A startup is ready to launch a first batch of ASICs to mine Ethereum (ETH). Vitalik Buterin’s cryptocurrency is based on Ethash, a well-known Proof of Work (PoW) algorithm that is also used by a large number of different altcoins.

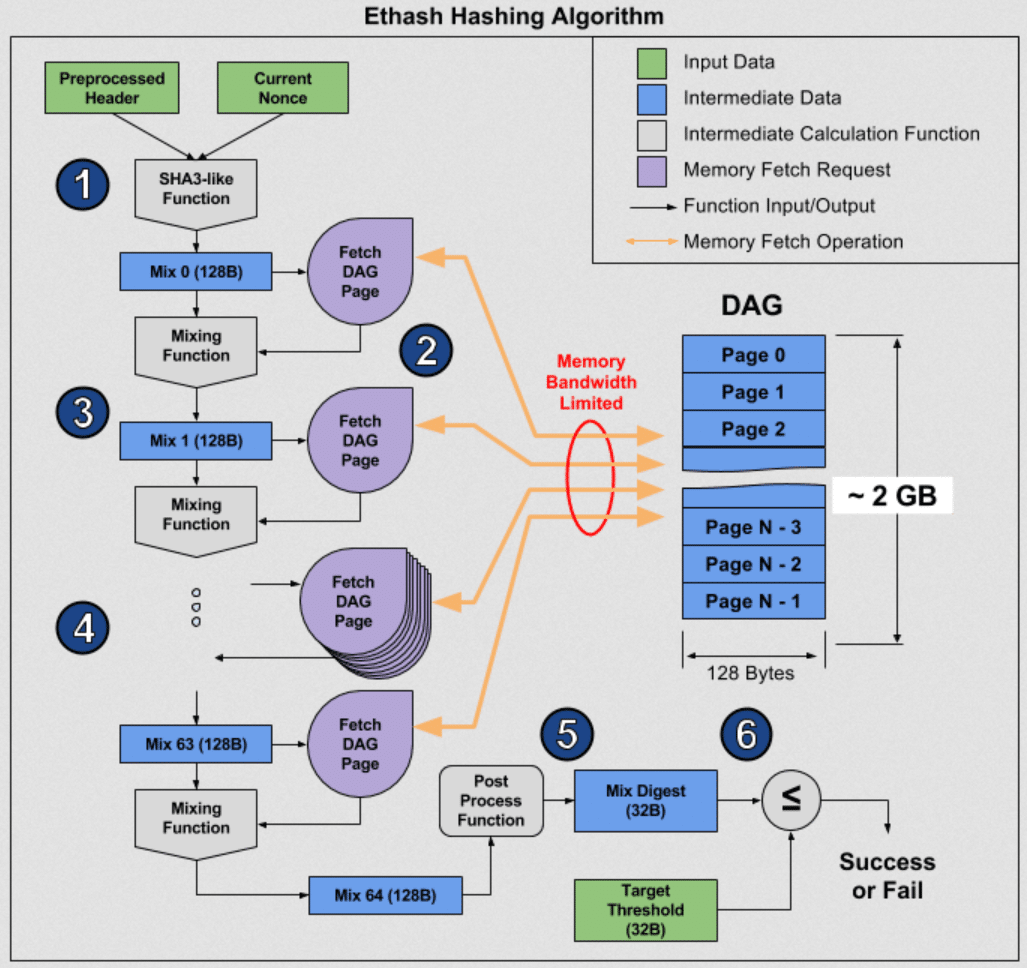

This algorithm mixes two standard cryptographic functions, the SHA-3 and the Keccak. This results in a resistance to ASICs but at the same time is also fast to verify and execute.

The resistance to ASICs is guaranteed by the memory-hard nature of the algorithm, given the use of a pseudo-random data set initialised according to the length of the blockchain, therefore variable. This data set is called DAG (Directed Acyclic Graph) and is regenerated every 30 thousand blocks (about 5 days). Despite this, several companies have managed to launch ASICs to mine ETH.

