SPONSORED POST

On August 3, 2018, the parent company of the New York Stock Exchange, Intercontinental Exchange, announced the formation of a new company and Bitcoin futures trading platform aimed at large-sized institutional investors and traders called Bakkt.

Since then, Bakkt has been considered by the cryptocurrency community to be the catalyst needed to spark Bitcoin’s next bull run. However, a number of delays due to licensing from the New York State Department of Financial Services and lack of approval from the CFTC have kept the launch of the new platform at bay throughout all of 2018 and into 2019.

But that all changed when Bakkt CEO Kelly Loeffler revealed that Bakkt’s physically-settled Bitcoin futures contracts had finally received a green light from the CFTC, and would be officially launching on September 23, 2019.

As soon as the news broke, the crypto market heated up, and Bitcoin began to show signs of bullishness once again. However, the bullish rally has now slowed, and Bitcoin is consolidating inside a multi-month tightening trading range within a triangle chart formation that many analysts are expecting to break down briefly ahead of the Bakkt launch.

But with the Bakkt launch expected to be such a bullish event – creating much market demand amid an ever-decreasing supply – any drops below current price support levels will likely be short-lived and be bought up by crypto traders eager to “long the dip.” And with the market expected to turn extremely bullish after Bakkt’s launch, those long positions may become the most profitable trades of their lifetime, if the right platform and tools are used in preparation of the big move ahead.

Why Bakkt Is Expected To Be Bullish For Bitcoin

The entire 2017 crypto hype bubble and any price action since has been predominantly driven by the retail investing public or everyday average Joes who are looking to strike it rich with an emerging technology that provides easy access.

However, as easy as it is for the mainstream public to access the crypto market through exchanges and trading platforms like PrimeXBT, large-scale institutional investors with massive amounts of capital require certain safety and protections be in place before their money is invested – especially in an industry so plagued by scams and crime as the cryptocurrency market.

Institutional investors of such scale require a certain level of comfort that would come from working with familiar wall street companies, before taking the plunge into a market like Bitcoin and cryptocurrencies.

Bakkt being a product and platform created by New York Stock Exchange parent company ICE, gives the new Bitcoin futures platform an air of trust that other big names in the crypto space simply cannot offer wall street types.

The influx of capital from these institutional investors is also said to have a dramatic effect on Bitcoin’s value by increasing demand and absorbing its already scarce supply.

Bitcoin’s supply is hard-capped at 21 million BTC, giving it a property of scarcity similar to that of gold, earning it the nickname of “digital gold.” The amount of Bitcoin released into the market also becomes increasingly diminished with each hard-coded “halving” – an event that reduces the block reward Bitcoin miners receive for confirming transactions.

With Bitcoin’s supply always an issue, even the slightest changes in demand can cause a bull run to begin. In the case with the launch of Bakkt and their physically-settled Bitcoin futures contracts, the change in demand will be anything but slight and could have an enormous impact on the Bitcoin supply and therefore, causing the price of Bitcoin to skyrocket.

What Analysts Are Expecting for Bitcoin Price Action Ahead of Bakkt Launch

With a launch as important as the upcoming Bakkt launch on September 23 ahead, crypto analysts and traders are researching Bitcoin price charts more than ever to help them predict the price action in the days ahead.

Volatility and trading volume in Bitcoin markets has faded as investors and traders sit by the wayside and await Bitcoin to choose a direction and break out of the current trading range that is causing boredom across the space.

The Bakkt launch is a significant event, and the market is expecting volatility to begin just ahead of the launch, either front-running the launch with a massive rally, or as many analysts expect, Bitcoin could sweep its recent lows, setting a new lower low that shakes out Bitcoin traders ahead of the Bakkt launch.

Bitcoin price has been supported by price levels around $10,000 and lower at $9,000. Bitcoin is once again trading around $10,000, which either is a bear trap ahead of the Bakkt launch, or is the first stop on a trip below $9,000 to set new lows around $7,500 to $8,500 where buyers are awaiting to “long the dip” in hopes of catching the last lowest price before Bitcoin heads off on a massive bull run that eclipses what was seen during the crypto hype bubble of 2017.

Crypto analysts say that Bitcoin price is currently locked inside a descending triangle, which could break down ahead of the Bakkt launch. The sharp fall should quickly be bought up, causing a “spring” that drives prices higher. The formation matches up with the crypto community awaiting to buy Bitcoin at lower prices in anticipation of the Bakkt launch.

If for some reason Bitcoin price doesn’t ever sweep current lows, technical analysis shows that a break above $12,000 ahead of the Bakkt launch could potentially propel Bitcoin price to reach a new all-time high above $20,000 – the previous high set back in 2017. If Bitcoin price is able to break its former all-time high, then Bakkt will indeed be the catalyst that ignites the next bull run, and sends Bitcoin off into new price discovery mode.

How To Maximize Profits on PrimeXBT During Bakkt-Related Volatility

They say volatility is a trader’s best friend, and extreme volatility is expected in the days ahead and after the launch of Bakkt’s trading platform.

After going on a parabolic rally for the first half of 2019, Bitcoin price has been consolidating for three months now and is ready once again for a big move. Volatility has reached levels not seen since November 2018 and April 2019, and each time resulted in an over $1,000 price movement and a major trend change.

