Ethereum whales, the owners of large quantities of tokens, are increasing their ETHs during this final part of 2018.

In fact, according to data published by Diar, the first 500 ETH addresses per amount of ERC20 tokens (including all other standards based on the Ethereum blockchain) currently have 20 million tokens within them, just under 20% of the total circulating supply.

At the beginning of 2018, which was the hottest period for cryptocurrencies, this value was 11 million tokens, while at the beginning of 2017 it was only 5 million. The purchase of these tokens is not in itself inconsistent with the rather low volumes of the last six months since purchases can be made continuously even at these low prices. If anything, the accumulation has been more convenient and more distributed.

It is, therefore, a process of concentration with an increase in possessions of the order of 80%, despite the fall in prices started in February 2018. This is an indication that the operators interested in the token have kept their interest active.

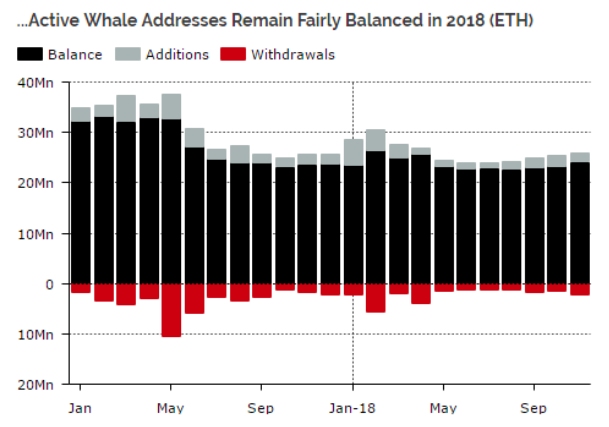

The addresses, on the other hand, are rather stable, as indicated by this graph:

At the current ETH price, the value in the hands of these large holders is about 2 billion dollars, not something that goes unnoticed. However, in absolute terms, it is much lower than it was at the beginning of the year.

In general, there has been a process of concentration in the possession of ETHs, an economic phenomenon indicative of the maturity of Ethereum and at the same time the effect of the end of many ICOs, which, having reached the end of their projects, have put the tokens back on the market and then in the wallets of the whales.

Moreover, the owners of these large wallets have certainly tried to mitigate the losses during the year in order to limit the effects on their assets.

We will probably also have a concentration in the number of participants in ICOs based on the ETH blockchain and these 500 owners will play an essential role in future projects.

The progressive concentration of token holders can also have multiplier effects on volatility: fewer operators with large reserves means that, in the event of an upturn, there will be a possible greater speed in pouring the tokens on the market itself.

In addition, in the event of opposite market movements, fewer investors will be available to act as a buffer during price drops.

In itself, the greater concentration in token ownership does not mean less decentralisation because the mining activity may not be affected. However, the large stakeholders, being a smaller number, could represent a kind of oligopoly.