These days the crypto exchange Gemini, owned by the Winklevoss twins, has been challenged by the market situation.

The company has been forced to cut some of its staff after volumes on the platform dropped dramatically, all the while facing some tough regulatory challenges.

Let’s try to take a closer look at the matter.

Summary

The crypto exchange of the Winklevoss brothers fires 50% of staff during bear market

Gemini, a well-known crypto exchange run by the Winklevoss twin brothers, is facing a turbulent period that threatens to bring the company’s finances to their knees.

The Winklevoss brothers, who back in 2011 sued Facebook for intellectual property infringement earning a $65 million settlement, now risk shutting down their cryptocurrency exchange company.

With the prolonged decline in market prices and volumes on exchanges at multi-year lows, Gemini is no longer profitable and has been forced to lay off some staff to stay afloat.

In particular, about 500 employees have been cut off since the bear market began, half from a peak of nearly 1,000 in 2021.

This includes some Gemini executives such as the chief operating officer and the co-head of the exchange’s NFT platform.

Decisions about cutting personnel costs in half were made by Pravit Tiwana, a former Amazon Web Services executive hired as chief technology officer in January 2022.

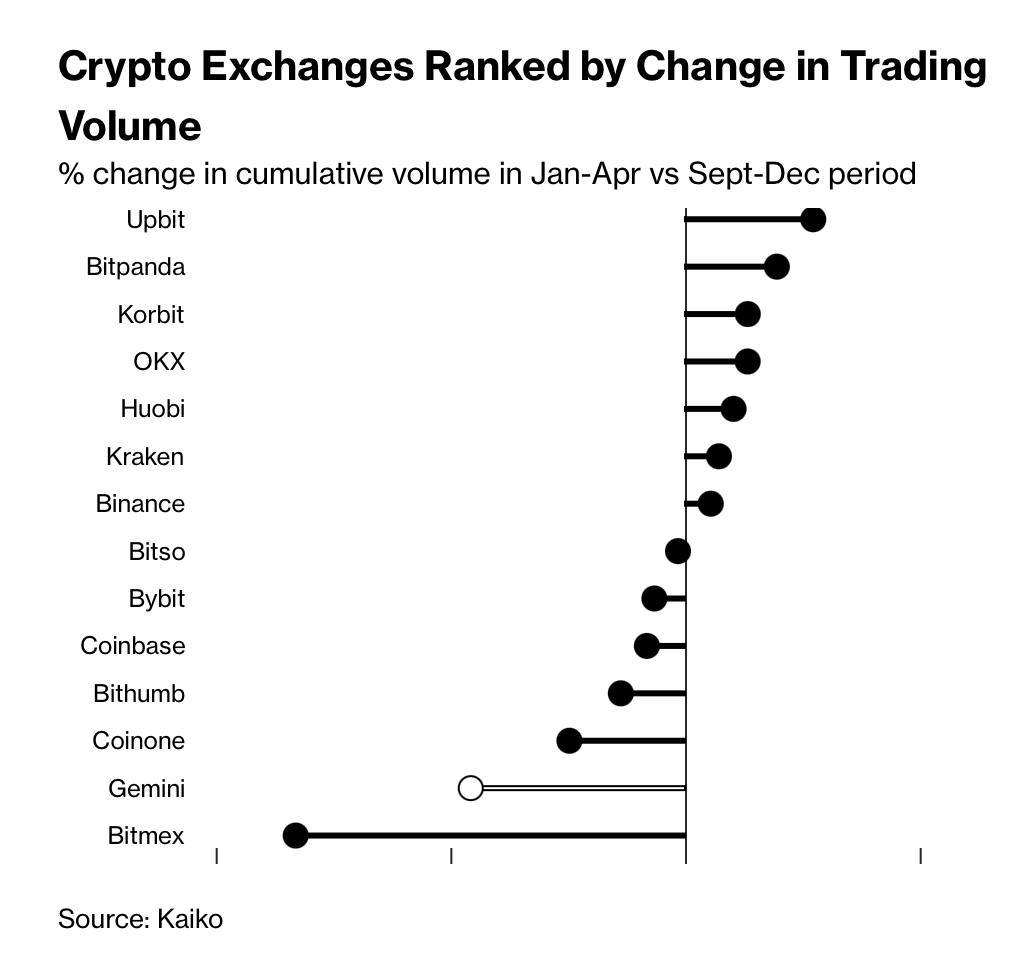

According to Kaiko‘s data, volumes generated by Gemini from January to April this year were down 46% from those recorded during the September-December period of 2022.

