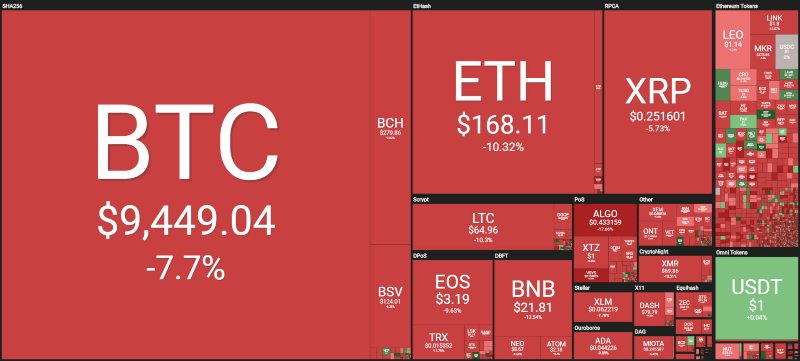

After two weeks of uncertainty, the price of bitcoin is characterised by a strong crash in favour of the Bears, pushing down the timid rises of the past few days, bringing prices back to the level of mid-August, the lowest day of the month. It is precisely the price of BTC today to drop and come out of the triangle that marked the trend of recent weeks. The breaking of the 10,000 dollars, pushes BTC to the levels of the end of July. With today’s collapse (-7%), Bitcoin returns to the $9,500 area.

The drop of Ethereum is even more evident, falling by 10% and breaking through the lows of mid-August, revising the levels of early May, cancelling all the rise that had accumulated in the last three months.

This concerted decline throughout the industry sees 95% of the first 100 cryptocurrencies in negative territory.

Among the most evident crashes, we find REN in 82nd position, which drops over 20%, followed by Algorand (ALGO) which drops by 17%, thus marking its new absolute lows despite its brief lifetime.

Among the best known in the top 20, there are also Binance Coin (BNB) Monero (XMR), Cardano (ADA), TRON (TRX) and Ethereum Classic (ETC), all falling by 12%.

Among the few rises of the day, the strong countertrend movement of Egretia (EGT) stands out, with a rise of 30%, followed by Golem (GMT) with a rise of 12%.

Despite the particular day, the positive note is that the number of cryptocurrencies listed by CoinMarketCap breaches the threshold of 2500 tokens for the first time.

Despite the market being decidedly different from 2017, there has been an increase in new tokens. In the early days of 2019, these were about 2,000: the average after eight months is 50 new tokens emerging every month.

Today’s sharp decline causes the market cap to collapse again, falling to $246 billion, the lowest level in the last 2 months. This lack of capitalisation is due to the altcoins: their total capitalisation is just over 15 billion dollars.

This is a very good snapshot of the current situation that has coexisted for several weeks, with bitcoin continuing to confirm its dominance.

In fact, the dominance of BTC is now back above 69% at the expense of Ethereum who, with today’s downturn, is back to touch the lowest levels of recent years below 7% of dominance, while Ripple struggles to confirm above the levels of recent days at 4.3%.

The crash of Bitcoin (BTC)

Bitcoin today, with the breaking of the 10,000 dollars, breaks the psychological level that coincided with the passing trendline that brought together the bullish minimums of the last two months. The downward movement of these last hours, showing how in only one hour the price of bitcoin lost 600 dollars, is a signal that brings back the fears of a possible sinking under the lows of the summer at 9,200 dollars.

If the Bear’s legacy were to continue in the coming hours, coinciding with the closing of the US CME futures contract that will take place tomorrow, a possible break of $9,200 would attract prices to test the medium-long term support at $8,800.

Below this level, there would be ample space for downtrends which would cause concern for a possible return to the lows of early June in the $7,500 area.

In such a context it is preferable to follow the supports rather than identify turning areas of the upward trend, which are several percentage points away.

The price of Ethereum (ETH)

The situation of Ethereum is much more serious. With the breaking of the August lows and the bullish trendline that passed in the $180-185 area, which supported the upward trend of recent months, the strong movement that has developed in recent hours and which sees the prices of Ethereum lose more than 50% from the annual highs recorded at the end of July begins to worry.

For Ethereum, it is important not to sink below 155 dollars in the next few days, otherwise, a strong downward trend would open with targets that could review the levels of early March. However, the risk is the reversal of the upward trend that has supported the current annual cycle so far.