In this article, we delve into Firefish, a cryptographic protocol that facilitates instant access to liquidity for holders of Bitcoin. The platform offers the possibility to request a loan, paid in euros directly to your bank account, by simply pledging your BTC for a defined period of time. With Firefish, you can maintain full control of your finances, meeting your cash needs without having to sell Bitcoin to the whales, while also taking advantage of its potential for future growth.

Let’s discover together how it works.

Summary

What is Firefish: the decentralized protocol that simplifies access to liquidity with Bitcoin

Firefish represents a revolutionary P2P platform that connects Bitcoin holders and individuals with fiat currency availability. The protocol’s goal is to eliminate the presence of intermediaries in transactions involving the two parties, offering loans in euros collateralized in BTC. In practice, through Firefish, users can deposit the cryptocurrency and take on a debt, paid directly into their bank account. These operations are also supported by specific legal documentation that certifies the validity and legality of the exchanges.

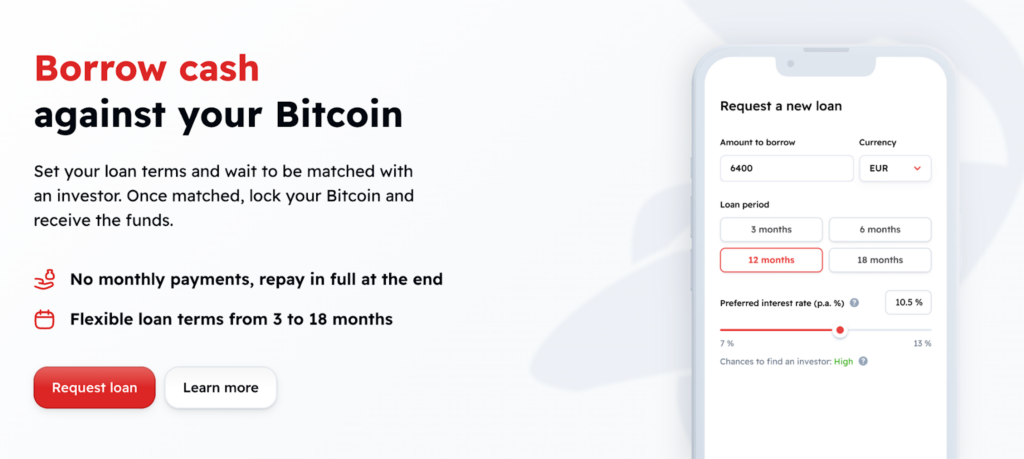

“`htmlIf you need liquidity but do not want to sell (rightly) your Bitcoin, FireFish is absolutely for you. In a few clicks, you can request a loan ranging from 800 to 15,000 EUR (in addition to CZK and USDC), with a flexible duration from 3 to 18 months and repayment in a single final installment. Among the various options, the platform allows users to independently choose the desired interest rate of the loan, with a threshold that ranges between 6% and 13%. To register, you can go through this link and enjoy a discount on fees, as well as support us in the search for new interesting protocols.

“`

Obviously, Firefish, as a P2P operator, offers users with liquidity in euros the opportunity to earn a return on their capital. Just like for those who borrow, those who lend the money can enjoy a risk-free interest ranging from 6% to 13%, while at the same time helping to meet the economic needs of some bitcoiner friends. The entire process is regulated by code and guaranteed by the blockchain, without intermediaries involved in the custody of BTC.

Up to today, Firefish has helped to provide loans for over $5,000,000, saving many Bitcoins from being sold to whales and banks. Over 5,000 users have already registered and have used the platform to manage their financial needs, processing exchanges for more than $65,000,000.

How to request a loan in euro on Firefish

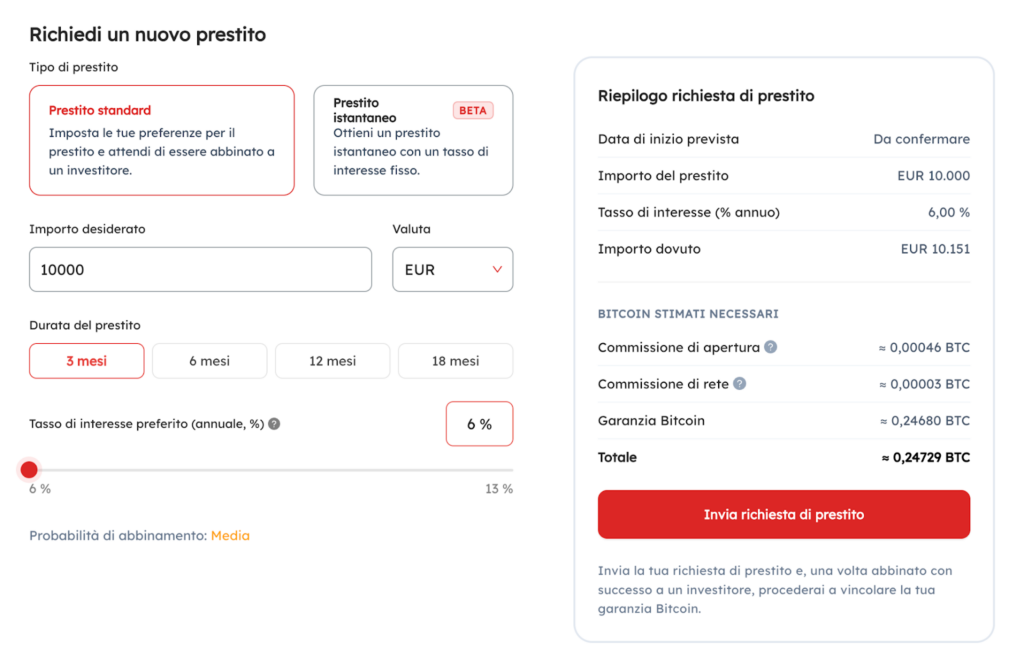

At this point, let’s take a closer look at how to obtain a loan in euros by pledging your Bitcoin on Firefish. The first thing to do after registering via the access link is to click on the item “Loans” and select the various fields such as the amount of the debt, the currency, the duration of the loan, and the predetermined annual interest rate. You can choose whether to request a standard loan (manually select the rate) and wait to be matched with an investor, or an instantly settled loan with a fixed interest rate of 12.5%

