Global investment fund VanEck has made its price prediction for Ethereum in 2030, highlighting optimism for the second most capitalized cryptocurrency in the crypto market.

The analysis was carried out taking into account a number of objective and verifiable data which overall treat Ethereum as a business rather than a blockchain.

Let’s see together VanEck’s price estimates and what interesting details emerged from the study.

Summary

VanEck and its bullish price forecast for Ethereum

VanEck, the New York-based hedge fund, has given its opinion on the future price of Ethereum, with a forecast that sees the crypto going above $10,000 by 2030.

The methodology by which the valuations were made, takes into account well-established data such as projected cash flows of the Ethereum network, assessment of market capture, and revenue distribution.

Overall, Ethereum was analyzed as a business in its own right, given that, according to VanEck, it offers a service that is highly demanded by the market, namely providing its framework and security to all users who want to “trade” in the Web3 world.

Decentralized applications and smart contracts cannot function without a reliable transaction layer that can securely scale all requests that are proposed on-chain.

In this context, the blockchain devised in 2014 by Vitalik Buterin represents the most robust solution with a degree of efficiency and decentralization inferior only to that of Bitcoin, which, however, cannot accommodate smart contracts in its ledger, limiting itself to mere P2P money transfer.

VanEck believes that Ethereum will capture value precisely from the concept of “Security as a Service,” which will be increasingly demanded by all the applications and infrastructures that will emerge between now and the next few years.

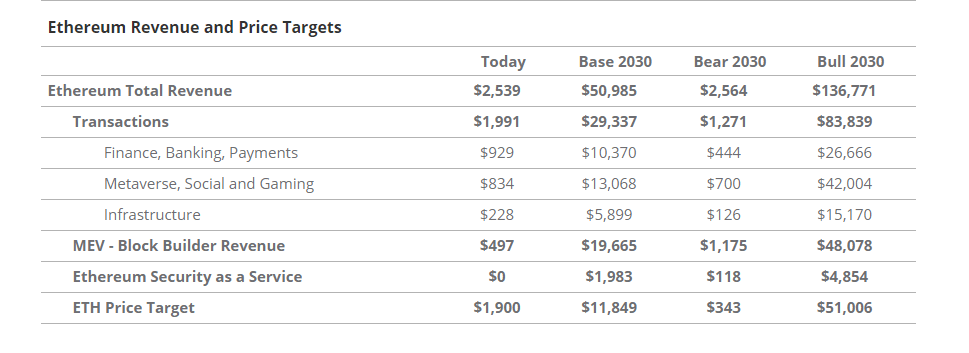

Going into detail now on the price analysis, we can see that the investment fund did not provide a single projection for Ether, but defined a price target for three future scenarios.

In the most bearish scenario, ETH will reach a price of $343 in 2030, in the neutral one it will touch a value of $11,849 while according to the most optimistic estimate it will reach as high as $51,006.

Ethereum price predictions: the Flashbots Layer 2 market

Very interesting details emerged in the study that led the investment fund to make such a bullish Ethereum price prediction, especially for the Layer2 and FlashBots MEV market.

In particular, VanEck believes that thousands more Layer2s, which are layer 2 infrastructures that rely on Ethereum to enjoy its framework and security, will emerge in the future, with a range of off-chain operations being performed.

Competition will lead to lower L2 margin rates from the current 15-40% to 10% in 2030 while assuming at the same time that 98% of all Ethereum transactions will originate from these very lower substrate blockchains.

At the same time, 50% of the total asset value will remain on the main blockchain, which will continue to earn from all transactions that are executed due to its predisposition as a “global computer for the world.”

The concept of “Security as a Service” is of fundamental importance to Ethereum’s business, which while securing all assets and smart contracts within its network, sells blockchain space to anyone who wants to participate in the business as validators, builders or relayers.

