On a positive day for the cryptocurrency sector, there is the difficulty of Bitcoin price that even today comes back to almost $8000 dollars, after trying to recover in the last hours the $8,500-$8,700 marks.

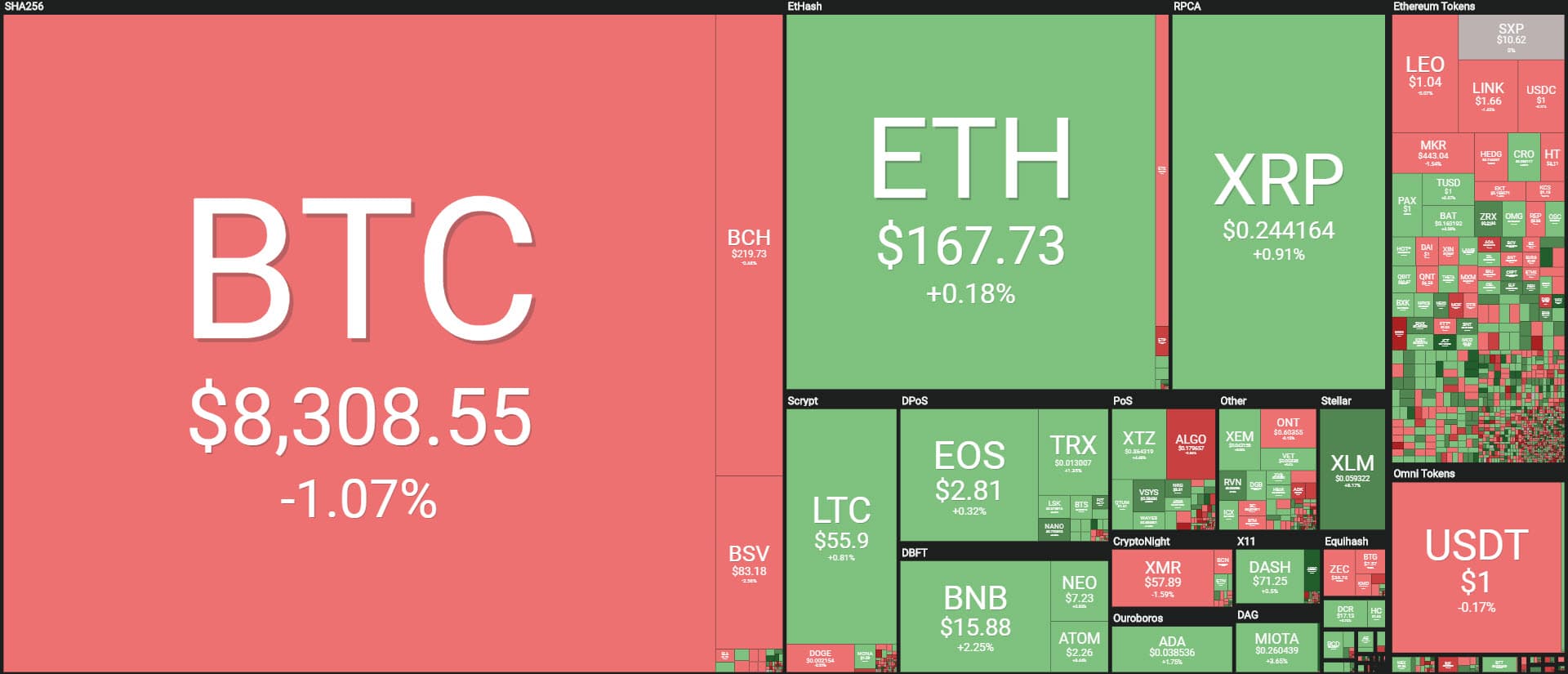

After the storm of recent days, today marks a clear prevalence of green signs that must not be deceived: there are signals of reaction to the very deep sinkings of the last 48 hours. Unlike yesterday, more than 70% of cryptocurrencies are in positive territory.

Among the first 10, we have green and red signs alternating again. But Bitcoin and Ethereum continue to maintain a trend under the parity.

Bitcoin fails to hook up to $8,500, a reference level as it is the area that was the cap last May during the upward phase of bitcoin before the bullish movement culminated in the mini rally in mid-June.

Ethereum is unable to stabilize and resume the share of $170 dollars, after trying to recover this level in the last hours as well as yesterday.

Among the best, Stellar (XLM) stands out, who during the day scored a double-digit rise, slowing down in the last hours. Stellar is now at +5%, benefiting from the launch on the list of Coinbase for U.S. users living in New York that until now could not trade Stellar, which is the tenth crypto in the ranking of the largest capitalized.

Together with Stellar, Coinbase has announced that it has included Chainlink in its basket for New York users, but LINK today does not show a particular positive movement. Chainlink during the sinking of the last 48 hours was, however, one of the few cryptocurrencies that absorbed the blow well, without pushing below the previous lows scored a few days ago.

On the opposite side, among the worst of the first 20, there are Huobi Token (HT) and Monero (XMR), both dropped by about 2%.

Total capitalisation remains below $200 billion with the dominance of Bitcoin slightly retreating to 68.3%. Ethereum remains at yesterday’s levels at 8.3%. Ripple is also stable at 4.8%.

After the boost to $110 billion that took place yesterday, there was a sharp drop in volumes: trade collapsed to just over $60 billion dollars in the last 24 hours. This is a sign of strong generalised volatility.

The general context still requires particular attention and caution, as after the flood that hit the entire sector, it is necessary to find an area of balance that will most likely take a few days to determine whether we are still in the presence of the bearish storm or if we’re seeing the formation of the supports from which to restart.

Bitcoin (BTC)

The bitcoin remains stranded at the lowest point in the last few hours. The price of Bitcoin is again testing the $8000 dollars. A break of this level would attract speculation at the next support level of $7,500.

In such a case, it will be decisive to keep this level, because a further break-down would open a wide bearish space that would not exclude very dangerous sinkings that could affect the long-term bullish trend.

Ethereum (ETH)

Ethereum is in a situation similar to Bitcoin: stopped at the levels of the last hours, has failed the recovery of the $170 dollars and waves dangerously in the area $165 dollars. A break in the lows marked by Tuesday’s sinking in the $150-$155 area could attract speculation and bring Ethereum back to test the $125, the area of the next level of support.

To definitively dispel the fears regarding Ethereum it is necessary to resume the quota of $200-$210 dollars, which at the moment seems to be a very difficult level to reach, considering the depression that is hitting the whole sector and the lack of cues that could attract new purchases.

In this phase for Ethereum, it is necessary to find levels to lay the bases to be able to set again a bullish phase.