SPONSORED POST*

RBIS, the token behind the ArbiSmart project has emerged as an increasingly popular contender in a crypto market which has been up and down like crazy over the last few months.

While traders are seeking out new ways to benefit from crypto market opportunities without getting burned when prices suddenly drop again, RBIS has risen steadily in value ever since it was launched in 2019, climbing steeply, even during bear markets. It has received incredibly rosy forecasts, with analysts, projecting a rise in value to forty times the current price by 2023.

Let’s look a little closer at the facts and figures to see if RBIS can live up the growing hype.

Summary

Arbismart and RBIS, a proven success

ArbiSmart saw year-over-year growth in 2020 of 150% and since then the community has grown at an exceptional rate. On an unwavering upward trajectory, the RBIS token has risen in value by 630% in just two years and shows no signs of losing steam.

So far in 2021, the development team has implemented a series of major upgrades to the system architecture, and more improvements are on the way for Q4. Moreover, while token demand has been increasing steadily, the amount of RBIS that can ever be created is finite, limited to 450 million.

Reliable revenue

One major reason for the growing popularity of the project is the fact that ArbiSmart not only generates substantial profits, but it offers a secure hedge against a market crash. To understand how, let’s examine the RBIS utility in greater detail.

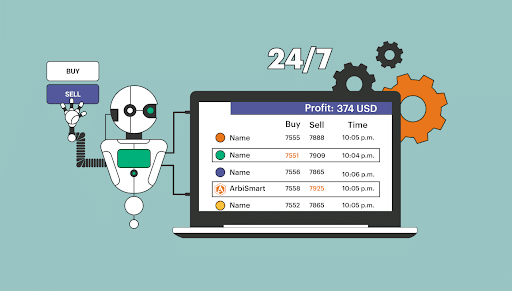

ArbiSmart performs crypto arbitrage. This is an investment strategy that takes advantage of the fact that an asset can be temporarily available across a few exchanges at different prices at the same time. Integrated with nearly forty exchanges, ArbiSmart’s automated system tracks hundreds of coins at once, looking for price disparities. It buys the coin on the exchange where the price is lowest and then instantly sells for a profit on the exchange where the price is highest.

Temporary price discrepancies across exchanges are often the result of disparities in trading volume and liquidity between exchanges of different sizes, and they will continue to occur with the same regularity, whether the market is bullish or bearish. This means that crypto arbitrage traders can safeguard against a sudden change in market trajectory leading to the loss of all their crypto gains and they can continue to generate a consistent profit, regardless of whether crypto prices are tanking or taking off.

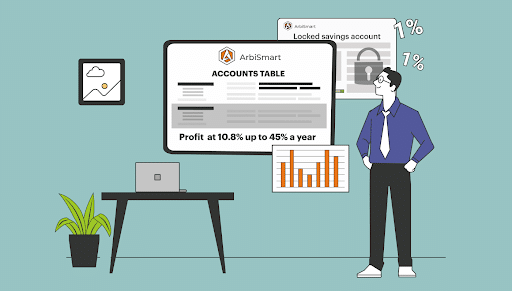

This relative stability is reflected by the fact that you can work out in advance exactly how much you will make, by inputting an investment amount and a time frame into ArbiSmart’s profit calculator. Profits from crypto arbitrage start at 10.8% and reach up to 45% a year, depending on the size of your deposit, and you will then receive compound interest on those earnings.

There is also the option to store your funds in a locked savings account for a set period and make as much as 1% a day in additional passive profits.

Plus, you will be earning capital gains on the rising value of the RBIS token, which has already more than quintupled in value and is projected to go up by 2,000% by the end of 2021.

Project maturity

2021 is expected to see a huge jump in the RBIS price for a number of reasons, one of which is the fact that in Q4 of this year it is set to be listed on global exchanges.

The later half of this year is also going to see substantial expansion, with a string of new utilities being added, in a development push set to continue into early 2022. These new services include a crypto credit card, a mobile app, a yield farming program and an interest-bearing wallet.

With all these developments in the pipeline and the ongoing growth of the ArbiSmart community, the price of the RBIS token looks set to soar in the coming months, so this is a great time to get on board. To shield your crypto capital against the next bear market and earn a generous, steady return on your investment, buy RBIS now.

*This article has been paid. The Cryptonomist didn’t write the article nor has tested the platform.