SPONSORED POST*

Blue-chip cryptocurrencies are slowly regaining lost territory from their historic bull run. 2023 could be the year for meme coins and we’re already seeing some winners. Big Eyes Coin, a relatively new project, has an impressive goal of raising $50 million.

The coin seeks to make a lot of money for investors who are new to the space. Plus, investors can be part of an eco-friendly initiative. 5% of all tokens will be stored in a charity wallet and given to charitable organizations to repair the ocean’s ecosystem.

Prices increase by 20% with every funding stage. Crypto-enthusiasts can take advantage of this and earn capital gains if they purchase Big Eyes Coin. There are still a few more stages left so that investors can make a return.

Big Eyes Coin offers more than just more money. With NFT club access and community ownership, buyers of the coin can expect a carefully curated collection of cute cats.

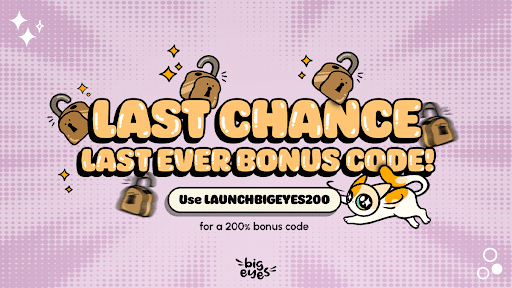

There are just 3 more days left before the promo code “BIGEYESLAUNCH200” runs out. Crypto-enthusiasts stand to make a lot of money and more importantly, be part of an exciting development in the crypto landscape.

Was FTX Something We Will See Again In The Future?

FTX was the most significant crypto scam we may see in a while. It has dimmed the reputation of the crypto industry and many significant investors were defrauded by this scheme, including Kevin O Leary, who lost a $15 million payment from FTX to be its spokesperson.

Such a huge catastrophe may have impressed an idea in the mind of an investor: that all crypto companies and products are simply one big scam.

But there is a distinction to be made between FTX and other companies such as 3AC, Voyager, and Celsius Capital. The former was a clear Ponzi scheme while the latter was the natural bankruptcies that occur when any industry experiences a severe downturn.

Investors that gave their money to FTX assumed it was being routinely managed as a customer deposit and assessed for risk. Instead, the money went to luxury properties in the Bahamas and Alameda Research, a subsidiary of Sam Bankman Fried’s flagship company.

This is why despite the severe downturn and loss of faith, we’re still seeing an improvement in fund inflows across digital assets. Not all cryptos are scams in the same way not all scams are crypto-related.

As always, investors are expected to exercise caution with any investment, but looking back, it’s not hard to see why people were fooled. There is a certain idea going around major newspapers – such as the Guardian – that Sam Bankman Fried is not too far off from Bernie Madoff, the man who instituted one of the largest Ponzi schemes in the U.S.

While they both dress differently and are apart by at least a decade in age, scammers can appear in any form, so be aware.

Disclaimer: This article is not investment advice. It is an attempt to keep crypto-enthusiasts aware of recent developments. Anyone who chooses to invest in any crypto mentioned in any article does so at his own risk.

Presale: https://buy.bigeyes.space/

Website: https://bigeyes.space/

Telegram: https://t.me/BIGEYESOFFICIAL

*This article was paid for. Cryptonomist did not write the article or test the platform.