Ethereum trend

Ethereum is back above $2,300 at the time of writing and +10.5% for the last 24 hours. Crypto traders know that sentiment around the crypto market can change swiftly and traders currently are wondering if they’re in the midst of one of those changes.

There are more people talking about the potential and possibly inevitable ETH / BTC flippening than maybe ever before – the ETH / BTC pair is +91.96% for the last 90 days and +165% for the last 12 months.

The potential value of smart contracts and the future of web 3.0 are becoming more mainstream but does that mean Ether’s price will go to the moon in the short term and finish the second half of 2021 bullishly?

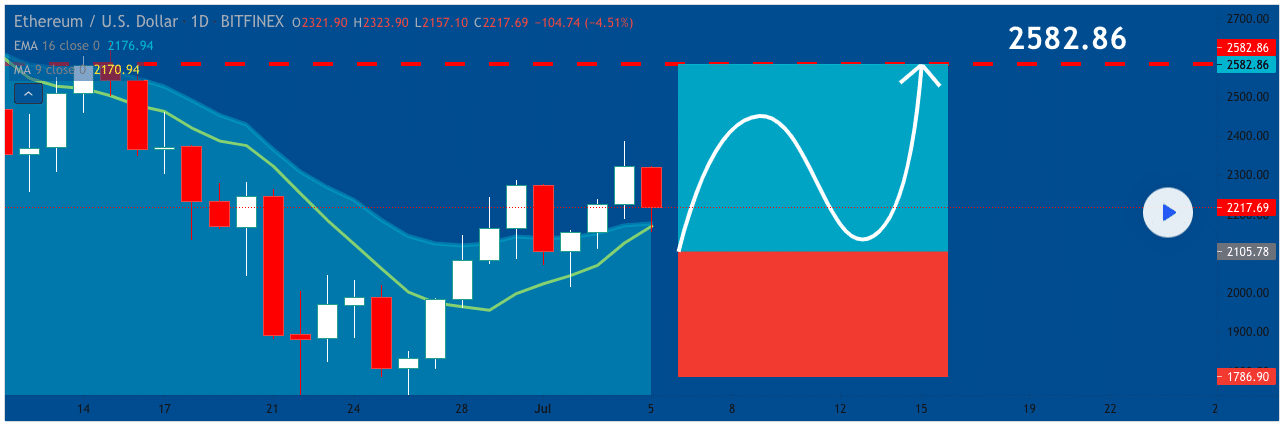

ETH is +913% for the last 12 months against the dollar and if the chart below from UnitedSignals plays out the percentage could be heading much higher.

The 1D chart on Ether is super bullish above $2,217 and as long as the macro [BTC] stays sideways or bullish then ETH’s $2,500 first target can be hit.

Ether’s 24 hour range is $2,212-$2,347. ETH was $238 on this date last year.

Tuesday’s ETH daily close was $2,310 [+5.22%] and it put in its first green candle since Sunday.

Uniswap prices

Uniswap might still be the most shocking development of the last 12 months. Multiple airdrops netted lucky participants of the DEX thousands in free tokens over the last year and the governance token has gained favor at least partially as a result – UNI is +2,094.7% since launching on September 16, 2020.

UNI hadn’t even launched at this point last year and reached an all-time high of $44.92 on May 3rd.

Despite a massive pullback with the rest of the market, UNI is now 50% of its ATH.

