Sponsored post*

The Bitcoin market has been soaring, with a current price equivalent to over 25,000 USD. It remains a great source of investment even for those who didn’t get in on the ground floor and only hold a few Bitcoin.

There are a number of ways to invest with Bitcoin, but they normally fall into one of two categories: Fast and high but risky, or slow and low but safe.

The first type of investing would include options such as short-term trading. This involves the rapid purchase and sale of digital currencies to take advantage of extreme Bitcoin exchange volatility over minutes, hours or a days. This is an incredibly high-risk form of investing that has the potential to generate huge profits in no time at all, but it can also wipe out your savings with a keystroke.

A perfect example of the second type investment is HODLing. For those who bought Bitcoin a decade ago, this has indeed worked out well and those lucky few are now millionaires. HODLing, is often said to stand for the phrase “Holding on for Dear Life” and refers to the strategy of buying Bitcoin and holding on to it for the long term, to ride out crypto market volatility with its dramatic peaks and troughs and wait for it to steadily appreciate over time.

This is probably one of the safest options with Bitcoin but would be a lot more expensive to try today. Not only is this a slow way to earn a return, but it also means that your money is sitting idle and not working on your behalf.

There is of course another route you can take that offers generous, rapid returns at close to zero risk.

The Best of Both Bitcoin Worlds

These days, particularly with all the current economic uncertainty, many people are looking for a low-risk strategy, and in an ideal world, they don’t want to have to compromise on profits. The best way to do that is with crypto arbitrage.

Crypto arbitrage enables you to profit from crypto exchange price inefficiencies. There are short windows of time in which a cryptocurrency will be available at different prices at the same time, across multiple exchanges. So, to profit from this temporary phenomenon, you can buy the coin on the exchange where the price is lowest and then immediately sell it on the exchange where the price is the highest to make the best possible return. To manage all this before the window of opportunity closes, you need to use an automated platform to achieve the required speed and have the necessary functionality to perform multiple tasks at once.

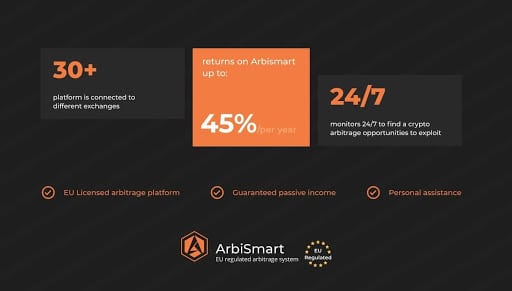

To gain a better understanding of how it all works, let’s look at ArbiSmart, an EU licensed, crypto arbitrage platform. The platform is connected to 35 different exchanges, which it monitors 24/7 to find crypto arbitrage opportunities to exploit, executing a large volume of trades simultaneously. The platform is fully automated, so you just sign up, deposit fiat or crypto, and the platform will then take over, identifying and taking advantage of crypto exchange price inefficiencies, to generate returns of up to 45% a year.

What are the Dangers to Your Bitcoin?

While crypto arbitrage involves only minimal exposure, the second you start trading with your Bitcoin, you are opening yourself up to a degree of risk. This is primarily because there are certain dangers that accompany investing in an emerging asset class in an under-regulated market.

Crypto assets are still in the process of being categorized and legislated by different governments around the world, so as a result, questions relating to taxation on crypto earnings and issues of consumer protections are still being ironed out. Also, due to the anonymity, speed and decentralization of the crypto space, it has attracted a criminal element that is finding ways to take advantage of unwary investors, through hacking and fraud.

Want to know how to protect yourself? Do your homework and find out everything you can about whichever platform you choose to invest with. This will involve reading through coverage in major crypto publications, looking at online discussions of the platform on social channels like Twitter, Telegram and Reddit and checking out consumer review site ratings. You will also need to see how accessible the company’s service and support is. If you have a time sensitive issue, or have difficulty withdrawing your funds, you will want to be able to speak to someone directly, straight away. Accountability is essential if you are going to hand over your crypto capital to complete strangers. Finally, and most important of all, you should only be trading with a fully licensed and regulated crypto arbitrage platform. This is non-negotiable. If they are not regulated – RUN!

ArbiSmart, for example, is FIU licensed, meaning that it has to comply with the strictest EU regulations relating to data security protocols, external auditing, anti-money laundering measures, adequate operational capital, client account protections and more. Once you dig a little deeper, the company has a strong online presence with consistently good community feedback, a 4.3/5 TrustPilot rating and a steady stream of positive press coverage. Finally, the ArbiSmart support team is available via a wide selection of channels, from Telegram, Twitter and Messenger, to email phone and WhatsApp. All this makes ArbiSmart a reliable crypto arbitrage platform, but none of that matters if the company doesn’t deliver profits.

When Can You Start to Cash in on Your Crypto?

Crypto arbitrage has become so incredibly popular in the last couple of years because it not only cuts risks down to close to zero, as crypto market volatility doesn’t impact your earnings, but it also generates revenue. At ArbiSmart, depending on the amount you deposit, you can earn guaranteed returns reaching up to 45% year. You can see exactly how much you are going to make per month and per year, in advance by looking at the company account page, or you can use their investment calculator to see how much you can earn from your deposit sum over a given time frame, or how much you need to deposit in order to reach your profit target in a specific period.