New ASICs to mine Ethereum (ETH)

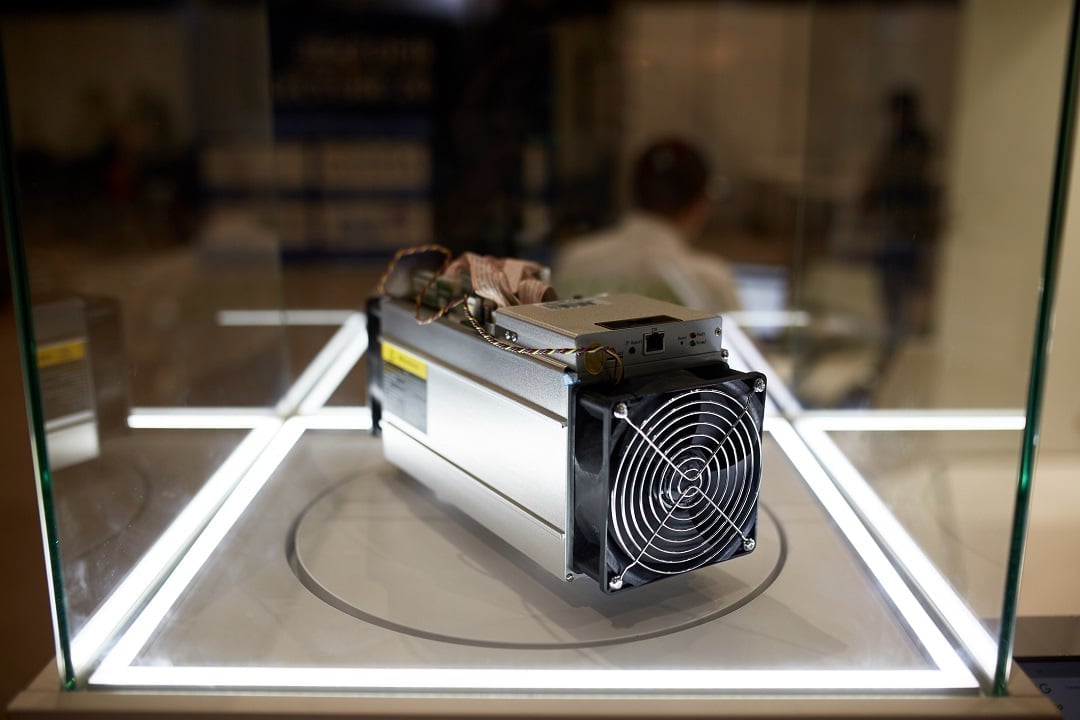

Linzhi is a Shenzhen-based company that was founded in 2018 by Chen Min, former project manager at Canaan Creative, manufacturer of the Avalon bitcoin miner. The company, which started out with an initial investment of $4 million, has been working on this solution for some time and is about 9 months behind schedule.

Initially, the goal was to launch the first samples in April 2019 and mass production in June.

“We underestimated the complexity of the chip and how long it would take to grow the team and make the company functional. We are cautiously optimistic that we can just move forward the rest of the schedule, which would mean 12/2019 for sample machines and 02/2020 for mass production.”

The company is now ready with a first batch of 200 ASICs.

If these ASICs are competitive enough then mass production will begin with the goal of challenging industry leaders such as Bitmain and InnoSilicon. The first specifications mention 1400 mega hashes per second (MH/s) with a consumption of 1 KW/h.

By way of comparison, the InnoSilicon A10 achieves 450 MH/s with 850W power consumption while 8 NVIDIA GTX TitanV video cards, one of the most powerful on the market, achieve only 656 MH/s with about 2.1 KW/h power consumption (source: f2pool).

To date, the prices of the ASICs have not yet been disclosed, however, Chen is already planning a reverse discount strategy to disadvantage purchasers who want to purchase several units, thus encouraging decentralization.

Possible problems: ProgPoW and PoS

One of the main problems for companies that produce ASICs for Ethereum is the arrival of ProgPoW. It is a Proof of Work (PoW) consensus algorithm that is resistant to ASIC devices. Developers discussed it at length and concluded that the algorithm should be implemented, but without defining any precise timeline.

It will certainly not be ready for the next hard fork, Ethereum Istanbul, which is scheduled to arrive in October of 2019. The update will be divided into two parts: the first part, unless there are delays, will arrive on the mainnet in October and will include six changes to the protocol, called Ethereum Improvement Proposals (EIPs).

Ethereum is also undergoing a major overhaul: preparations are underway for it to become a Proof of Stake blockchain with the launch of Casper. The move to the PoS would make any ASIC completely useless.

If ProgPoW is activated or the transition to PoS occurs, the company will focus on ETC mining.

“Our plan A is to focus on ETC mining. So if ETH will still be an option, that’s something good to have. In the ethereum community, the ProgPow plan still has some uncertainty. For the time being, we don’t see it as a market that we will obtain, so I don’t really care that much.”