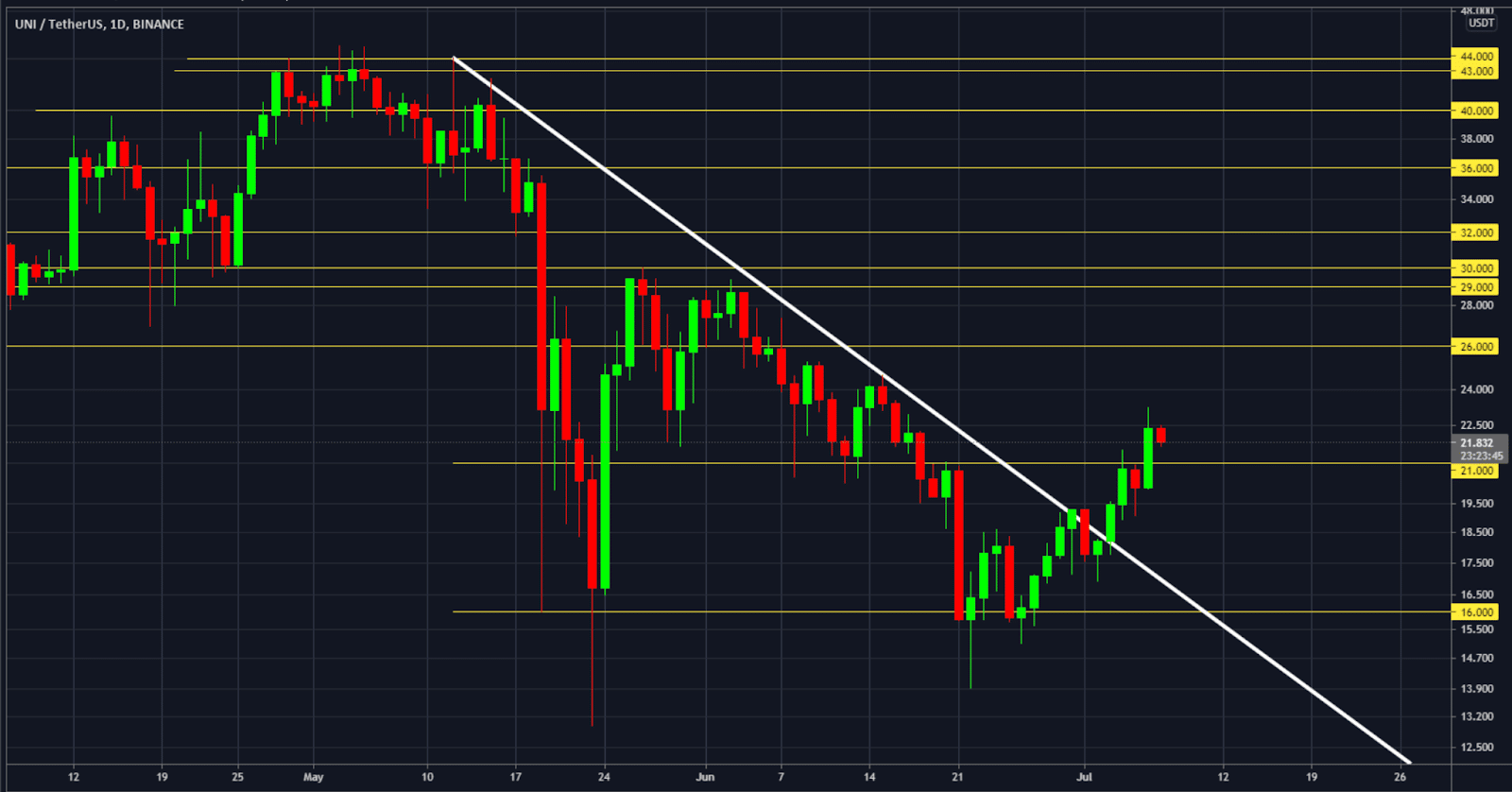

Below is a UNI 1D chart from @tendorian9 on twitter, UNI has broken above an important trendline and flipped $21 as overhead resistance and into support resistance.

The overhead first target for bulls on UNI is $26. A secondary target to the upside that traders will likely take profits at is $29.

A bearish scenario might look like a retest of $21 that fails and falls beneath the trendline again. The next support zone for Uniswap under $21 is $16 historically.

Uniswap’s +20% for the last 7 days and is one of the few alt coins that’s broken out since a bottom was put in on the macro market.

Uniswap’s 24 hour range is $20.03-$23.23.

Tuesday’s daily candle close for UNI was $22.29 [+11.04%] and it was the first green candle close since Sunday’s weekly close.