Summary

Bullish candle for Bitcoin

Bitcoin’s price closed Tuesday’s daily session with a bullish engulfing candle and BTC’s price finished the day +$904.

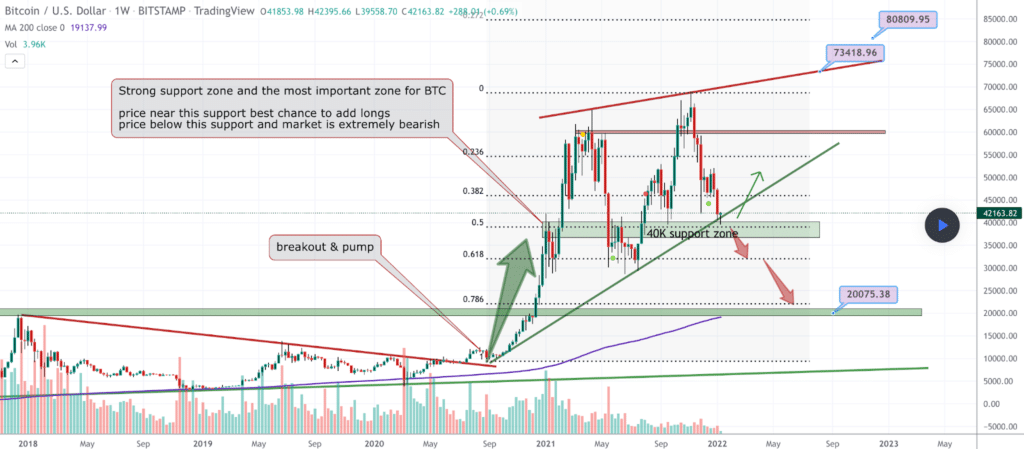

The BTC/USD 1W chart below from MMBTtrader indicates that BTC’s price is within its $40k support zone [at the time of writing] and Tuesday’s candle saw bullish traders step in to control the day’s price.

Overhead bullish BTC traders are targeting the 0.382 fib level [$45,985.86] with a secondary target at the 0.236 [$54,316.66] if they can overcome the $46k level and flip it back to a bullish support level.

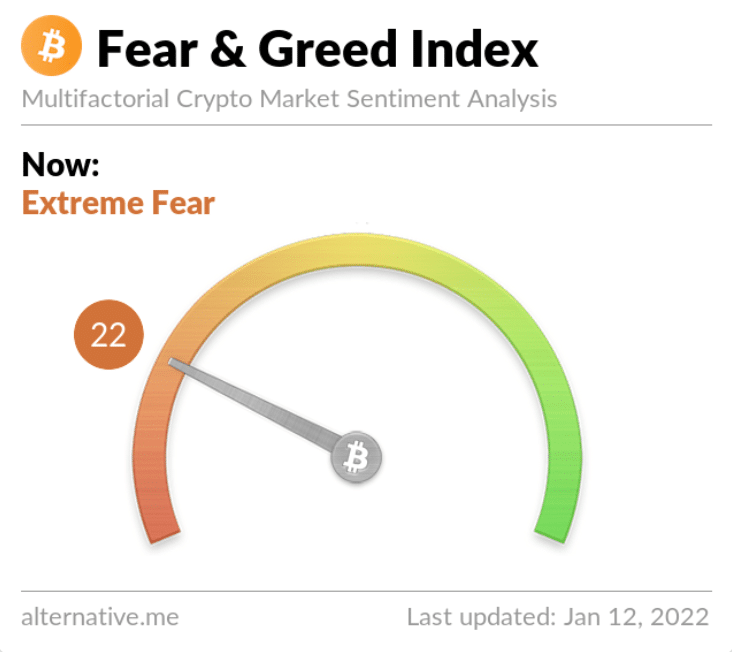

The Fear and Greed Index is 22 Extreme Fear and +1 from Tuesday’s reading of 21 Extreme Fear.

Bitcoin Moving Averages: 20-Day [$46,740.77], 50-Day [$53,135.61], 100-Day [$52,474.2], 200-Day [$47,734.57], Year to Date: [$43,472.64].

BTC’s 24 hour price range is $41,382-$43,223 and its 7 day price range is $40,655-$46,928. Bitcoin’s 52 week price range is $28,991-$69,044.

The price of bitcoin on this date last year was $33,938.

The average price of BTC for the last 30 days is $46,872.

Bitcoin’s price [+2.16%] closed its daily candle worth $42,743 and in green figures on Tuesday for the third time over the last four days.

Ethereum analysis

Ether’s price also bullishly engulfed its daily candle on Tuesday and finished the day +$152.47.

