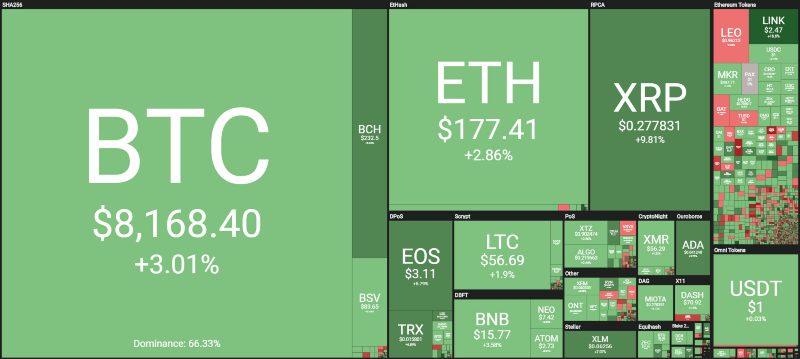

After spending an almost lateral weekend, the week begins with a clear prevalence of green signs. Among these, the price of the XRP token stands out, rising by 8%.

More than 80% of the first 100 cryptocurrencies are in positive territory. Most importantly, among the top 20, there are only two negative signs. The first is the LEO token that falls below the dollar, the level at which the token was launched last May. LEO today marks a drop of 1.5%.

The other negative performance is that of Dash, which loses 0.2% by retracting and going to test the 71 dollars, absorbing the movement in a much better way compared to the rest of the sector.

Among the top 20, the best today is Chainlink (LINK), which scored an increase of 11% going beyond 2.50 dollars. Chainlink reverses the medium-term trend by recording one of the biggest increases in the last 10 days. From the low of September 26th, LINK recovers about 60% of its value. It will be very important in the coming days to confirm the bullish structure, going over 2.70 dollars. The bullish signal would be invalidated only with a return below 1.70 dollars.

On the second step of the podium, there is crypterium (CRPT), which rises by 11%. The third best of the day is Ripple (XRP), which climbs about 8% on a daily basis. The price of the XRP token gains more than 25% from last week’s lows and tries to recover the $30 cents threshold, a level that was important to Ripple as a support area last August and has now become a medium-term resistance.

The rebranding of Ripple and other Ripple related companies, such as RippleNET, by founder Brad Garlinghouse, seems to give new life and new impetus to the price of the XRP token that seems to rebuild its reputation by consolidating third place in the ranking with a capitalisation of $12 billion, levels that Ripple has not seen since last summer.

On the other hand, the worst of the day is Centrality (CENNZ), which drops 14%.

Thanks to the bullish movement of more than 80% of the cryptocurrencies, the total capitalisation rises to 220 billion. The dominance of bitcoin is decreasing, falling below 67%. Ethereum takes advantage of this, earning 2% today, as does bitcoin, and regains 8.8% of the market share, the highs of the last month. Ripple, on the other hand, managed to regain 5.4% of dominance, levels abandoned last July. Ripple’s recovery was quite good.

Bitcoin (BTC)

Bitcoin went to test the $7,800 again in the night between Sunday and Monday, and in these last hours, it is back at $8,200, levels it had left last Thursday before the start of the weekend.

Bitcoin continues this swing in the range between 7,800 and 8,400 dollars, showing a very uncertain trend. For BTC it is necessary to leave the $7,800-8,400 channel to give clear operational indications.

Ethereum (ETH)

Ethereum continues its period of congestion, with prices that cannot go beyond 185 dollars, levels reached on October 1st. For Ethereum it is precisely the 185 dollars threshold that must be regained and broken upwards to try to attack again the 200 dollars, which it abandoned in the second half of September.

It would be an upward push that would allow to finally abandon this movement of congestion and drive away any fear of a new slide to the bottom. In a medium-long term perspective, ETH is in fact in a bearish channel started in June and that will see the upper neckline break only with a push beyond 200 dollars.

On the contrary, it will be very dangerous to push beyond 165-170 dollars in the next few days because this would attract speculation and bring prices down.