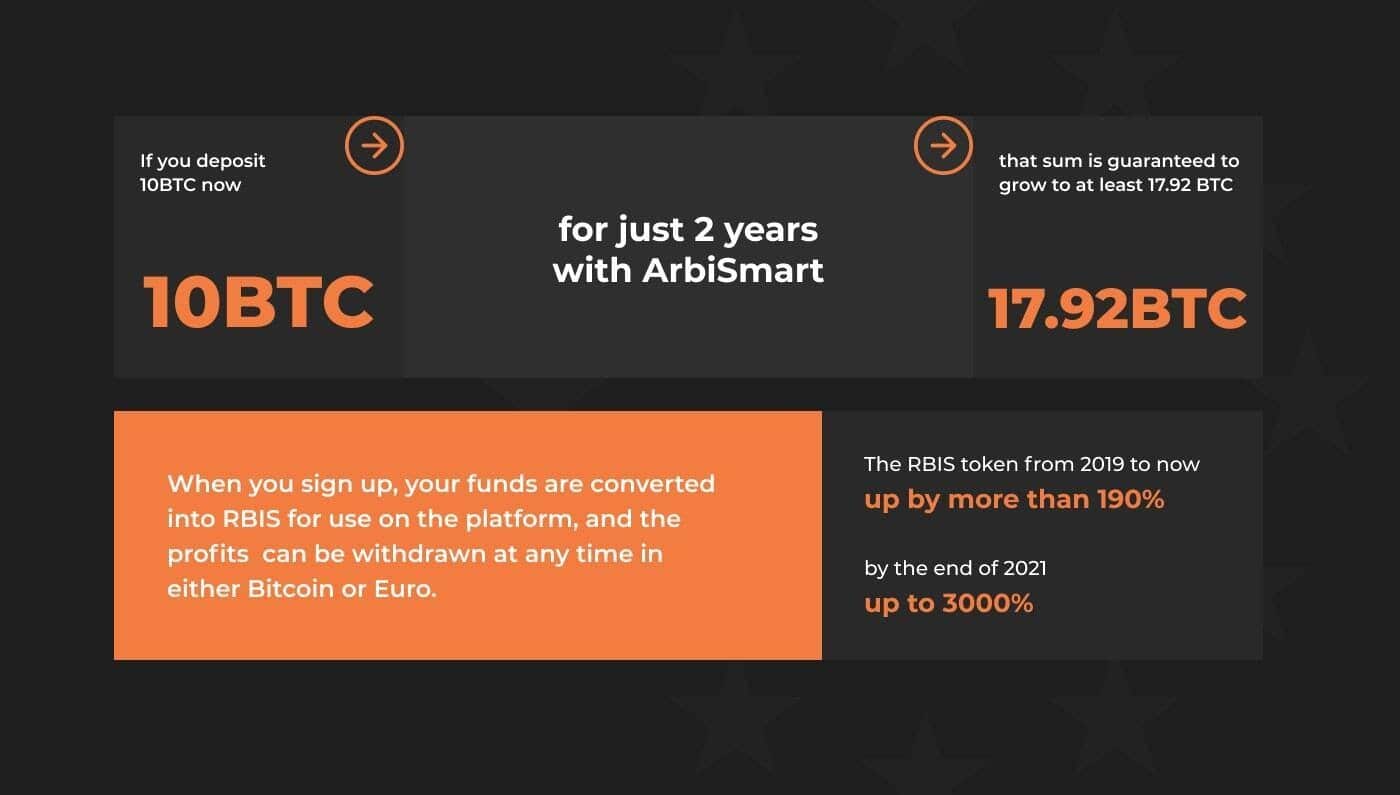

For example, if you deposit 10 Bitcoin now, with compound interest, that sum is expected to grow to at least to 17.92 BTC in just two years. This profit calculation doesn’t even take into account additional profits from the rising value of RBIS, the platform’s native token.

When you sign up, your funds are converted into RBIS for use on the platform, and the profits can be withdrawn at any time in either Bitcoin or Euro. The RBIS token has been rising steadily in value since it was introduced in early 2019. It has already gone up by more than 190% and based on the increasing popularity of the platform and the expansion of ArbiSmart’s financial products and services, the token is projected to go up by 3,000% by the end of 2021. All this translates to bigger profits on top of those earned through crypto arbitrage investment.

Bitcoin and the crypto market as a whole are clearly here to stay. This is an exciting market that is gaining legitimacy across the international financial arena as it gradually reaches mainstream adoption levels and becomes a part of the average trader’s portfolio. The Bitcoin boat hasn’t yet sailed, as it is still generating huge profits for smart investors. Crypto arbitrage is a great way to minimize the risks of Bitcoin trading, and avoid the dangers of extreme crypto market volatility, while still offering unmatched profits, with no effort required.

Don’t want to miss your chance with the Bitcoin boom? Start trading today.

*This post has been paid. The Cryptonomist didn’t write the article nor tested the platform