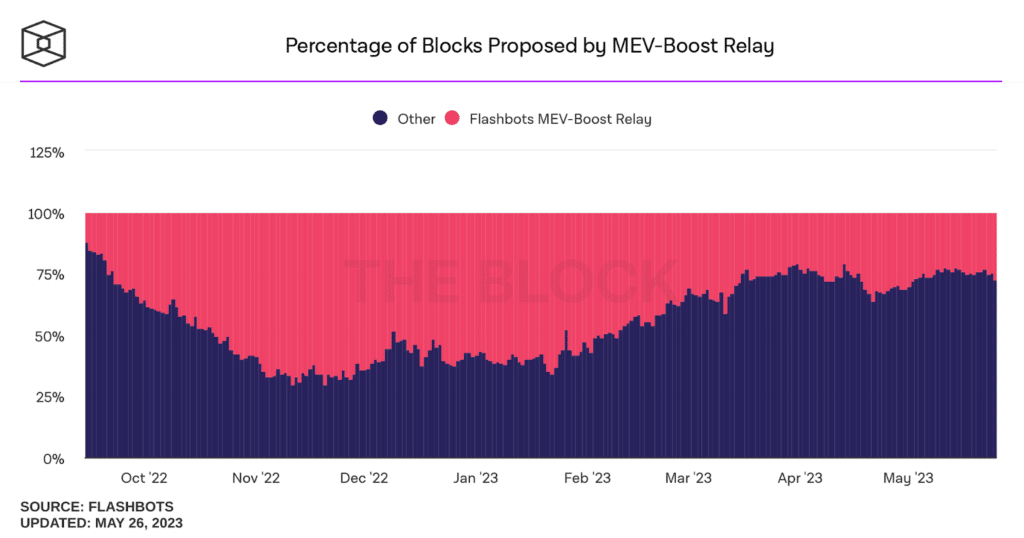

All these actors collaborate and compete with each other at the same time to issue a block of transactions on Ethereum and to decide the order in which they will be executed.

Indeed, the validation of blocks on this blockchain is not done randomly, but there are many individuals operating with sophisticated hardware, known as flashbots, who through MEV maximization strategies decide the order of users’ transactions.

By proposing their own version of blockchain, these bots take advantage of arbitrage opportunities, liquidations, and “frontrunning” large orders to make a lot of money.

In parallel, the Ethereum blockchain earns more fees from this activity because the sorting of tx in the block, costs flashbots a lot in gas fees.

VanEck thinks that MEV bots will help bring in $19.6 billion to the Ethereum network, while still seeing their TVL drop from 2% today to 0.10% in 2030.

To date, 1 in 4 blocks in the chain is offered through these MEV strategies.

Ethereum became deflationary after the London hard fork

Another very interesting insight in the Ethereum price prediction provided by VanEck concerns the “burn ratio” of ETH that will be reached in 2030.

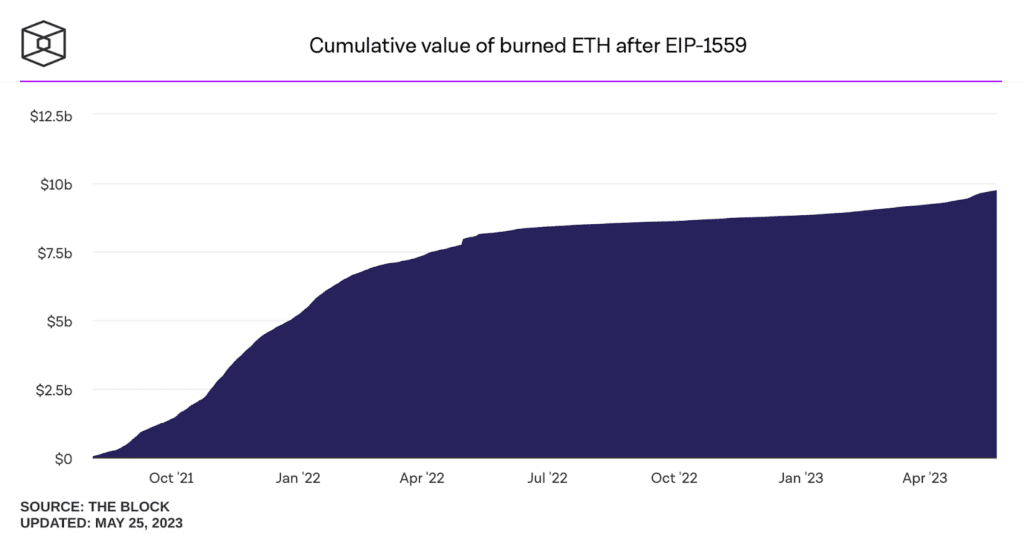

After the London hard fork, specifically with “the Ethereum improvement proposal 1559” it was determined that with every transaction carried out on the blockchain, a portion of Ether would be burned, as a compensation mechanism to the issuance of coin as block reward.

Unlike Bitcoin where the halving mechanism on miner rewards and the supply defined at 21 million contribute to the strength of the asset price, in Ethereum these conditions are not there by default.

Ethereum in fact has an infinite max supply and prior to this update the cryptocurrency was seen by investors as potentially very inflationary.

The basic concept of the coins burn is that the more activity on the network, the lower the inflation of the network.

Since August 2021, when the Ethereum hard fork was executed, it has burned more ETH than have been mined again to pay for block validation.

This means that so far the mechanism has allowed the network to bring down the burden of inflation, even becoming deflationary and eliminating excess ETH worth $9.7 billion

It is not certain that this condition will remain so over time. However, VanEck believes that the “burn ratio” will reach 80% in 2030.

This is a key cue that shows how the Ethereum network is conceived as being of extreme value to VanEck and what the growth expectations are not only in terms of price but also in the amount of transactions and value that will be stored on it.