In the last 24 hours, the Winklevoss exchange generated volumes in the spot market of $23 million, which is extremely lower than market leaders such as Binance and Coinbase that produced trades of $7.3 billion and $976 million, respectively.

In total, Gemini’s market share in April amounted to 0.12% of global spot volume, a figure up from 0.07% in February 2022, but down 50% from a year ago.

Eswar Prasad, professor at Cornell University, said the following about the exchange‘s situation:

“its small market share and series of regulatory problems portend a bleak future for Gemini.”

SEC lawsuit against the Winklevosses’ crypto exchange

Weighing down the financial situation of crypto exchange Gemini and the Winklevoss brothers is the US Securities and Exchange Commission (SEC), which in January filed a lawsuit against the exchange and its affiliate Genesis Global Capital, a now-bankrupt crypto lender.

The allegation speaks of an alleged sale of unregistered securities through the “earn” product offered by the Winklevoss brothers, who are now seeking to defend themselves by asking for the case to be dismissed, calling the SEC’s action “ill-conceived.”

Regulators are seeking a settlement including “permanent injunctive relief, restitution of ill-gotten gains plus prejudgment interest and civil penalties.”

The bankruptcy of Genesis, which was penalized by the exposure of its assets on FTX and Three Arrows Capital, has led to a lowering of investor confidence on all services led by Gemini, resulting in decreased volumes and market share.

In addition, legal complaints and class actions are pending against Gemini Earn for leading to the loss of all funds of users who had deposited cryptocurrencies on the platform.

In total, nearly 300 users have joined a class action organized together with Genesis’ creditors on the social media platform Telegram.

To atone for all these problems and to find new markets abroad, especially in what concerns the derivatives trading sector in crypto, where Gemini is almost still absent, the Winklevoss brothers have talked about a second headquarters in Dublin.

Cameron has said publicly that he and his twin will not leave the United States but will try to build a European market for Gemini in parallel, with the goal of reviving the company’s finances.

Will Gemini be able to survive?

At first glance, the Gemini crypto exchange does not appear to be exactly on the verge of bankruptcy given the economic capacity that is in the hands of the Winklevoss brothers.

The twins made a billion-dollar fortune by investing profits from the Facebook lawsuit in Bitcoin in 2011.

Regarding the issue of Gemini’s financial difficulties, the Winklevosses decided to invest $100 million from their own pockets to cover some of the company’s operating expenses.

Some rumors spoke of seeking foreign funding for the exchange, although the twins’ lawyer Charles Harder clarified that the company never intended to seek foreign funding.

He also told Bloomberg that there are no material documents such as a pitch deck and term sheet that would confirm the rumours.

Instead, what seems to be verified is that JPMorgan has abandoned its relationship with Gemini, urging the exchange to find another banking partner since the business has stopped being profitable.

This further fuels investors’ fears about a future for the historic Gemini exchange, which is becoming increasingly uncertain.

In fact, the brothers could stop funding Gemini should it turn a loss again in the next quarter.

According to Campbell Harvey, professor of finance at Duke University and author of the book “DeFi and the Future of Finance,” the issue could be resolved by a takeover by a larger player in the industry.

These are his words, hinting at a possible presence of exchanges such as Binance, Coinbase or Kraken

“The Winklevoss twins have a strong brand. You can imagine possible mergers.”

However, Gemini’s legal problems with the SEC could make a takeover by a competitor problematic.

In the meantime, the exchange is trying to grit its teeth and hoping for a bullish market recovery for the cryptocurrency sector, which would surely lead to increased volumes in the markets and a return of profitability for the company.

We remain on our toes to monitor Gemini’s performance and assess the next decisions to be made by the Winklevoss twins.