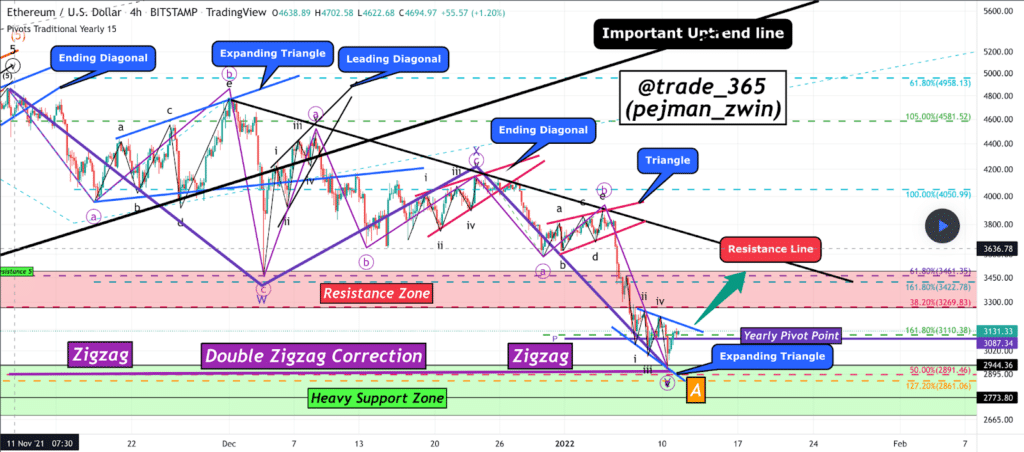

Today we examine the ETH/USD 4HR chart below from pejman_zwin and the most important levels for traders. Bullish Ether traders are trying to maintain control of the 38.20% fib level [$3,269.83] and again reclaim the 61.80% fib level [$3,461.35].

Conversely, Ether bears are trying to break the 38.20% fib level and again send ETH’s price back down to test the 50.00% fib level [$2,891.46]. As traders will note from the chart, the $2,7k level is proving as a heavy support zone for Ether bulls.

Ether’s Moving Averages: 20-Day [$3,755.43], 50-Day [$4,122.22], 100-Day [$3,837.50], 200-Day [$3,215.71], Year to Date: [$3,421.10].

ETH’s 24 hour price range is $3,061-$3,262 and its 7 day price range is $3,011-$3,840. Ether’s 52 week price range is $1,010-$4,878.

The price of ETH on this date in 2020 was $1,045.41.

The average price of ETH for the last 30 days is $3,085.46.

Ether’s price [+4.94%] closed its daily candle on Tuesday valued at $3,237.93.

Avalanche analysis

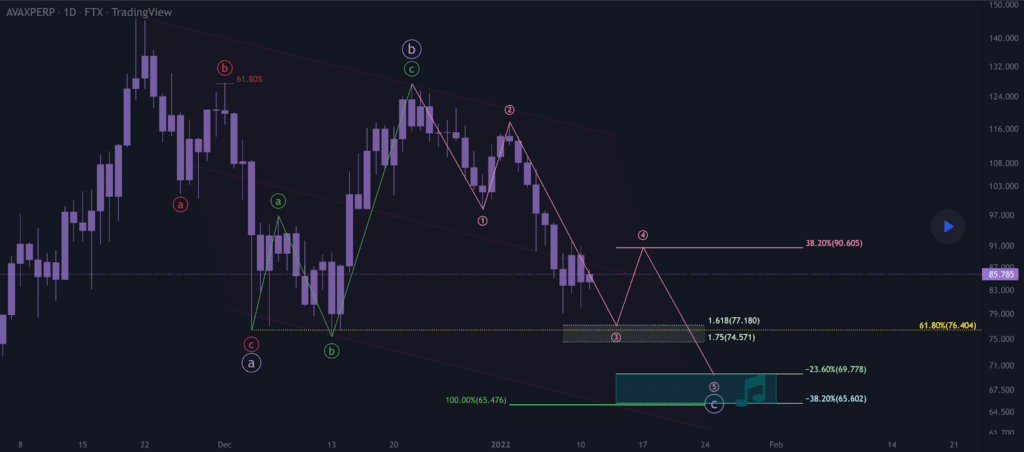

After finishing its first daily candle of 2021 in green figures Avalanche’s price suffered from incessant selling and AVAX bears rattled off 7 straight daily closes in red figures. Bullish AVAX traders are trying now to shift the short term momentum with a second green candle close over the last three days and AVAX’s price finished +$5.13 on Tuesday.

The AVAX/PERP 1D chart below from Eloquent illuminates the critical areas for AVAX market participants and shows that AVAX finished in the middle of its current range on Tuesday. The range AVAX’s price is trading in is between the 61.80% fib level [$76.40] and overhead resistance at the 38.20% fib level [$90.60].

The trend is currently in favor of bearish traders; therefore, their first target if they snap the 61.80% fib to the downside is the -23.60% fib [$69.77] with a secondary target of the -38.20% fib [$65.60].

Avalanche’s price against The U.S. Dollar for the last 12 months is +1,267%, +981.3% against BTC, and +350.4% against ETH over the same timespan.

Avalanche’s 24 hour price range is $83.61-$90.62 and its 7 day price range is $80.31-$106.53. Avalanche’s 52 week price range is $6.44-$144.96.

AVAX’s price on this date last year was $7.75.

The average price for AVAX over the last 30 days is $102.95.

Avalanche’s price [+6.08%] concluded its daily session on Tuesday worth $89.56.