The Blockchain Transparency Institute (BTI) has published a report on the quality of trading and exchanges, focusing mainly on the so-called wash trading, i.e. fake trades created only to increase the volumes of the exchanges.

The website, in collaboration with several exchanges, has developed algorithms that allow assessing the quality of the exchanges, filtering those that are not credible and creating a database called “Clean API” in which all the correct data are stored.

The data concern the frequency and size of the volumes as well as the correct operation of the exchanges that close the accounts which are suspected of wash trading. This has allowed BTI, an independent body financed exclusively by the sale of its reports, to assign the “BTI Approved” logo to certain exchange websites.

The recommendation for exchanges is to create a system of self-regulation so that any doubt about their operational quality can be removed.

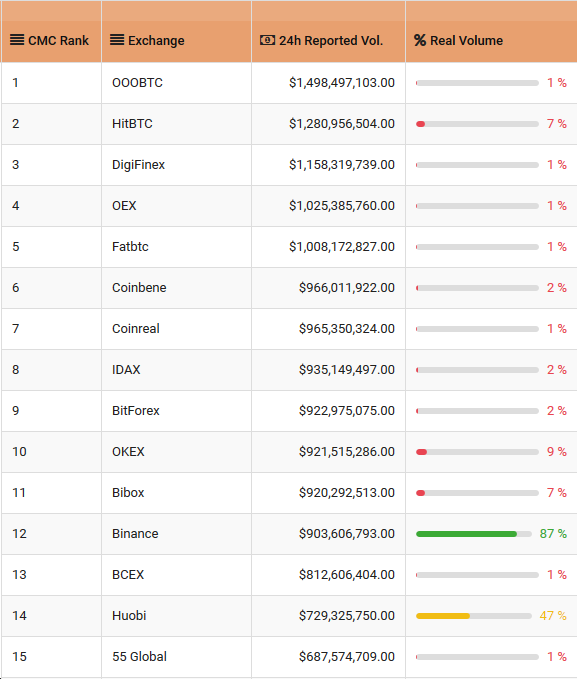

Unfortunately, the BTI report is very puzzling about the real volumes of the main exchanges: in fact, 17 of the first 25 websites would have a quantity of fake trading volumes equal to or greater than 99%.

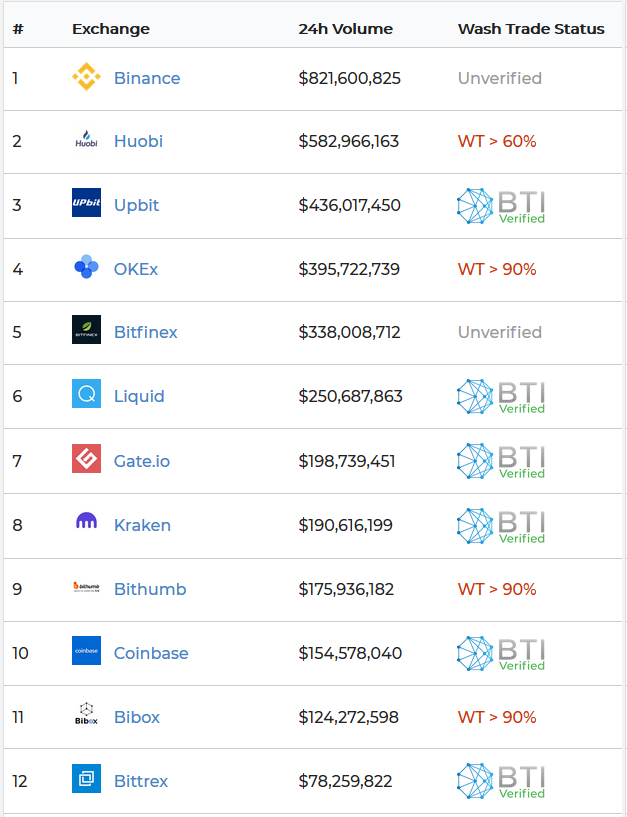

If the first 12 exchanges for quality of result are considered, the result is the following:

Exchanges with wash trading below 10%, considered residual value, have been defined as “BTI Verified” and among these names are some of the companies with the best reputation in the industry. Kraken was the cleanest, with fake trading below 1%.

Even Coinbase and Upbit had low percentages of negative trading, alongside Binance, which had regular results as well, even though 30 pairs had operational problems.

The worst exchanges use different tactics to carry out wash trading: from buying thousands of Twitter profiles that are then linked to fake trading, the purchase of likes, the filling of order books with completely fake trades and the use of mirror trading techniques to distort volumes.

At the same time, different types of bots are also used to hide traders, but always in a way that does not affect the actual price of the transaction, which could also result in painful losses for the exchange itself. In fact, many of the high-volume exchanges would see trade collapse to miserable levels if bots were excluded.

The reason why there are exchanges with such important false data lies in the fact that the costs of design and implementation of this type of activity have collapsed allowing the market entry of an excessive number of operators.