Deutsche Telekom, a leading telecommunications company on a global scale, announced today that it will become a validator on Polygon’s infrastructure.

The news is very positive for Ethereum’s Layer 2, which fortifies and decentralizes its Proof-of-Stake network even more.

Let’s take a look at all the details together.

Summary

Deutsche Telekom extends its nodes on Polygon

The multinational telecommunications company Deutsche Telekom will soon become an effective validator within the infrastructure of Polygon, Ethereum‘s main scaling network with a $1 billion TVL.

This does not represent the first instance of the German company joining the blockchain world, given its recent participations with Flow, Celo, Chainlink and Ethereum.

In this regard, with reference to Vitalik Buterin‘s network, which serves as a central hub in the development of smart contracts, Deutsche Telekom had entered as a node operator in October 2022, more specifically in the liquid staking market.

Today it is Polygon’s turn, which sees its inner circle of validators (about 100) expanding by further decentralizing how block validation is achieved while increasing network security in parallel.

About the news, the head of Deutsche Telekom’s Blockchain Solutions Center, Dirk Röder quoted the following:

“The Polygon ecosystem is very developer-friendly and resource-efficient. It is based on the highest security standards of the Ethereum ecosystem.”

On the other hand, the Chief Operating Officer of Polygon Labs, Michael Blank, praised the entry by the new partner with these words:

“This collaboration will pave the way for more businesses to embrace blockchain technology through Polygon and empower consumers by unlocking the ownership and autonomy that web3 technology offers.”

Therefore, Deutsche Telekom effectively becomes part of the network of nodes that produce and validate blocks, participating in the consensus mechanism inherent in the Polygon infrastructure and contributing to the security of the blockchain and the many Supernet apps.

Layer 2 represents one of the most developed solutions in terms of scalability and decentralization, allowing developers a wide range of implementations.

The partnership will positively contribute to expanding the development possibilities of users in the blockchain world who already enjoy simplified access to scaling solutions such as zero knowledge rollup, sidechain and blockchain-specific decentralized apps.

What is Deutsche Telekom

Deutsche Telekom represents one of the world’s leading telecommunications operators, established in 1966 from the former state monopoly Deutsche Bundespost.

To this day, it is a parastatal company with the German state still holding the majority of shares, but privately managed and organized.

Deutsche Telekom controls a number of companies (all beginning with T-) involved in fixed and mobile telephony, Internet services, and business utilities, such as T-Home, T-Mobile, T-Online, and T-Systems.

New infrastructure node operator Polygon also owns majority stakes in foreign telephone companies such as Slovak Telekom, Magyar Telekom and T-Hrvatski Telekom.

The company, which is headquartered in Bonn, generates annual sales (2019 figures) of 80.5 billion euros, of which 95.2% comes from telecommunications services, 4.4% from IT and communications systems development, and 0.4% from numerous other activities.

The geographical breakdown of revenues is the following: Germany (23.1%), Europe (13.7%), North America (62.8%) and other countries (0.4%).

According to 2019 data, Deutsche Telekom has 216,000 employees and a net profit of 3.9 billion euros.

The company is publicly traded and its stock capitalizes a total of about 104 billion euros, with a price per share of 20.94 euros.

Deutsche Telekom has a presence in more than 50 countries and provides its services to about 178 million mobile, 28 million fixed-line and 20 million broadband customers.

Despite the fact that the telecommunications business is in decline across Europe, the company has shown a proactive approach to new technologies, exploring development solutions for infrastructure built on blockchain.

We hope that in the future the multinational company will push more and more into the web3 world by generating part of its revenue through block rewards and user tx fees and abandoning the outdated telephony business.

The latest news regarding Polygon and crypto MATIC

In addition to the partnership affair with Deutsche Telekom, there is more news for Polygon and the native MATIC token.

