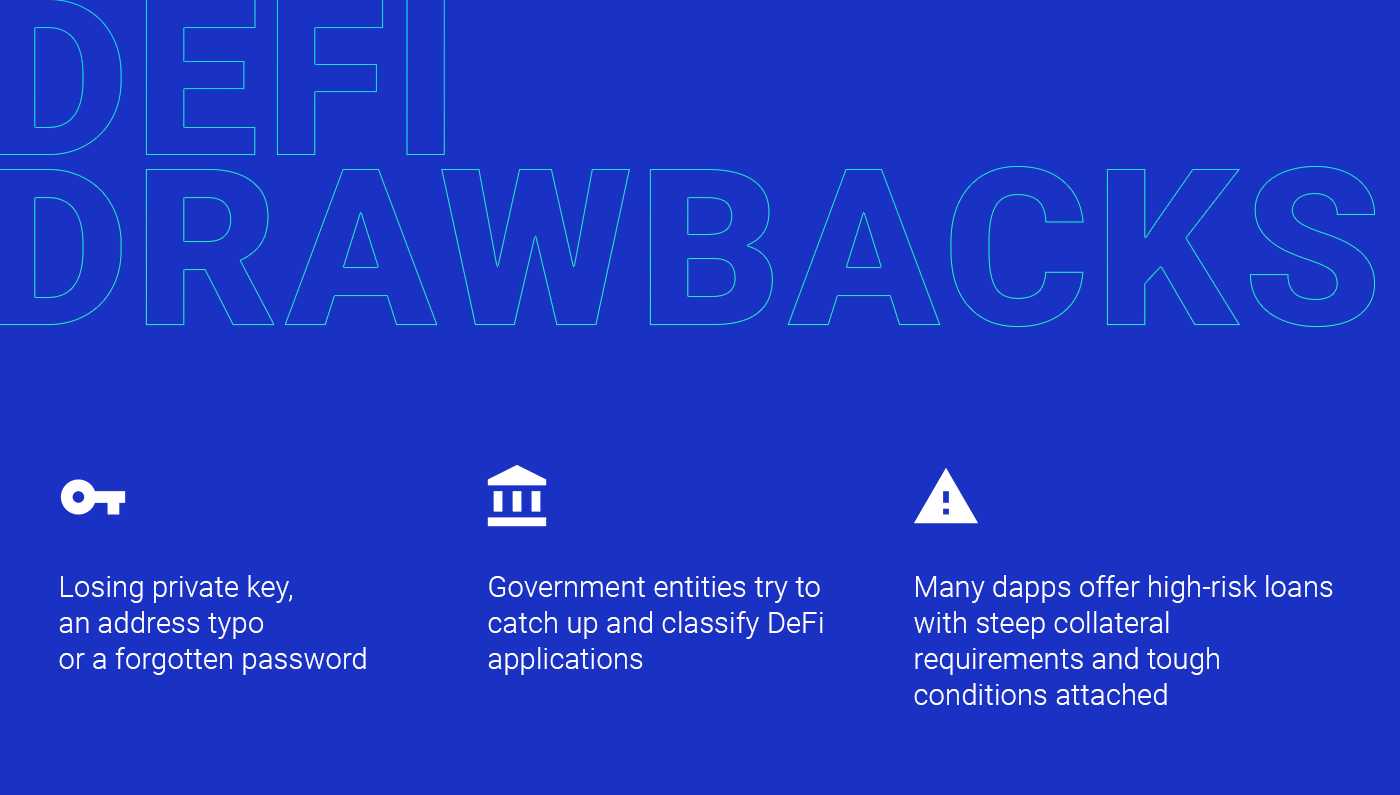

What are the Drawbacks of DeFi?

We’ve now defined DeFi and examined some of the clear advantages of a digital banking system that is fast, efficient and flexible. However the disadvantages of blockchain for Decentralized Finance should not be dismissed out of hand.

Firstly, as with many forms of crypto investment, there is always a danger of losing your crypto forever. Because you have complete control of your digital assets, a lost private key, an address typo or a forgotten password can mean that you lose your money forever.

Secondly, as crypto represents a still emerging asset class, the regulatory status of your investment may remain undecided for the foreseeable future, while government entities try to catch up and classify DeFi applications.

