Summary

Summary

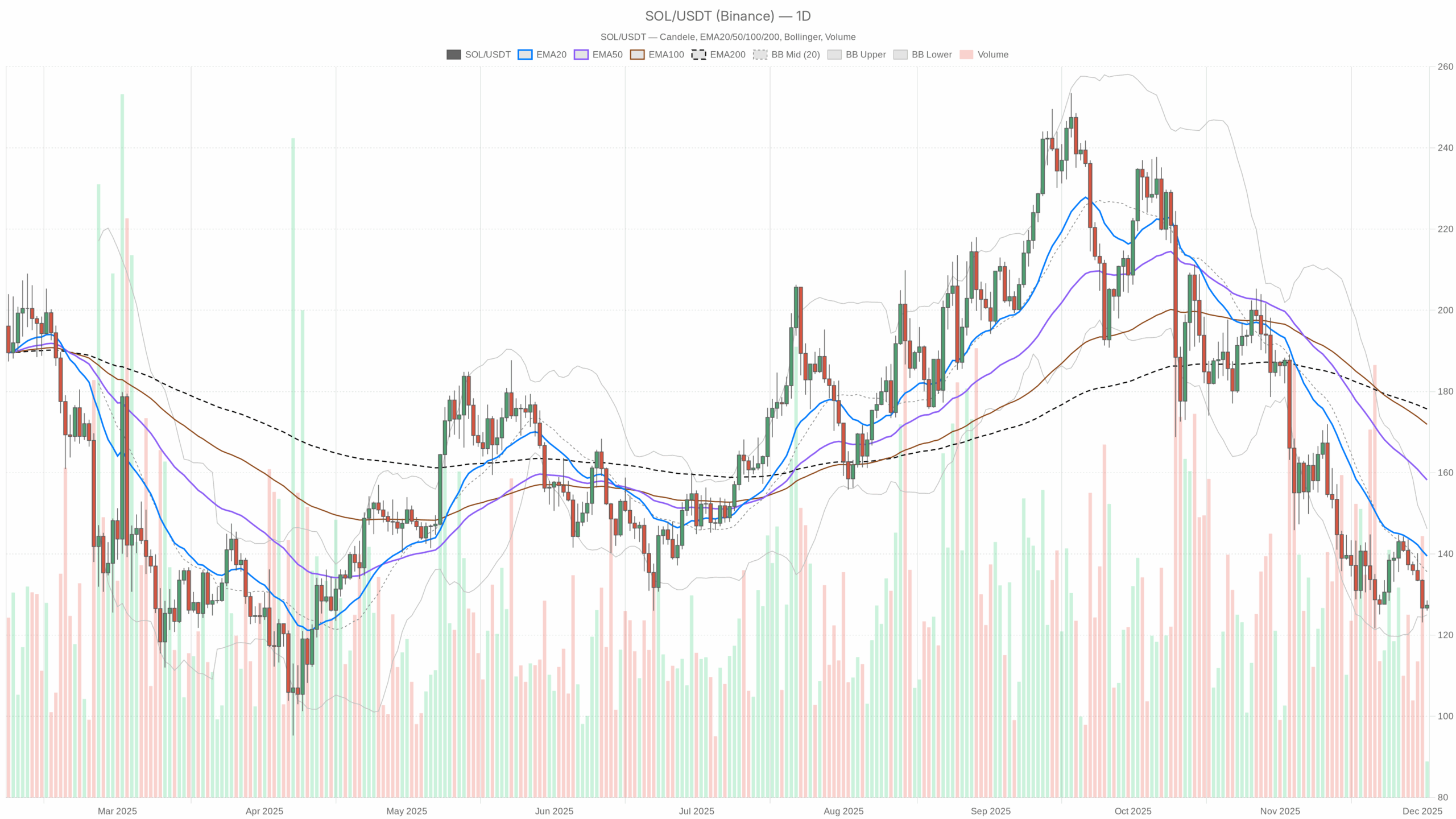

SOL is trading near the lower edge of its recent daily range, with the spot price at 127.35 USDT. On the daily chart, the asset sits below the 20, 50 and 200-day EMAs, confirming a broadly bearish regime despite some short-term stabilization. Momentum indicators show oversold but not capitulated conditions, leaving room for both relief bounces and further grinding downside. Volatility, as captured by ATR and Bollinger Bands, is elevated but not explosive, pointing to a controlled, trend-driven environment rather than a panic market. Meanwhile, market-wide sentiment leans heavily risk-off, yet intraday data for SOL suggests pockets of dip-buying. Overall, traders are cautious, with larger players likely waiting for clearer confirmation before committing to a new medium-term trend.

