The beginning of the week is coloured by green hope with prices back close to the records set in the first days of last week. A rise led by the two leaders, Bitcoin and Ethereum, who in these hours marked rises close to 10%.

Only tokens linked to decentralized finance are doing better. In fact, the best five rises of the day are led by Aave with a climb of over 15% and back above $75, just one step away from the mid-month records. Followed by Ampleforth (AMPL) and Synthetix (SNX) up 13% from yesterday’s levels. A short distance away, Yearn.Finance (YFI) and SushiSwap (SUSHI) are keeping pace with an increase of over 10%.

The climb of the last few hours lacks the support of volumes, a necessary condition to confirm the validity of this bullish flashback that few would have discounted so quickly.

The weekend recorded a total volume below that of recent days, highlighting the pause of the big players who have contributed to reinforcing the recent rises.

The market cap is $570 billion, just $10 billion below the record of November 25th. Bitcoin continues to contribute to the strengthening with the return to over $356 billion, the highest level ever. With a choral movement, Bitcoin’s dominance rises above 62%, along with Ethereum regaining 12.1%. Ripple (XRP) surprises with a jump going to 5%, a level abandoned exactly last year at the end of November 2019.

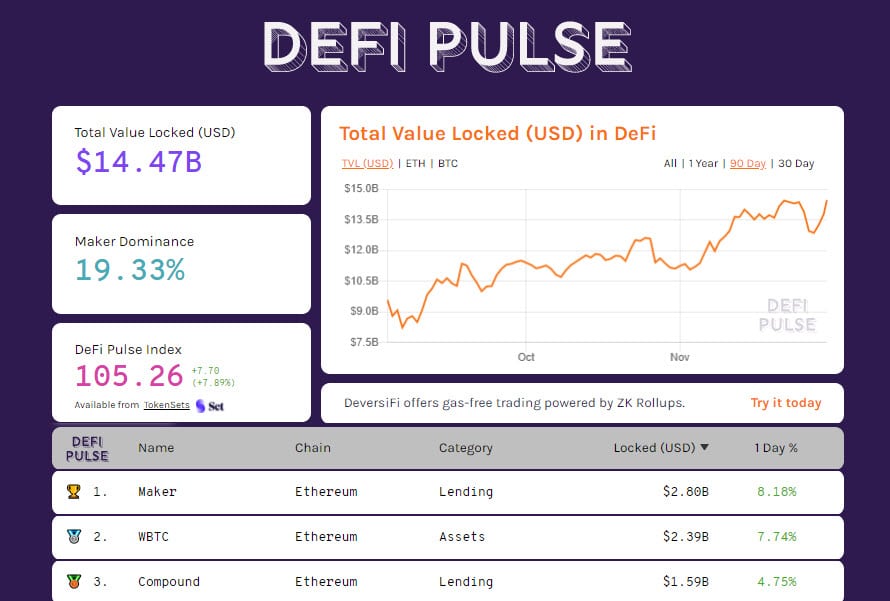

The increase in prices is raising the total value locked (TVL) in decentralized protocols to over $14.4 billion, above the previous record set on November 22nd.

Maker maintains its leadership by establishing the total value locked at $2.8 billion. The total number of ETH stuck in DeFi continues to decrease, falling below 6.6 million. BTC remain stable above the 167 thousand tokenized units.

Bitcoin (BTC)

In these hours the prices of Bitcoin fly beyond the maximum set the previous week. With an increase above 19,700 USD it is the new record of the last two years, now one step away from the absolute historical record of 19,870 USD on December 17th, 2017.

Exceeding this level could result in the closing of positions set downwards, as well as the covering of positions to protect open Call options. November is set to write a new chapter in Bitcoin’s history that is set to close the best month ever.

Ethereum (ETH)

Ethereum, after having sunk under 500 USD in the past few days, with a sprint is back over 610 USD, impacting the last strike protected by the operators in options. The breaking of this resistance would see area 625 USD as the next upward target. The support of the current bullish phase is confirmed by the increase of positions to protect the supports, already present for several weeks.

With prices returning to current levels, there remains ample scope for price movement without impact on the uptrend that has been present for more than eight months. The dangers of sinkings under 400 USD, the first real alarm for the medium to long term trend, are now disappearing.