SPONSORED POST*

Primarily driven by speculation, and largely unregulated, the crypto market can be highly volatile and unpredictable, carrying significant risks. As a result, it is critical to mitigate your exposure, using various risk management tools and implementing low-risk trading strategies.

Summary

How to Minimize Trading Risk

There are several strategies you can use to minimize trading risk, such as diversifying your portfolio, investing in a variety of assets and sectors to spread out your risk. You can also set a stop-loss order, an automatic order to sell a security if its price drops to a certain level. This can help limit your losses if the market moves against you.

Mitigating your risk can also be achieved by doing your research on the companies or assets that interest you, before making any trades. You should also develop a trading plan, including entry and exit points, risk management strategies, and profit targets.

Don’t invest more than you can afford to lose and at every stage of the trading cycle, keep an eye on your portfolio, and make adjustments as needed. This can help you stay on top of market trends and make informed decisions.

Another factor to consider is the level of risk involved in your chosen strategy. For instance, short term swing trading, while potentially highly lucrative, exposes you to far higher risk in the volatile crypto market than a slow but steady strategy like HODLing. One strategy though, offers the best of both worlds. Crypto arbitrage is gaining popularity for involving low-risk while delivering high-returns.

Crypto Arbitrage and Low-Risk Returns

Crypto arbitrage is the practice of buying and selling cryptocurrencies across different exchanges to take advantage of price differences and generate profit. It is considered a low-risk trading strategy because it involves exploiting price disparities, rather than speculating on the direction of the market.

For a start, it involves limited exposure. Crypto arbitrage requires you to hold positions for very short periods, usually just a few seconds or minutes, which means that you are exposed to market risk for a very short time.

The goal of arbitrage is to exploit temporary price differences between exchanges, with the expectation that prices will eventually converge. This means that the profit or loss potential of the trade is limited, since the price difference will eventually disappear. Also, arbitrage opportunities tend to appear when there is low volatility in the market, which means that the risk of sudden price movements that could negatively impact the position is lower.

Since arbitrage trading focuses on taking advantage of price inefficiencies, and doesn’t require predicting the direction of the market, this reduces the risk of taking a losing position. In addition, only a limited amount of capital is required to execute trades, which further reduces the risk of loss.

The Easiest, Most Profitable Way to Trade Crypto Arbitrage

The best way to employ a crypto arbitrage strategy is to use an automated trading system. A bot can track hundreds of coins across multiple exchanges simultaneously, exploiting a huge number of price disparities at once, with exceptional speed and efficiency.

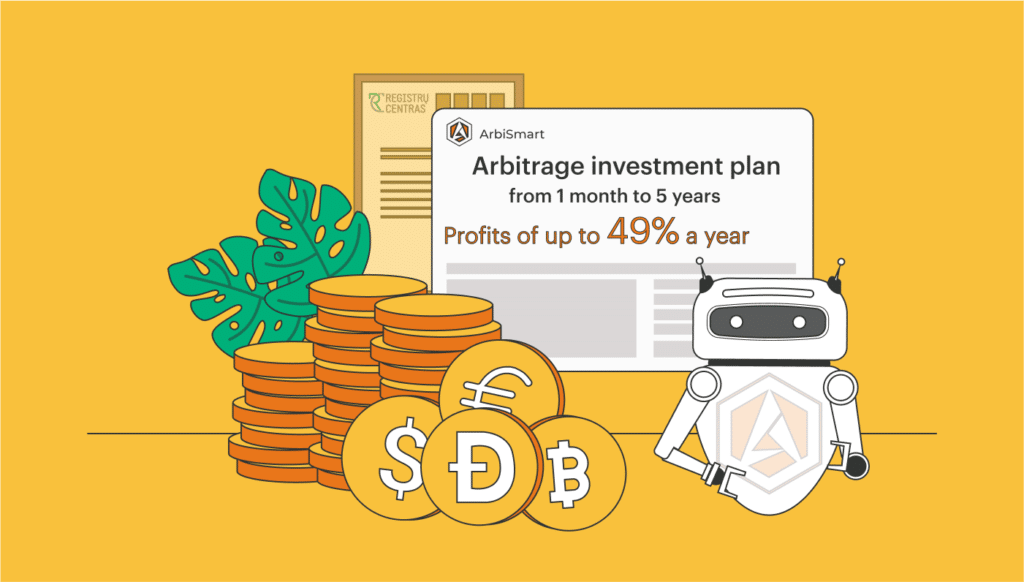

To see how it works let’s take as our example, ArbiSmart, a well-established, regulated arbitrage platform.

ArbiSmart is an EU authorized automated crypto arbitrage system that supports around 30 different FIAT and cryptocurrencies, from Bitcoin and Dogecoin to Euro and USD. To start earning you make a deposit and open an arbitrage investment plan for the time frame of your choice, ranging from as short as one month to as long as five years. The bot then takes over, generating consistent profits of up to 49% a year on investment plans in all currencies, except for RBIS, the native token, on which you can receive up to 147% a year, plus compound interest. Profits are paid out daily and the exact amount you earn depends on your deposit amount, the currency and length of the investment plan contract, as well as your account level, which is higher the more RBIS you own.

To earn low-risk gains, with a bear-resistant strategy that requires zero effort and a minimal initial investment, give automated crypto arbitrage a go!

*This article was paid for. The Cryptonomist did not write the article or test the platform.