Solana crypto market: Market Context and Direction

Zooming out, the broader digital asset landscape remains dominated by bitcoin, which holds a hefty 57.3% market share. This elevated dominance generally signals that capital is consolidating in perceived “safer” majors rather than flowing into alternative layer-1 ecosystems like Solana. Moreover, the total crypto market capitalization stands around 3.03 trillion dollars, with a modest 0.5% gain over 24 hours, suggesting cautious accumulation rather than a euphoric melt-up.

Sentiment data reinforces this defensive stance. The Fear & Greed Index sits in Extreme Fear at 23, indicating that investors remain wary after recent drawdowns. In such conditions, altcoins tend to lag until bitcoin stabilizes more convincingly. That said, Solana’s share of global market cap near the mid-single digits highlights that it is still a core component of the risk spectrum, and flows can quickly rotate back once confidence returns. DeFi activity on Raydium, Orca and other Solana-based protocols, with sizeable all-time fee generation and recent short-term spikes, shows that the underlying ecosystem retains traction even as price consolidates.

Technical Outlook: reading the overall setup

On the daily timeframe, SOL closes at 127.35, notably below its 20-day EMA at 139.48, 50-day EMA at 158.21 and 200-day EMA at 175.69. This clear separation of price beneath all three moving averages confirms a dominant bearish trend structure. It implies that rallies into the 135–160 zone are likely to encounter supply from traders exiting underwater positions or short-term swing sellers leaning into the downtrend.

The RSI at 34.48 reinforces this picture. It sits below the neutral 50 mark but remains above classical oversold thresholds, pointing to weak but not exhausted momentum. Sellers remain in control, yet there is room for a countertrend bounce without necessarily ending the broader down move. The MACD on the daily chart prints a line at -8.82 against a signal at -9.86, with a slightly positive histogram of 1.04. This small uptick indicates that downside momentum is starting to stabilize; the bears are no longer accelerating, even if they still set the tone.

Bollinger Bands add nuance: the mid-band is at 135.58, with the upper band at 146.17 and the lower band at 124.99. Price hovering just above the lower band highlights that SOL is in a pressure zone near support, where further sharp selling may begin to exhaust itself, yet a decisive close back above the mid-band would be needed to argue for a sustainable recovery. The ATR at 8.08 underlines a backdrop of elevated but controlled volatility, where daily swings are meaningful but not chaotic, rewarding disciplined risk management over aggressive leverage.

Intraday Perspective and SOLUSDT token Momentum

While the daily structure leans bearish, intraday charts paint a more balanced story. On the hourly timeframe, SOL trades at 127.37, almost exactly in line with the 20-hour EMA at 126.96, but still under the 50-hour and 200-hour averages at 129.61 and 134.05. This configuration signals a short-term neutral regime attempting to build a base within a larger downtrend.

Meanwhile, the hourly RSI at 49.03 sits close to equilibrium, suggesting a tug-of-war rather than one-sided selling. The hourly MACD line at -0.72, just above its signal at -1.24 with a positive histogram, hints that intraday bears are losing dominance and that short-term momentum is tilting toward consolidation or a mild rebound. On the 15-minute chart, the picture improves slightly: price at 127.36 is now fractionally above both the 20- and 50-period EMAs, with RSI at 56.12. As a result, very short-term traders appear willing to buy dips near 126–127, even as higher timeframes remain cautious.

Key Levels and Market Reactions

Daily pivots place the central reference point almost exactly where SOL trades now, at 127.3. This area acts as a balance zone where neither buyers nor sellers have a clear immediate edge. Just above sits a first resistance region around 128.6; a clean break and intraday hold over this band could encourage scalpers to press toward the mid-Bollinger zone around 135, testing whether the recent downtrend is losing grip.

On the downside, the first notable support emerges close to 126.1, aligning loosely with the lower daily Bollinger Band at 124.99. A sustained move below this cluster would signal that downside continuation is reasserting itself, potentially dragging price into a deeper retracement toward prior demand zones. Conversely, repeated defenses of 125–126 with rising intraday lows would strengthen the case that a short-term floor is forming inside a larger corrective pattern.

Future Scenarios and Investment Outlook

Overall, the prevailing scenario remains cautiously bearish on the higher timeframe, with clear evidence of a downtrend in need of consolidation before any durable recovery. As long as SOL stays below the descending cluster of daily EMAs, rallies are better viewed as potential selling opportunities or risk-reduction windows for longer-term holders.

However, the alignment of intraday neutrality, stabilizing MACD, and price clinging to the lower Bollinger Band suggests that a relief bounce or sideways phase is increasingly likely. In such an environment, active traders might focus on range strategies between nearby supports and resistances, while longer-term investors may prefer to wait for trend confirmation through a reclaim of key moving averages and an improvement in broader risk sentiment beyond Extreme Fear. If those signals converge with renewed capital rotation away from bitcoin dominance toward high-activity ecosystems, the Solana crypto market could eventually transition from defense back to accumulation.

This analysis is for informational purposes only and does not constitute financial advice.

Readers should conduct their own research before making investment decisions.