Additionally, many dApps offer high-risk loans with steep collateral requirements and tough conditions attached. For example, if the value of the coin that the crypto holder has offered as collateral drops to below a certain threshold then their funds are liquidated completely and they lose all of their capital.

Finally, smart contracts are open to forms of attack that do not exist in traditional financial ecosystems. In the first half of 2020 there were already at least five major hacks on DeFi applications that led to significant losses.

DeFi Meets CeFi: A Winning Formula

In light of the issues that have yet to be resolved in the DeFi arena many investors are recognizing that the best way forward is to combine the best aspects of DeFi with the benefits of a more traditional, Centralized Finance (CeFi) approach.

One of the best examples is ArbiSmart that is offering the best of both worlds, with a hybrid system that delivers the accessibility, privacy, cost efficiency and speed of blockchain alongside the added layers of security that come with a CeFi platform’s human oversight, rigorous regulation and risk management protocols.

ArbiSmart uses AI-based algorithmic software on a fully automated crypto-arbitrage platform that offers exceptionally low-risk, high-return investing.

Arbitrage involves buying an asset on one market at a low price and then selling it on another platform at a higher price for a profit. On the crypto exchanges, a coin can temporarily be offered at different prices on various exchanges at the same time.

The ArbiSmart system automatically scans over twenty exchanges simultaneously to find the lowest purchase price for a cryptocurrency. It buys the coin where the price is the lowest and then immediately sells it on the exchange where the price is highest to earn a profit on the spread before the price discrepancy gets resolved.

Arbismart provides returns of up to 45% a year, far higher than any legitimate competitor in the DeFi space, where the average return is approximately 12% per annum.

Although ArbiSmart is automated, they offer one of the major advantages of CeFi, by having an expert risk management team overseeing the platform and monitoring the markets around the clock. This enables them to minimize exposure by allowing for human intervention in instances of extreme crypto market upheaval, thereby mitigating a lot of the risk associated with fully automated DeFi applications. Personal, human support is also available 24 hours a day both from dedicated account managers as well as via email, phone, Viber, Telegram, Messenger and Whatsapp. Unlike with completely decentralized financial applications, ArbiSmart can assist in the case of lost access. Users can always reset their passwords, and keys cannot be lost, ensuring they can always regain access to their account balance.

In addition, Arbismart has implemented a series of strict security measures that don’t leave the system as exposed to hacks as DeFi open source systems. ArbiSmart is also fully EU licensed, ensuring that the company is frequently audited, implements AML and KYC protocols, to safeguard against fraud and undergoes high-level data security checks. Also, if there ever were a hack, as a regulated company ArbiSmart has an internal emergency insurance fund to cover all operational capital and protect users against loss.

Another way in which ArbiSmart is a more secure option than its purely DeFi competitors is that it does not offer high risk, over-collateralized loans in a market characterized by high volatility. Unlike many decentralized apps, ArbiSmart does not expose crypto owners to significant losses from market fluctuations. Not only is it impossible for a price shift to lead to the loss of all of your funds but the rising value of RBIS, ArbiSmart’s native token means you can actually earn exceptional capital gains.

As soon as a user registers with ArbiSmart, their capital is converted into RBIS to be used by the automated platform. At any point, the user can choose to either withdraw their passive profits in BTC, ETH, or EUR, or reinvest them to earn compound interest.

In the year and a half since its introduction, the RBIS token has risen by 120% and it is continuing to steadily go up in value. In fact, if it continues on its current path, the coin is projected to go up by 3,000% by the end of 2021. This upward trajectory is not only due to the increasing popularity of the platform, but also to a focus on product development.

The latest addition to ArbiSmart’s financial products and services is our EU licensed interest bearing wallet, which offers interest rates that can exceed 45% a year.

As with many DeFi products, in return for providing liquidity, you can benefit from a high yield on your investment. Closed accounts earn a better return, with an extended lock on the savings generating a higher interest rate and for funds converted into RBIS, the yield is even greater.

DeFi clearly has a lot to offer as an innovative development in online financial management. Returns can be exceptional and the system is fast, accessible and versatile. However, users may be exposing themselves to higher risks, as well as lack of oversight and protection.

Companies like ArbiSmart are meeting the needs of the crypto community like never before. With a hybrid approach that takes the best aspects of both the traditional and more disruptive financial systems, we are able to offer unmatched security, efficiency and profitability to every type of crypto investor.

To learn more about ArbiSmart, check out the company website, or open an account directly.