Generally, the world is divided in two when it comes to the cryptocurrency market: there are those who are supporters of it and say that these types of assets are here to stay and will be part of the next global financial system, and those who, on the other hand, believe that they are merely a speculative bubble destined to burst.

Which of the two opposing poles is right? We find out in this article

Summary

Does the cryptocurrency market represent a speculative bubble destined to implode?

Starting in 2008, when Satoshi Nakamoto released the Bitcoin Whitepaper, the cryptocurrency sector has been repeatedly labeled as a speculative bubble destined to burst.

Probably the reason for this popular thinking stems from the high volatility that is the main feature of the market for Bitcoin and other cryptocurrencies.

Consider that Bitcoin alone has been declared “dead,” as many as 474 times, despite having punctually disproved with facts the statements made by the media or by alleged influencers who evidently understand very little about finance.

From January 2012, the year Bitcoin began to be popularized outside computer programming circles, to the present, the industry’s leading crypto has grown 5800 times.

While it is true that BTC has suffered several drawdowns over the years that have reached as much as -90%, this does not justify equating it with the term “speculative bubble,” which seems more apt to describe ponzi schemes or assets with no intrinsic value.

Volatility will always remain one of the main factors that characterize highly innovative and early-stage asset classes such as cryptocurrencies.

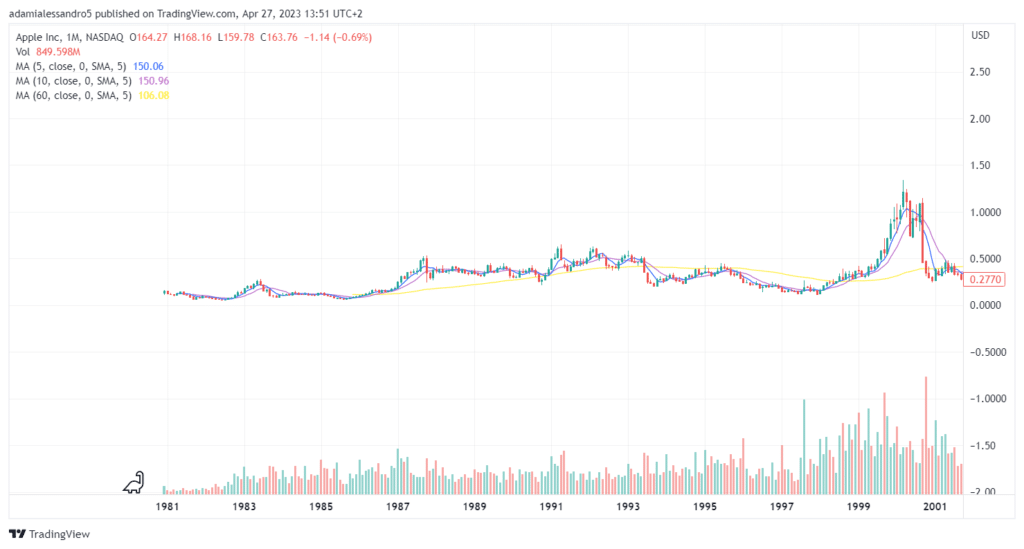

Even Apple, which today represents one of the world’s most important tech giants, experienced not insignificant price changes in its early years, which caused analysts at the time to question its future.

Just think that in September 2000, Apple’s stock lost 57% of its value. At that time the tech company had a market price of less than $1 while today it is worth about $165.

The bottom line is that when a cryptocurrency has a small market capitalization as in the case of altcoins or the early years of Bitcoin’s price, the price trend can be easily manipulated even by entities that do not have the same economic availability as Black Rock and Vanguard.

What needs to be observed in such a complex environment as crypto is not the price factor, but the adoption that this type of technology achieves and the improvements on the technical side of blockchain infrastructure.

Moreover, the price of a cryptocurrency is influenced by so many factors that make it virtually impossible to decree its failure through a few lines of explanation.

Unfortunately, few understood the real potential of cryptocurrencies and blockchain many years ago. Today the situation seems to have changed slightly, and many companies and investment funds have extensive know-how of how the cryptocurrency world works, far from labeling them as speculative bubbles.

The 3 “mini” speculative bubbles in the cryptocurrency market

Bitcoin and the rest of the cryptocurrency market cannot be simplistically described as speculative bubbles.

The fundamental characteristic of speculative bubbles concerns the disproportionate rise in the value of the asset, followed by a price burst that brings the latter to levels below pre-rise levels. Hence, a bubble describes an isolated trend in the financial markets that lasts for a narrow period of time, bursts and does not return over the following years.

