Among the big ones, the price of Bitcoin is now recovering from yesterday’s lows, with a gain of over 10%. Bitcoin goes from a price of 6,500 to over 7,000 dollars, going up to 7,200 dollars. BTC’s hashrate is also on the rise.

It’s a very positive day with a clear prevalence of the green sign, a green hope for more than 90% of cryptocurrencies. Among these, 20 signs indicate double-digit increases of more than 10%.

This trend has been going on since yesterday, after the reaction to the night’s sinking between Sunday and Monday. Since yesterday, cryptocurrencies have triggered a rebound which is still ongoing today

Even Ethereum, after having sunk to the lowest levels of the last six months at 135 dollars, tries to regain the 150 dollars in the last hours. Ripple lags behind: despite the rise in the last 24 hours, XRP has a positive sign but stops at 3%.

Among the big ones, Maker‘s (MKR) rise emerges in particular: after having faced a decidedly negative week, today has one of the best rises, scoring more than 17%. VeChain (VET) and Cosmos (ATOM) also stand out from the others with increases of over 14%.

On the opposite side, there are very few cryptocurrencies in negative: among the worst ones, like yesterday, there is Molecular Future (MOF), which cancels most of the gains made in recent days and now retreats by 7%.

Despite today’s rise, capitalisation remains below 200 billion dollars, a demonstration of how these green signs are a purely technical rebound.

Bitcoin maintains 66% of the dominance, Ethereum remains above 8%, while Ripple continues its bearish trend falling below 4.8%, levels that it has not recorded since late September and that highlight the particular momentum that characterises the delicate decline of XRP.

Bitcoin: price and hashrate

In this last downturn, Bitcoin showed a strong movement that caused prices to lose more than 50% of the value from the tops at the end of June, falling to 6,500-7,000 dollars, levels at the beginning of May. Despite this setback, the network of Bitcoin remains strong, there is no sign of a flight of miners.

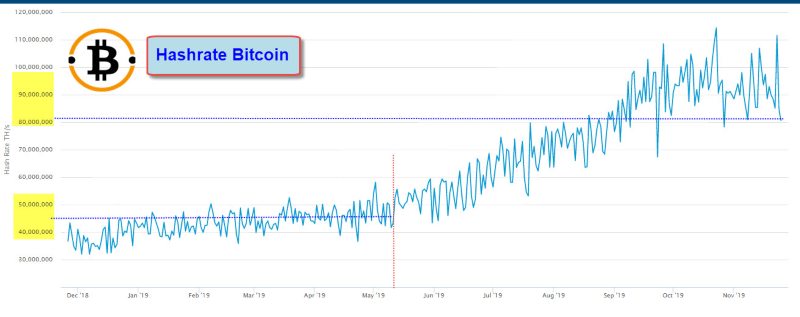

Looking at the hashrate graph, which is Bitcoin’s computational power, it is noticeable that despite the difficulty, the hashrate is twice as much as in mid-May, when the price was the same.

From the 50 million of the second decade of May, it reached a peak of 100 million last week and currently travels around 83 million, well over 80% of computing power. This shows that the strength of the Bitcoin network remains intact and well above the May levels.

The price of Bitcoin tries to react to the long-term bullish trendline. After the test during the night between Sunday and Monday, it attempts to rebound but fails to exceed the threshold of $7,500, a technical level that could give the first sign of a bullish turn.

A possible lack of strength not allowing to return over 7,500, would be a signal to observe carefully, suggesting that the short-term trend would continue to be bearish.

Ethereum (ETH)

After breaking through the $155 threshold and pushing below $135, Ethereum still shows a short-term bearish trend, which began with the tops at the end of June and which still remains valid.

For ETH it is necessary to recover the 155 dollars threshold, which is near the current 148 dollars, so it is important to engage this level as soon as possible to evaluate the next resistance, probably at 185 dollars.

However, without a clear signal of recovery at $155, it will be important for ETH to follow the short-term trend and understand whether or not the $135 holds. In case this holding fails, space opens up for testing the crucial long-term support level of $125.