According to the latest Diar report, Coinbase wants to turn its USDCoin into an international payment utility token, an operation of no easy success.

As previously stated by the company’s Vice President, Dan Romero, one of the goals of the company’s strategy was to move away from the normal narrative surrounding virtual currencies and open up new territories for fiat currencies through the provision of services such as international payments.

Unfortunately, however, the approach to these objectives is encountering major problems: in fact, the offer of currency transfer services in countries without financial infrastructure faces operational problems because there is no direct access when buying virtual currencies with fiat currencies.

While Coinbase aims to serve customers in Argentina, Mexico, Peru, Colombia, Chile, India, Hong Kong, Indonesia, South Korea, the Philippines and New Zealand, at the same time the inhabitants of these territories are not always able to buy what the exchange offers, because, outside of Europe and the US, only a third of countries allow buying virtual currencies with their national currency.

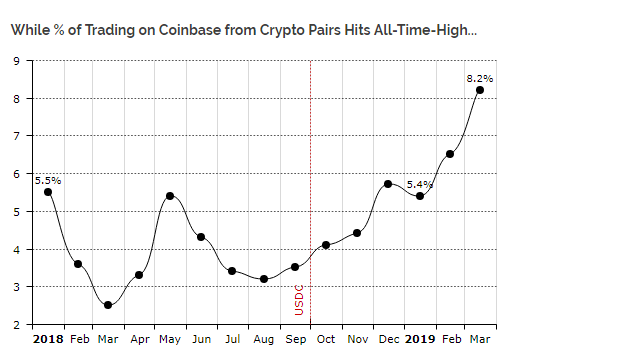

This means that, in these countries, trading mostly occurs crypto to crypto. Only in Indonesia, amidst these new markets, the use of credit cards will be allowed. At this point the possibility of using USDcoin as a service tool for international payments is limited: if I cannot buy the token, how can I transfer it abroad?

The desired shift of cryptocurrencies from investment to utility through the USDCoin stablecoin is therefore much more complicated than initially expected, but Coinbase can be reassured by the achievement of commercial objectives that it has not seen for several months:

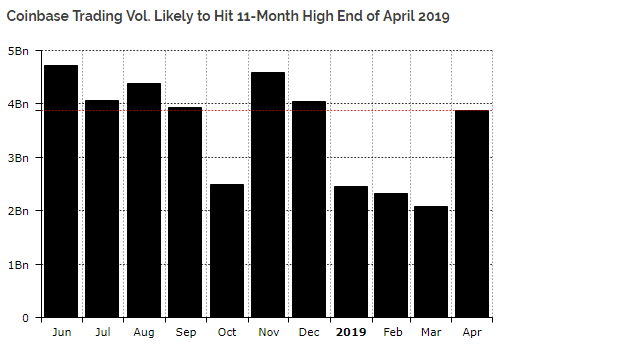

In April, in fact, Coinbase reached its 2019 trading highs, returning to the levels of late 2018, with a growing trading load among crypto pairs.

The corporate remuneration, and therefore the profit, derives mainly from the management of crypto trading, whereas the decentralised financial products, on which the management was very focused, have been developing slowly so far.