After two days of weakness, prices are back on the rise, led by Bitcoin, which is up more than 2% today. Ethereum is also up 1% and has recovered the $610 mark. Ripple (XRP) was not so lucky, falling more than 6%.

Among the big names, Cardano (ADA) is up 3%, followed by Litecoin (LTC) and Monero (XMR), both up 2%.

Financial markets drag cryptocurrencies down

The declines that have characterized the previous two days in particular, are accompanied by general declines in financial markets. Yesterday, the S&P 500 experienced a downward movement that in some parts of the day went beyond -5% before recovering at closing with a -0.7%. Gold was also in the red for the day, fluctuating around -2% and then limiting losses to -0.2%.

Yesterday’s events saw tensions heightened over the new strain of Covid in the UK which particularly affected the euro/dollar exchange rate with the dollar returning to strengthen before seeing the euro gain and taking the euro/dollar exchange rate to 1.22.

When the dollar fluctuates as much as it did yesterday, it is reflected in the financial markets and in the cryptocurrency sector in particular.

The sector saw the day continue on a positive note with over 70% of crypto assets above par. On the opposite side of the spectrum, Filecoin (FIL) is down 6% and Bitcoin Cash ABC is down over 6.5%.

The worst is Near Protocol (NEAR) which loses 8%. However, no double-digit declines are seen among the top 100.

Market cap, volumes and DeFi

The total market cap remains above $635 billion with Bitcoin continuing to strengthen its dominance over 66.5%, the highest level since last May. Ethereum, despite its rise, does not see its market share increase and remains below 11%. Ripple is at 3.4%, its lowest level of dominance since mid-November.

Volumes halved from the peaks recorded last Sunday, when they reached $600 billion for the first time in over two years, close to the records set in January 2018. Today, volumes halved and are around $300 billion, although they remain tonic day-to-day on a monthly basis.

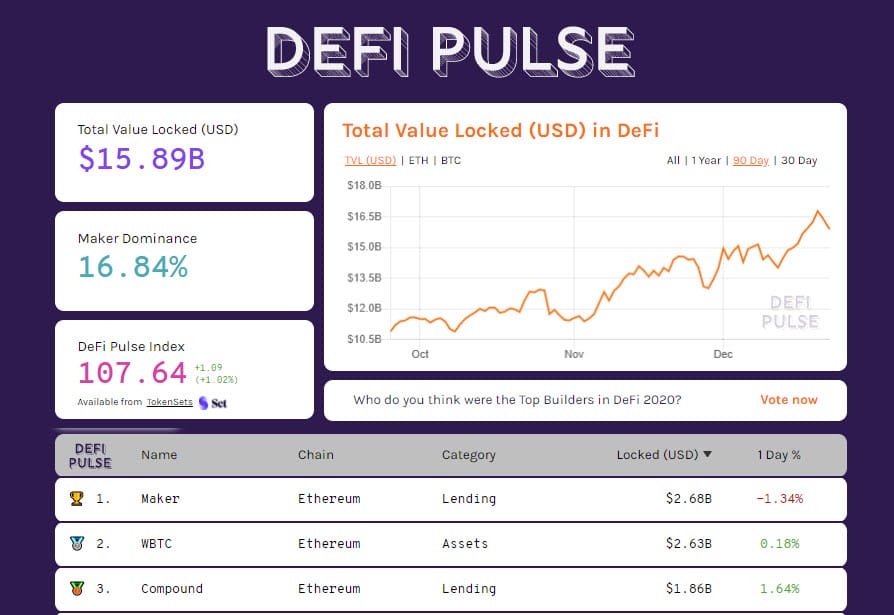

DeFi after peaking on Sunday at $16.7 billion, falls back below $16 billion. This is due to the loss of value in these hours, while the number of ETH locked in DeFi protocols is back above 7.2 million, the highest level not seen since last November 23rd.

The number of BTC tokenized on the Ethereum network remained stable at over 143,000 units.

Maker remains the leader at $2.7 billion, separated by a handful of millions of dollars from WBTC, Compound is in third place at $1.8 billion.

WBTC is getting closer to becoming the leader among decentralized finance projects.

Bitcoin (BTC) prices

Bitcoin is back above $23,000 after falling below $22,000 for a few minutes yesterday. In the short term, $22,500 is the critical area to continue to monitor carefully in the next few hours of the day, which coincides with 25% of the Fibonacci retracement when considering the lows of December 11th, the lows recorded after the rally that had characterized the last 10 days with the absolute historical records reached on Sunday.

A possible slide below this level would begin to give the first signs of weakness in the current monthly cycle that began with the lows of December 11th.

A return below $23,800 would continue to demonstrate the strength of the current monthly cycle, but this must also be accompanied by an increase in volumes. Otherwise, there would be a risk of repeating what happened on Sunday with a new record high after which hedging would prevail. In order not to risk a repetition it is necessary to attract new purchases even if the period, close to the Christmas holidays and the end of the year, statistically is not the moment that attracts particular rises from volumes. The context is different from previous years so it should be followed without excluding anything.

Ethereum (ETH)

Ethereum’s decline yesterday saw prices return to the low of $585, a test of the bullish trendline that has accompanied the upward movement since last November. Ethereum must confirm the holding of $585 in the next few hours, otherwise there would be room to test the $530 that coincides with the area of the Fibonacci retracement equal to 25% that considers the context of recent months which takes as reference the minimum of mid-November and the highs of last week.

Ethereum, in the event of a concomitant return of strength also for Bitcoin, sees a parallel reference area at $660. In case of a lack of buying volumes a return to this area is a signal that should increase caution as the rise must necessarily be accompanied by rising and not falling volumes.

Ethereum’s daily trades on the main exchanges exceeded 2 billion dollars, one of the best days of December.