The SUI-USDT exchange pair recorded an X20 multiplier on the starting price of the public sale; those who had the token in their crypto wallet got a real bargain!

The public sale took place on some centralised exchanges such as OKX, Kucoin and Bybit, while compared to the whitelist price, the increase is 100 times the starting price.

This is a great success for one of the tokens that aims to become an important part of the DeFi and Web3 world.

Where can you currently buy SUI and which crypto wallets are best suited to store it safely?

Summary

SUI crypto explodes at launch in pair with USDT: a X20 increase for those who had it in their wallet before listing

Yesterday, the SUI cryptocurrency officially made its debut in the major crypto markets, registering a killer price increase in the pair with USDT. Anyone who had it in their wallet before the listing made a huge profit.

Before talking about the pump there was on the exchanges where it was listed, it is appropriate to devote a brief introduction to the methodology by which the token was introduced through the community.

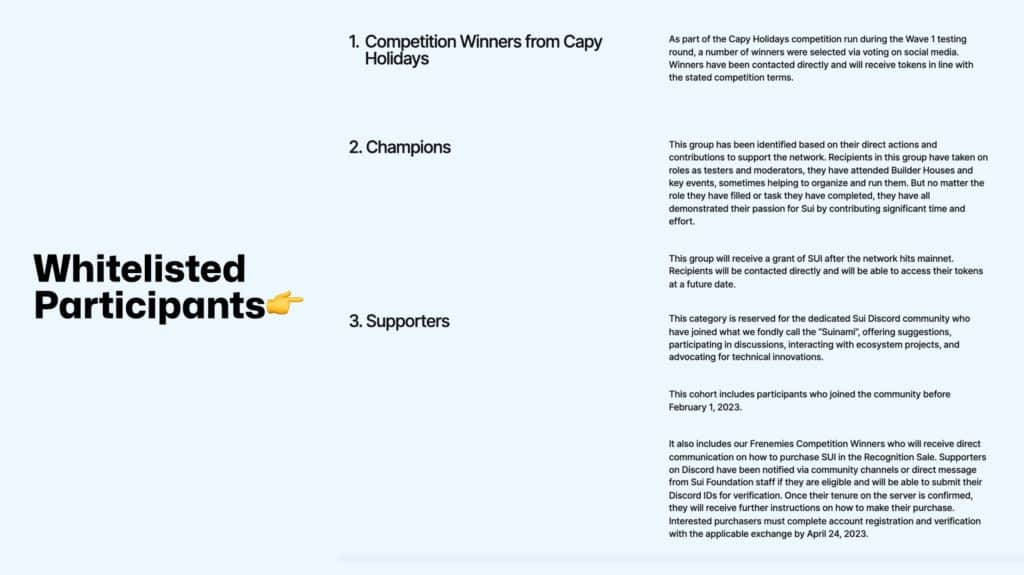

The distribution of the SUI took place among the supporters of the project BEFORE it was listed on the major crypto exchange platforms through a mechanism called the “Community Access Program“, in which a number of users were selected based on their participation in the project when it was still in development.

More specifically, those who tested the SUI testnet, community managers, developers and key contributors were privileged to purchase the SUI token at a price of $0.03.

Those who were lucky or deserving enough to fall into this category made an X100 from their initial investment if we consider the peak price touched on Biget.

For users who were not on the main whitelist, there was still a chance to participate in the public sale lottery, where a few users managed to get a certain amount of SUI at a price of $0.1 per token.

Again, although the starting price was about 3.3 times higher than the main contributors, those who managed to buy SUI at this price earned an X20 if we consider the peak recorded on Binance at the time of launch.

Considering that most of the exchanges that participated in the public sale allowed a maximum allocation of 10,000 SUI (thus an investment of $1,000), those who managed to sell at the top of the SUI-USDT pair on Binance earned a whopping $20,000.

On a less optimistic note, those who sell now, when the price of SUI is $1.37, will make a profit of $13,700.

ABSOLUTELY INSANE.

How to buy the SUI token with USDT and which wallet to choose to safely store the crypto

Although on this first day of trading the SUI token has pumped a lot in the pair with USDT, there are those who expect a continuation of the bullish trend for the crypto, as happened after the APTOS airdrop. On that occasion, within a few weeks of listing on the major exchanges, the token rose more than 500%. So let’s see which exchanges the token is listed on and which cryptocurrency wallet to choose to hold it safely.

Obviously, these are not financial tips: the intent is to share the thoughts and opinions of other people in the crypto world and provide some technical support on the type of wallet/platform to choose if you decide to buy SUI on your own.

