After three months of downturns that saw drops of up to 40% from the highs reached at the end of June, the crypto market in October 2019 closes with a bullish movement providing a strong signal which in part reverses the poor end of September.

This movement was concentrated at the very end of the month. October had not started under the best auspices, with bitcoin prices that for most of the month had experienced strong congestion with falling volatility. Volatility exploded in the third decade of the month with a bearish movement that saw prices test the $7,300 threshold, levels not seen since last June. The rest of the altcoins followed, revising the levels abandoned last spring.

A false break that in the following hours saw one of the most intense reactions by the bulls ever. In just 48 hours, between 25th and 26th October, Bitcoin scored a rise that went above 40%, an intensity that has not been recorded since 2011, when the market and structure were very different from that of today.

The reason why the crypto market has risen in October 2019

The sector was boosted by news from China, which included a statement by Chinese President Xi Jinping that challenged the world by self-proclaiming the nation as a leader in blockchain technology. These statements were subsequently reinforced with a strong line-up by the Chinese authorities to prohibit any statement that could damage the reputation of the term blockchain, through any channel that the government has control over.

Another piece of news that has gone unnoticed in part is that a few miles from the US border, Canada has approved the request for a Canadian asset manager called 3iQ who obtained approval to list Bitcoin Fund on the Toronto Stock Exchange (TSX). This fund will offer both retail and institutional investors direct exposure to a bitcoin ETP in North America. This news can really change the aspects and restrictions that have led the US SEC to reject all ETF requests so far. ETPs are part of the ETF markets.

This rise has been accompanied by a very strong increase in volumes that have seen Bakkt futures trading more than 1,120 contracts in a single day. A record that comes one month after the launch of the platform, which, in a single day, has seen trading volumes greater than all the contracts in equivalent value in dollars traded throughout the previous period from the date of the launch on September 23rd. This trend has continued over the following days, with trades on the Bakkt platform recording the most substantial week since the last month.

Another important indication in terms of volumes comes from Tether, which recorded a 109% increase in transactions above $100,000. A very high volume, with a counter value in dollars seven times higher than the previous week.

These figures indicate that institutional investors are turning their attention to the cryptocurrency sector.

The best crypto of October 2019

The cryptocurrencies that have most benefited from this massive inflow of volumes are Chinese projects. The best two are Centrality (CENNZ), which is up 500%, and Bytom (BTM), which is up 130%. Chainlink (LINK), 0x (ZRX), Bitcoin Satoshi Vision (BSV), Ontology (ONT), Basic Attention Token (BAT) and Neo (NEO) are also performing very well, all climbing by more than 50%.

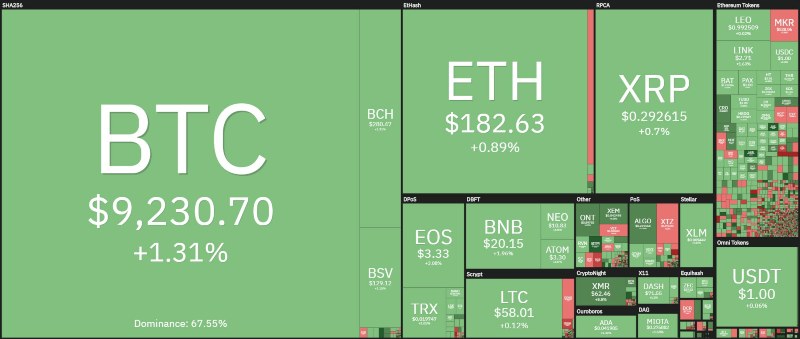

The top three in the standings also show positive performance. Bitcoin gains just under 15% on a monthly basis, while Ethereum rises 5% highlighting the difficulty in recovering the $200.

Ripple on a monthly basis gains 15%, performing better than bitcoin, with prices that are consolidating just under 30 cents, a level that if violated could project XRP on new highs of the period.

The total capitalisation of the sector returns to revise the 250 billion dollars after touching almost 200 billion dollars a few days ago at the beginning of the 3rd decade of October.

Bitcoin confirms itself more and more as a safe haven crypto, recovering the 68% of market dominance. Ethereum also recovers ground and regains 8% of market share. XRP does well too, returning over to 5%.