In today’s analysis, among the best-known tokens, it is worth noting the rise in the price of Basic Attention Token (BAT), which climbs by 5% and reaches the 30th position in the ranking with 245 million dollars of capitalisation and a value of the token that seeks to regain the 20 cents of dollars, levels abandoned with the drop of mid-August.

The price increase of the BAT token is mainly due to the positive news, in particular, the rumours about the verification as a producer by Wikipedia on Brave’s browser, which would bring the well-known digital encyclopedia to be another well-known name for the BAT tokens.

The development team also announced that the Brave browser wallet will integrate Ethereum’s ERC20 tokens. This mix of positive news brings new life to BAT, which stands out among the most popular tokens with a sharp rise in contrast to the other big names.

As for the rest, the situation is decidedly unaltered compared to yesterday, except for some particular situations involving Synthetix Network Token (SNX), which scores the best rise of the day with a rise of 14%, Ren (REN), which rises by 13%, and Dent (DENT), which scores a double-digit rise of 10% and ranks 97th.

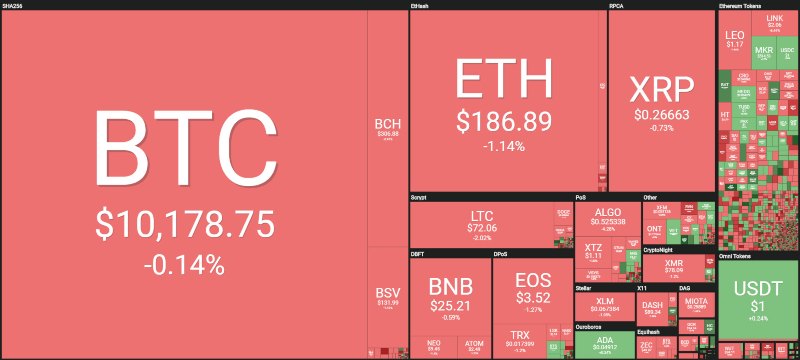

Among the top three, bitcoin and ethereum are marginally in positive territory, while XRP is below par, same for litecoin, which fails to regain the $75 threshold.

The market cap manages to conquer the threshold of 265 billion dollars, while bitcoin rises again over 69%, ever closer to 70% of dominance. The lateral trend of the last 10 days has not caused any particular shocks to prices.

This means that bitcoin is stabilising and confirming its market share. Ethereum, meanwhile, continues to stay above 7.6% dominance, while Ripple, despite today’s slight decline, remains stable at 4.3%.

Bitcoin (BTC) Price Analysis

Bitcoin continues dangerously to swing and test the bullish trendline that shows a slightly upward trend since mid-June.

The lower neckline phase of the triangle that has been squeezing prices for over two months is a signal that will have to be confirmed in the coming hours and days. It will be positive if this continuous test proves to be a phase of consolidation of the $10,000 level in order to attract new purchases that will propel the price in the $10,500 area.

If not, the current signal and technical structure would highlight a very bad bearish signal should the $10,000 level be violated in the coming days, accompanied by volumes that could bring prices back to test July levels in the $9,200 area.

Bitcoin’s volatility in recent days has fallen to 3.5% on a daily basis, levels that have not been recorded since last May. This shows that the current days are devoid of major price fluctuations and stimuli, which is not so frequent for long periods with cryptocurrencies and in particular with bitcoin, which has average fluctuations of around 5%.

Ethereum (ETH) Price Analysis

The price of ETH seems to have entered a phase of lethargy since August 15th, and can no longer recover from the lows of the last 10 days.

Despite the positive day, the ethereum network continues to be overloaded and this does not lead to the return of purchases because it burdens the network, pushing away some of the investors.

The price of ETH fluctuates dangerously around the $185 threshold which matches the levels of the bullish trendline that has been supporting the upward phase since mid-December 2018. For Ethereum, in addition to a collapse in volatility, there is also a sharp decline in trading volumes.