SPONSORED POST*

Lately, it seems like the news is packed with stories about falling bank shares and central banks bailing out financial institutions in the wake of rising interest rates. From the failures of America’s Silicon Valley Bank, Signature Bank and First Republic Bank to Switzerland’s Credit Suisse being rescued with a UBS takeover, the weaknesses in traditional banking systems have only made decentralized financial systems more attractive.

However, the crypto arena has also been proven vulnerable, due in part to its under-regulation and lack of oversight, with the collapse of FTX and, of course, the bankruptcy filing by leading crypto exchange Bittrex, last week.

Banks and digital wallets each have their own advantages and disadvantages, and the choice between the two depends on individual needs and preferences.

Summary

The Benefits and Limitations of Traditional Banks:

Banks are highly regulated and offer a high level of security, including deposit insurance and fraud protection. They also offer an exceptional level of convenience, providing a wide range of services, such as loans, credit cards, and savings accounts, all in one place. A large network of branches and ATMs, make it easy to access funds and manage accounts from anywhere.

However, one of the biggest issues with banks is that they often charge substantial fees for performing various services, such as overdrafts, ATM usage, and wire transfers. They are also less democratic than decentralized alternatives, as they may not be accessible to people with lower incomes or credit scores. Time is another major factor as transactions can sometimes take a while to process, especially for international transfers.

The Risks and Rewards of Digital Wallets

The FTX and Bittrex disasters are just the latest proof that the crypto sphere is severely under-regulated. Lack of oversight, high market volatility and anonymity has opened the door for fraudsters.

While digital wallets use advanced encryption, they rely on technology and internet connectivity, making them vulnerable to cyber-attacks and fraud. Moreover, while the situation is consistently improving as regulation improves and crypto gains greater global legitimacy, not all merchants accept digital currency payments, which can limit their usefulness.

Digital wallets are easy to use and offer quick transactions without the need for physical cards or cash, and they can be accessed from anywhere with an internet connection. There are no middlemen, so you are not paying exorbitant bank fees and from a security perspective you are shielded against inflation and stock market crashes.

Interest-bearing wallets can offer exceptional rewards and you can earn a passive income from interest payments without having to take the risk of speculating on the crypto markets. Interest-bearing wallets offer interest rates as much as fifty or even a hundred times higher than traditional bank savings accounts, while providing secure storage for your cryptocurrencies, reducing the risk of loss or theft. They often use multi-signature technology and other security measures to protect your funds.

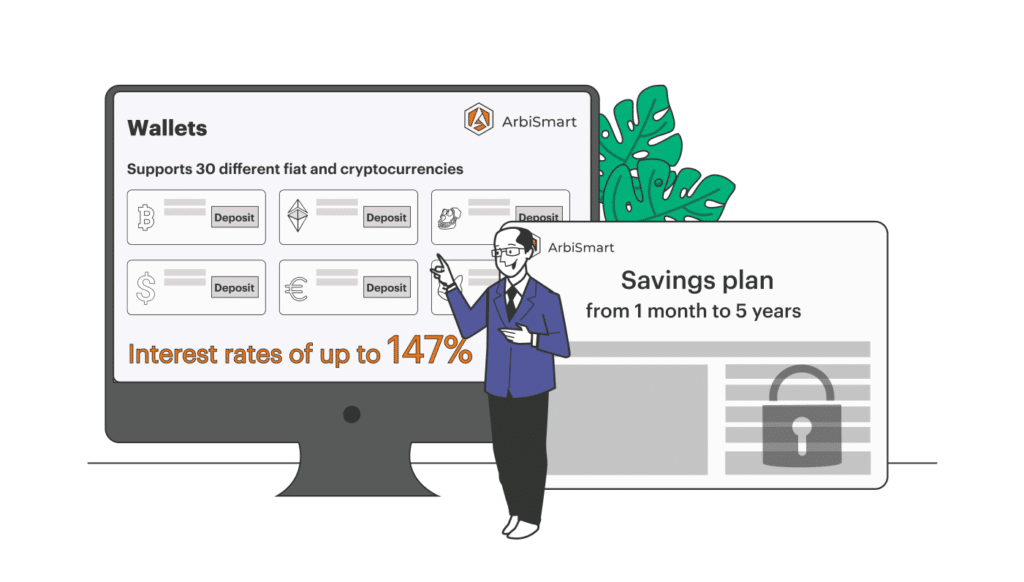

Interest-bearing wallets can be a great option for investors who want to earn passive income while also enjoying the benefits of security and convenience. For example, ArbiSmart, is an EU authorized and registered licensed, centralized wallet, with a proven record of security, having no history of breaches and industry-high interest rates, reaching up to 147% a year. The wallet supports 30 different FIAT and cryptocurrencies, so you don’t need to own Bitcoin, or Pepe coin to make a profit. There are even certain types of savings plans where you can earn interest in euros on your crypto savings. Savings plans can be locked for as little as 1 month or as long as 5 years, with a fixed profit that can be calculated in advance. Your profit percentage will be based on the contract length, balance currency and deposit amount, as well as your account status.

Banks offer security and convenience but may come with fees and requirements. Meanwhile digital wallets offer accessibility and incredibly generous rewards but can be vulnerable to security risks and may have limited acceptance. However, a regulated, licensed wallet that supports both FIAT and crypto offers a great solution.

To start earning secure passive profits, with minimal risk, open a savings plan today!

*This article was paid for. The Cryptonomist did not write the article or test the platform