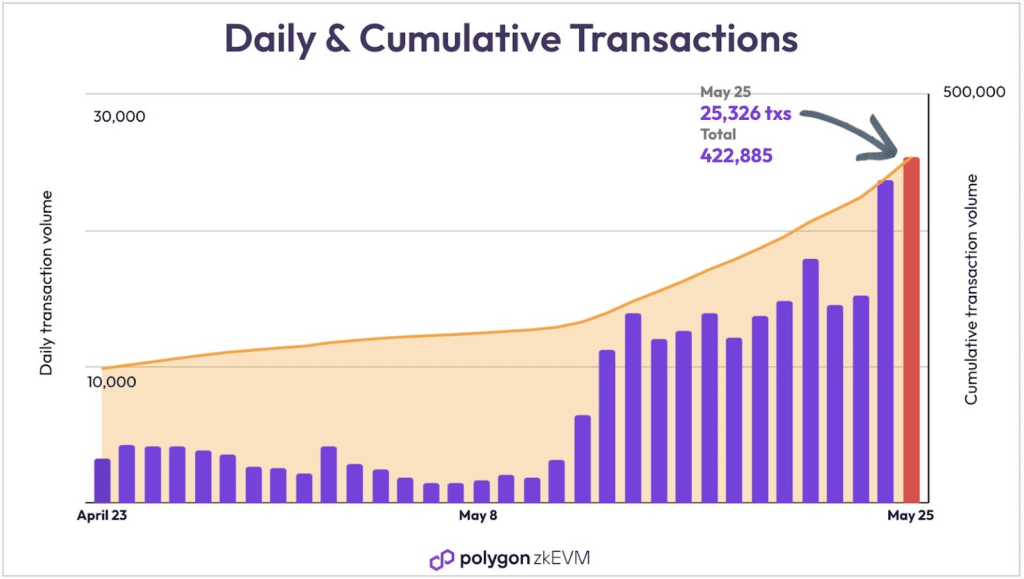

The most interesting news certainly concerns the achievement of a major milestone for Polygon’s Zk EVM network, which provides zero-knowledge cryptographic computation data by reducing block weight and increasing user privacy.

The new scaling solution, although it still has a low TVL ($15 million) and a number of active wallets of about 4 thousand, reached an ATH in May in terms of volume generated in a single day with 25 thousand transactions

This is a small but important step forward in the development and adoption of this zk network.

If you are interested in bridging funds from Ethereum to Polygon Zk EVM, you can do so here.

The second major piece of news concerns the expansion of activities aimed at increasing the liquidity and stability of the assets in the ZK network itself.

Specifically Gamma, a protocol for market making strategies has increased the network’s liquidity through liquid staking.

In addition, Clober, a liquidity protocol for EVM-compatible blockchains, has officially deployed its on-chain order book.

Both parties are helping to increase network liquidity and improve the overall user experience.

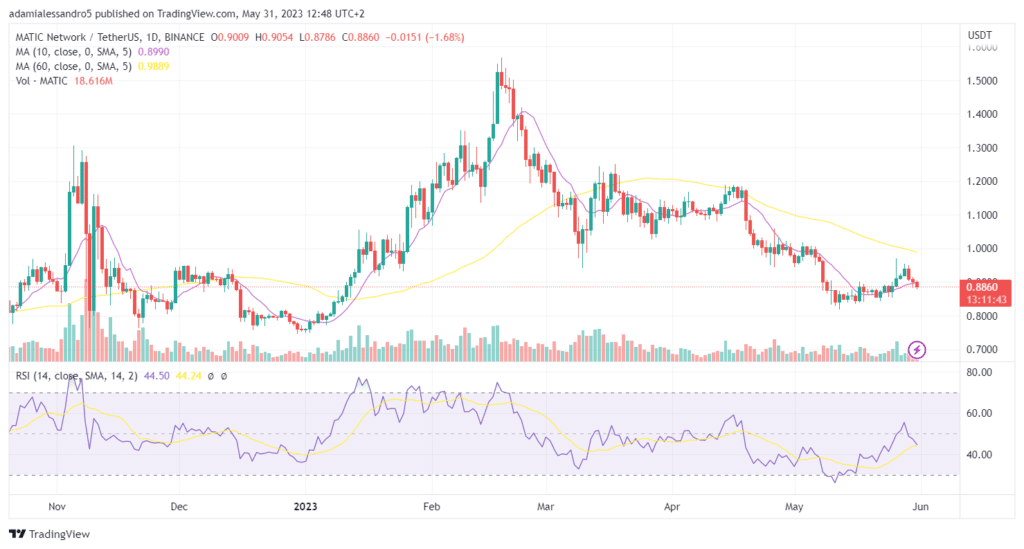

The MATIC token, despite relentless project developments and the success it is experiencing in the Zk world, is failing to emerge in a speculative manner.

Most likely this is due to the macroeconomic conditions in the markets and the uncertainty emerging in the sentiment of crypto traders.

MATIC has a current price of $0.886 per token, a market capitalization of $8.24 billion, and a circulating supply of 92.79% of total supply.

Prices are crushed by the 10- and 60-period moving averages on daily time frames with overtly bearish directionality.

The RSI gives no comfort in this regard, and it will probably be necessary to wait for new lows, likely in the $0.75 area to possibly see a reaction from the bulls.

In the meantime, the Polygon Labs team seems to have no fear on the speculative front and continues to improve its products, as is appropriate in a bear market period.