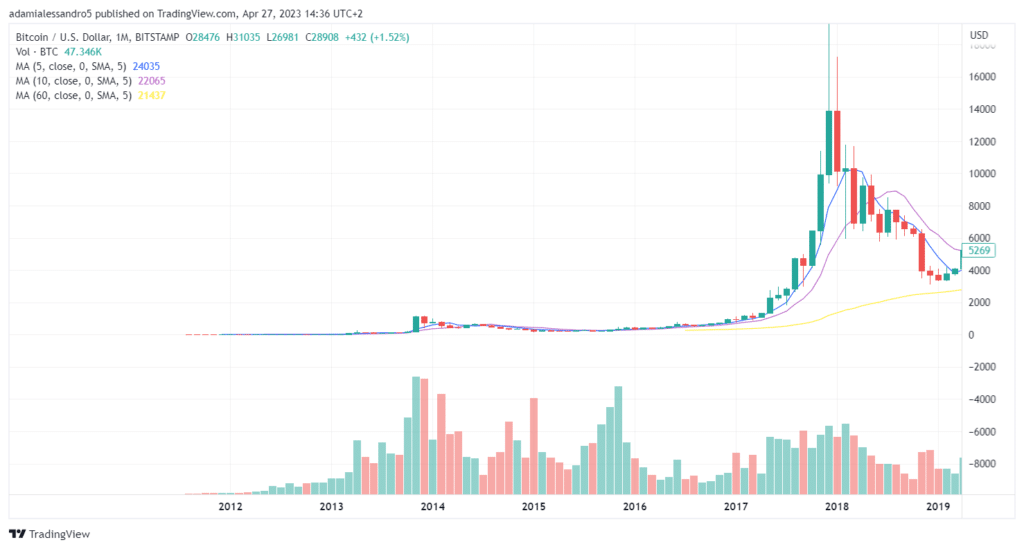

Bitcoin during its 15 years of existence has recorded 3 “mini speculative bubbles” (if we want to describe them that way) which, however, lasted very little because each time, in the span of a few years, the virtual currency returned above its pre-burst values.

Truth be told, whenever BTC has experienced a pullback during bear markets, prices have ALWAYS remained above values relative to the beginning of the previous bull run.

For example, at the end of the first bull run of 2014, which culminated with the bursting of its first mini speculative bubble, prices reached a low of $152 (considering the downward spike).

This price turns out to be higher than the value Bitcoin had before it started the same bull run, which was $90.

Even in the subsequent bull run of 2017, the same conditions occurred: before the price of BTC started its bull run in that year, its price was approximately $1000 while the minimum price reached in the bear market of 2018 was $3100.

We could make the same argument for 2021 but we cannot define with certainty that the current bear market has ended, hence we refrain from this consideration even though the parallels seem obvious.

The reason for such considerable price changes, as mentioned before, is dictated by many factors such as market manipulations.

However, what probably triggers these uncontrolled rises in the price of Bitcoin, which then ends up infecting the rest of the cryptocurrencies as well, is the phenomenon of halving, i.e., the cutting in half of the rewards for BTC miners who solve a block, which generates deflation on the price and hype on all markets.

All the innovations brought by cryptocurrencies since 2010

In support of the argument that cryptocurrencies do not represent speculative bubbles, besides providing a graphic demonstration of how inappropriate and degrading this term is, it is interesting to describe all the technical-level improvements and innovations that the crypto sector has brought in recent years.

Of course, in this context there is no shortage of cases of projects that generated nothing of interest within the industry and then died without ever having a chance to resurrect.

From 2010 to 2014 was the start-up period for these new technologies and the concepts of decentralization and financial freedom: cryptocurrencies were mostly traded through centralized platforms, such as Mt Gox. in which they lacked the security standards we can find today.

Many projects from that era arose only to compete with Bitcoin and attract the same capital, though without success.

Those years laid the foundation for everything that came later.

From 2014 to 2018 was the period of ICO sales and the birth of Ethereum.

The concept of smart contracts and “global computers for the world” began to emerge. The philosophy of DAOs also became mainstream, as a group of individuals making decisions in a decentralized manner.

CEXs moved forward, and in the meantime, more secure self-custody methods with cleaner user interfaces were developed.

2018 to 2023 were the most fruitful years in terms of innovations, with DeFi making its market debut with decentralized applications such as Uniswap.

Non-fungible tokens attracted off-the-charts attention until they succeeded in establishing themselves as the art of the future.

In the blockchain arena, different L1 consensus mechanisms have been experimented with and layer 2 scaling solutions have emerged that can increase the scalability of networks.

The Web3 field has experienced impressive growth, dictated by the myriad of applications that have sprung up with the intent of providing a version of the real world even within blockchains, such as metaverses.

We could stand here and talk about this for hours, but already from these few lines it is possible to understand that the whole phenomenon of cryptocurrencies does not represent an isolated speculative bubble, but a phenomenon of establishing a new asset class that is likely to become an integral part of the everyday financial and social environment.