Before proceeding, the Firefish dashboard will offer you a summary of the transaction, which includes all the estimated costs necessary for the operation. The costs include an opening fee (deductible via the access link shown above), network fees, and the guarantee of the Bitcoin put as collateral. The LTV on this platform is 50%. This means that if you have €20,000 in BTC you can request up to €10,000 in loan.

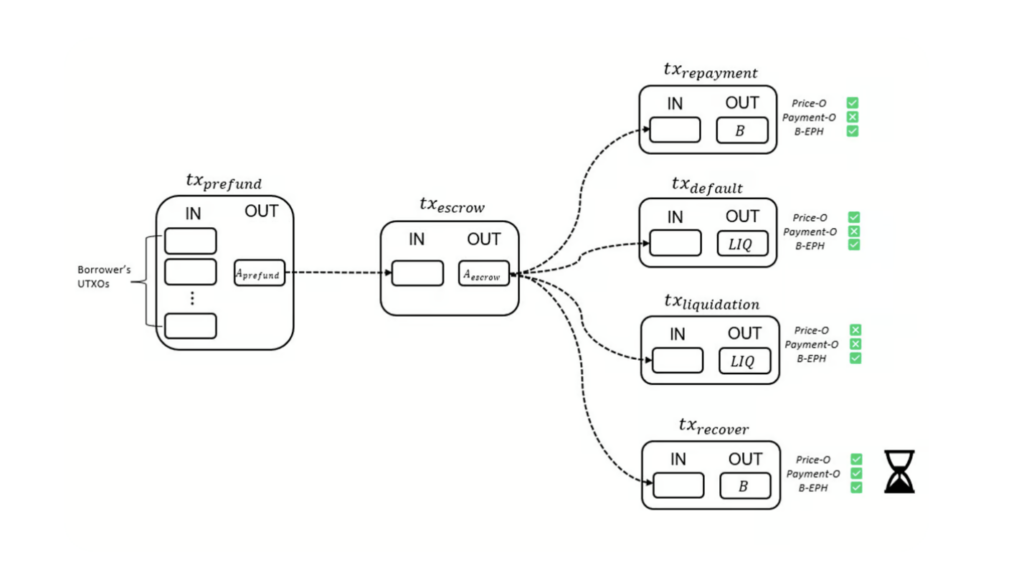

Once the loan request is matched with the offer from another investor, the Firesh protocol comes into play. At this point, the user taking on the debt must send their BTC (native, not wrapped) to an address that will be the central hub of the upcoming transactions. The application ensures that the BTC will be effectively returned to the owner as soon as the loan is repaid, or possibly transferred to the counterparty in case of liquidation or insolvency. The debt can be repaid at any time from the central dashboard through the provided information (IBAN, owner’s name, etc).

The Bitcoin blockchain supporting P2P exchanges

Firefish leverages for this purpose the scripting capabilities of bitcoin, such as multi-signature schemes and Partially Signed Bitcoin Transactions (PSBT), to ensure the correct flow of capital.

Without delving into technicalities, let’s say that two oracles within the platform track information such as the price of BTC and the fiat payment.

The possible resolutions of the event are essentially 4:

- the loan is correctly repaid and the BTC return to the owner;

- the loan is not repaid and the BTC go to the counterparty as collateral;

- the value of the collateral falls below the margin call value, the liquidation occurs and the BTC are transferred to the counterparty, the debt is automatically extinguished;

- Firefish ceases to exist (e.g., bankruptcy) and after a predetermined period of about 30 days, the BTC return to the owner.

The advantages of using BTC as a debt currency

Firefish represents a fitting example of how to optimize one’s finances using Bitcoin as a debt currency. Usually, “newbies” tend to sell their BTC to access liquidity, without considering the advantages of alternative solutions that exclude the event of selling on the market. First of all, if you don’t sell BTC, you can simply take advantage of its growth potential, especially in a bull market. Imagine depositing $20,000 in BTC on Firefish and taking a loan of €10,000. If the value of the crypto doubles, you could repay the loan for free and benefit from another $10,000 in capital gains (minus commission fees and the rate).

“`htmlAnother huge advantage of the practice of using Bitcoin as collateral for debt is to delay a taxable event according to the rules of the Italian Tax Authority. Selling your BTC on the market and making a profit results in a taxable situation, on which you will have to pay 26%. Instead, taking a loan does not create a fiscally taxable event until the BTC are either liquidated or returned and subsequently sold. Remember that debt in finance is never taxed.

“`To these benefits are added those typical of every decentralized environment which, in the case of crypto loans, does not take into account factors such as: repayment flexibility, the need for a good creditor, quick access to liquidity, and lower costs compared to centralized counterparts. Firefish adds the cherry on top, which represents the legal reporting of every operation carried out on the platform, thus providing a document that can be used in case of a tax audit.

In recent months, we have seen more and more companies, both Italian and international, adopt the Bitcoin model as collateral asset, highlighting the presence of a strongly growing trend. Among these, we find, for example, CheckSig, which announced its first loan guaranteed by BTC and Coinbase, which launched the service of loans covered by BTC.

At the same time, the company Cantor Fitzgerald is also planning a lending program guaranteed by the orange currency, valued at 2 billion dollars.