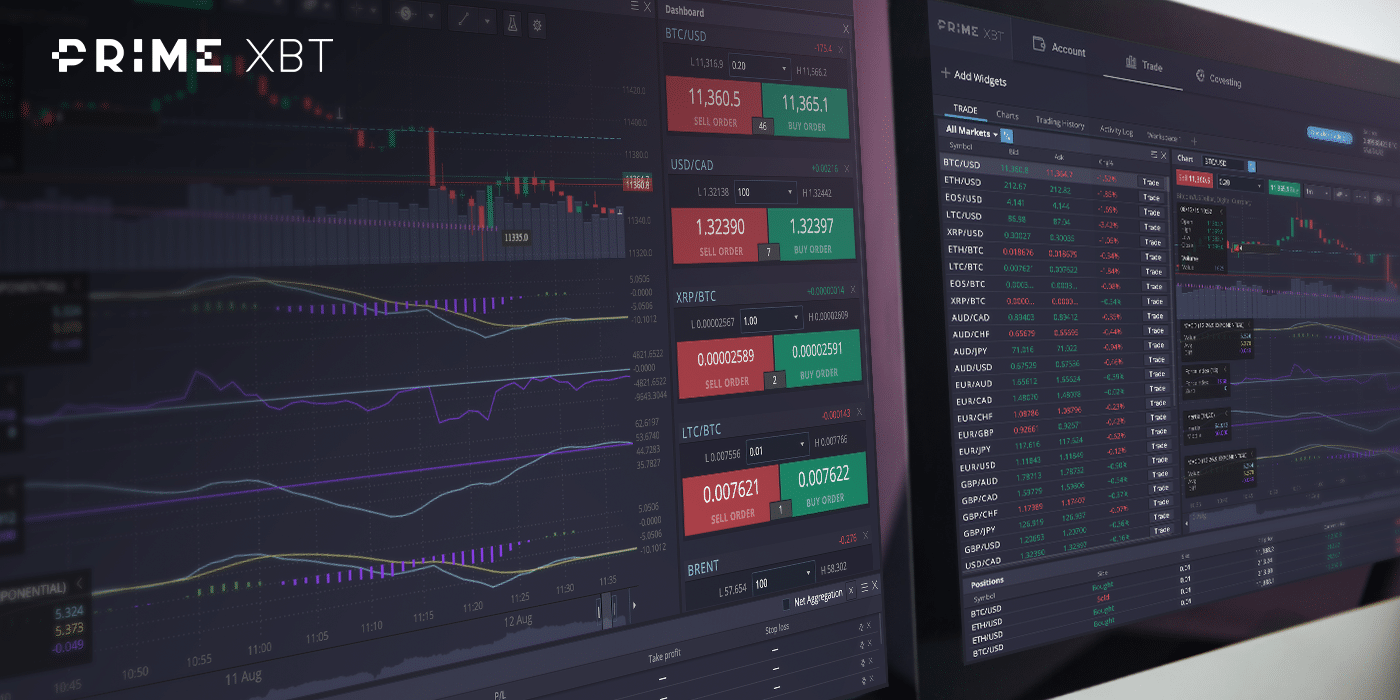

It’s not too late to get into position or get prepared for the upcoming volatility, to ensure that all profit opportunities are maximized while minimizing risk as much as possible. PrimeXBT makes this all possible by offering traders advanced trading tools that can help to get the best entry, protect positions from loss, and can even be managed on the go through a new smartphone application.

Using those tools, traders can open up short or long positions, or even both simultaneously to hedge against any unexpected price movements that may occur. PrimeXBT offers some of the most helpful indicators and technical analysis tools allowing traders to draw trendlines and patterns on price charts to help them predict where the market might move next.

By using these tools to get the best possible entry, opening a long or short position can be extremely profitable. With a brief shakeout expected ahead of the Bakkt launch, traders could open a short trade as a OCO order, and after the price limit is reached, the order becomes a long in the other direction. This method ensures no profits are ever left on the table.

A more conservative approach is to wait for the right entry, either a breakdown and shakeout under $9,000, or breakout above $12,000 to open up a 100x long.

With Bitcoin just starting on its next bull run, and with prices expected to reach $100,000 or as much as $1 million per BTC, catching the right long entry could be the wealth-generating profitable trade most traders only dream of.

Spot traders who buy Bitcoin at $10,000 would earn $10,000 if they sold at $20,000. But by using the power of 100x leverage on PrimeXBT, that same value trade would result in about $1 million in profit.

Considering that there are only 21 million BTC that will ever exist, the supply isn’t nearly enough for all 7.7 billion humans roaming the Earth to own a full BTC. With institutional investors ready to buy up the lion’s share of the Bitcoin supply, the price of the Bitcoin could go parabolic once again.

When the low supply meets high demand, Bitcoin price goes parabolic and rises rapidly. During the last bull run, Bitcoin price rose from $10,000 to $20,000 in less than a month, and at the start of April 2019, rose over $10,000 to reach $13,000 in June before it began consolidating in the current trading range ahead of the Bakkt launch.

No one truly knows how the influx of institutional money through Bakkt will affect Bitcoin price, but if the way the price rose during the last bull run – a bull run driven only by retail investors – is any indication, Bitcoin price could reach heights of $100,000 in no time, making any traders who opened long positions in anticipation of the Bakkt launch incredibly wealthy.