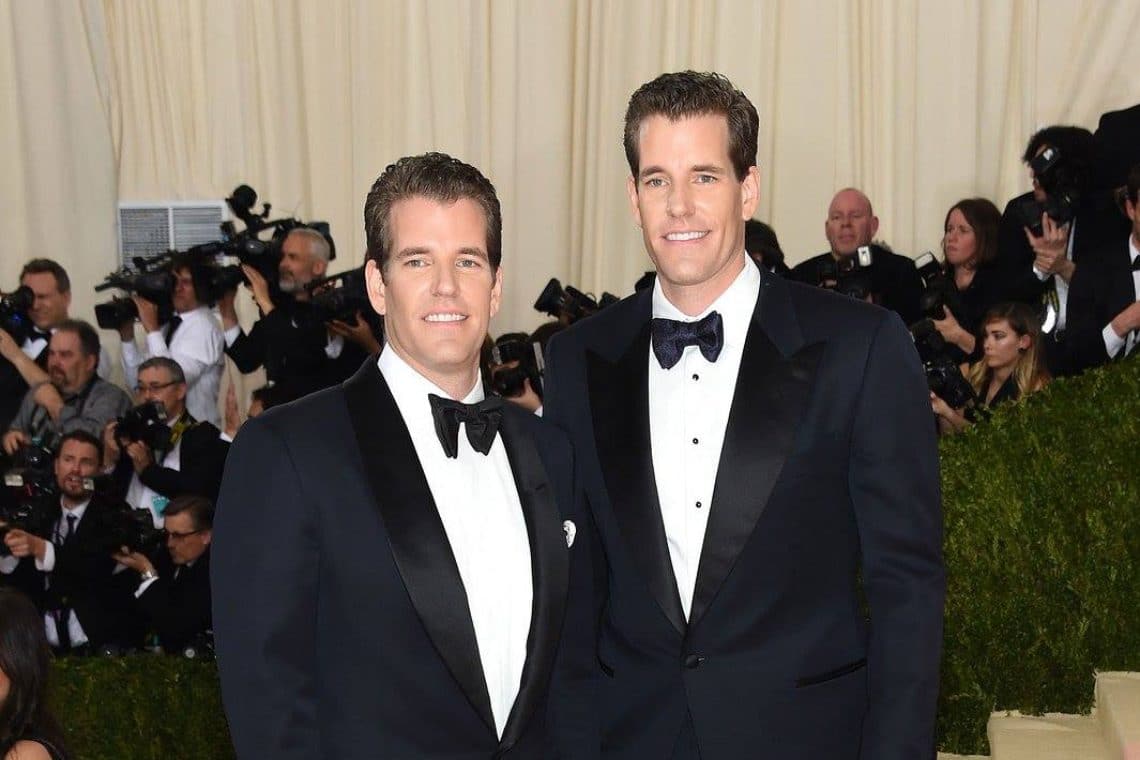

Twin billionaires Tyler and Cameron Winklevoss, creators of the Gemini crypto exchange, have invested in a startup, Colossal, which aims to bring back extinct species that could help the Earth’s ecosystem.

Summary

Genetics to help the ecosystem and combat climate change

Bringing lost species back to life, known as de-extinction, is the goal of the startup which, through genetic engineering, wants to create a new species of elephant that is almost identical to the woolly mammoth that went extinct 4,000 years ago.

American geneticist George Church, together with entrepreneurial partner Ben Lamm, former CEO of Hypergiant, wants to generate a hybrid between the Asian elephant and its prehistoric ancestor to combat climate change by restoring the root systems of plants where mammoths graze so as to extract more carbon from the atmosphere.

Colossal’s team analyzed the genomes of 23 species of living elephants and extinct mammoths, and the scientists estimate that they will need to simultaneously program more than 50 changes to the Asian elephant’s genetic code using blockchain technology to give it the characteristics needed to live in the Arctic.

A professor of genetics at Harvard, Church, through the process of cutting and pasting DNA sequences, saw the potential to develop new tools and techniques to help all threatened species survive.

The Winklevosses invest in Colossal

In the seed funding round, the startup raised $15 million by capturing the interest of other high-profile backers such as Tim Draper of Draper Associates, Peter Diamandis of Bold Capital and Jim Breyer of Breyer Capital.

The Winklevosses are known for their battle over Facebook’s intellectual property against Mark Zuckerberg, where they managed to turn the proceeds of the legal settlement into a $1 billion investment in Bitcoin.

They run one of the most influential cryptographic funds and one of the best digital asset exchange platforms, respectively named Winklevoss Capital and Gemini.

Cameron Winklevoss, in an interview with Fortune magazine, expressed his vision for Colossal’s possible future revenues, stating that there may be several economic opportunities over time, which could include the world of television or Jurassic Park-style theme parks for extinct animals.

In addition, Cameron explained that he does not envisage a return on investment in the first two years, but expects to monetize in a decade or so.

Winklevosses, Bitcoin and NFTs

When asked about the change in value of Bitcoin after the latest negative swings, Cameron Winklevoss said:

“I see Bitcoin ending the year at $100,000. There are a lot of tailwinds for it, with the biggest driver being inflation as trillions of dollars flood the money supply from loose monetary policy. My personal view is that Bitcoin is an excellent store of value, a way to hedge against inflation”.

On the subject of NFTs, the Gemini co-founder explained that he sees them as a new multi-billion dollar asset class with a value that can fluctuate just like that of BTC.

For the Winklevosses, NFTs should be treated as investments, and Cameron said he owns some digital works by the likes of Beeple and WhIsBe for that very reason.