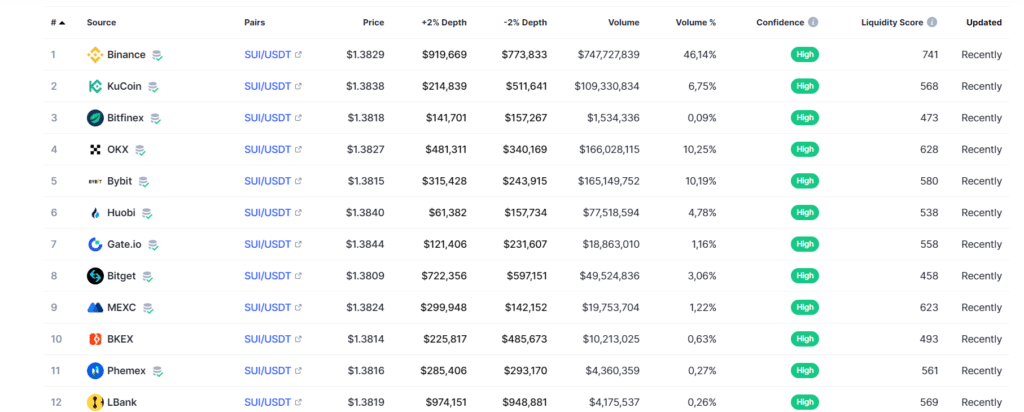

The main exchanges where SUI is listed are Binance, Bitget, OKX, Kucoin, Kraken, Bybit, Huobi, Gate.io, Bithumb, Mexc and many more.

The choice is very wide, since the launch of SUI was highly anticipated: basically, any exchange is fine to buy the token, unless you are in possession of millions of dollars of capital and had to choose among the most liquid markets.

In this case, the best choice would be to avoid the smaller exchanges and choose, according to your preferences, one of the platforms among Binance, Kucoin, Bybit and Okx, where the volume of the last 24 hours on the SUI-USDT pair exceeds $100 million on all 4 markets.

If you are a European user and want to buy SUI in EURO on Binance, you need to be careful because the volume of the last 24 hours is only 1.6 million EUR. Much better to choose to make the purchase with stablecoin tether.

However, on the custody side, there is a small consideration to be made: if you do not have knowledge and experience with self-custody solutions and are not navigating in the DeFi and Web3 world, the advice is to custody the SUI token on the same platforms where you are going to buy it, perhaps avoiding the fledgling exchanges and preferring those with a solid base and proof of reserves to back up their credibility and solvency.

The choice tends to be between Binance, Kucoin, Bybit and Okx, which are also the platforms with the most liquid markets.

On the other hand, if you are an experienced user and prefer solutions that allow you to always be in possession of the private keys to perform transactions, there are decentralised wallets that are right for you.

We are talking about the decentralised wallets “Sui wallet”, “Suiet”, “Ethos wallet” and “Fewcha wallet”.

You can find official links to the social pages of these wallets (where there are official download links) via the ecosystem portal of projects built on SUI.

What is expected from the future of SUI?

We have talked about the speculative side of SUI, the numbers it has recorded in trades with the USDT pair, and the best wallets to hold the crypto.

Instead, it is time to look at the fundamentals of SUI and the company behind it, Mysten Labs.

SUI started as a spin-off of Meta‘s Diem project, whose former developers decided to build the Layer 1 blockchain with the intention of horizontally scaling the on-chain transaction market.

In fact, according to Evan Cheng (co-founder and CEO of Mysten), Web3 is currently in a dial-up phase where processes are slow, expensive, insecure and difficult to build.

SUI’s company has raised several rounds of funding before coming to market, most recently in September 2022, when it raised $300 million at a valuation of more than $2 billion, according to CrunchBase.

To summarize the main points of the project, the technical innovations include the MOVE programming language, which is very user-friendly for developers, who can rely on a simple but efficient framework to build the next wave of decentralised applications on the blockchain.

MOVE is based on RUST, a programming language adopted by other major crypto projects such as Near, Polkadot, and Elrond, and developed by FB’s Libra project.

Another highlight of the innovation that SUI brings is the Narhal-Tusk consensus algorithm, which separates data transmission from the transaction consensus process, effectively solving the mempool storage problem that still exists in Bitcoin and Ethereum protocols.

Thanks to this “trick”, SUI is programmed to scale horizontally, supporting millions of transactions per second without the need for dedicated nodes in the network.

Many are calling SUI the next Solana and Aptos killer.

We will see what the future holds for this very interesting blockchain project.