What are decentralized oracles? Smart contracts, first introduced by Ethereum, were a revolutionary innovation in the blockchain world. However, it soon became clear that most of the blockchain’s real-world use-cases required constant collection of verified external data and response to real events.

The simplest solution from the outset was to rely on centralized providers to provide the data necessary to operate smart contracts.

However, this was betraying the spirit of decentralization inherent in the true blockchain revolution.

The oracle problem has been on the developers’ radar since the first draft of Ethereum’s White Paper:

“A trusted source is still needed to provide the price ticker”.

The blockchain cannot know at what price an asset is traded in the markets or how a sporting event ended. This is where the oracles come in, providing data not only on prices but on all kinds of external events such as results of political or sporting events and much more. Several startups have seized the opportunity and started to develop solutions to keep data feeds decentralized. In 2019, several projects aimed at solving the oracle problem emerged.

Chainlink: a decentralized oracle

Chainlink is a project that allows the exchange of information inside and outside a blockchain in a secure, reliable and decentralized way. It works through a network of nodes where data providers must stake their LINK tokens to join the network. If inaccurate data is detected, these tokens are lost. This allows the smart contract and those who rely on its truthfulness to be certain that no fraudulent or incorrect data has been added. Chainlink also uses multiple data sources, keeping oracles trustless with no downtime periods.

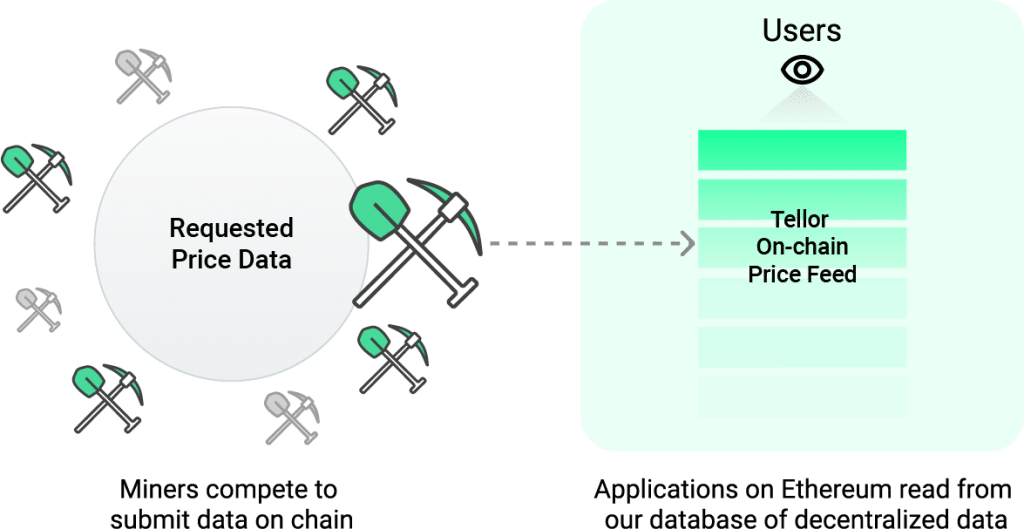

Chainlink has attracted a lot of attention thanks to an explosive 2019 as far as the price of the token is concerned, but it is not the only provider of oracles in the blockchain world. Tellor is one of its most interesting competitors which was able to quickly launch its mainnet due to the fact that the project is not trying to create oracles for every potential type of data, but focuses on price data feeds, with the clear goal of becoming a reference for the DeFi world. While 80% or more of smart contract use-cases require external resources, decentralized finance dApps are currently based on data feeds that are still highly centralized.

Decentralized oracles based on Ethereum and not only

Provable™ Things (formerly Oraclize, joined the Poseidon group in May 2019), satisfies thousands of requests every day on dApp platforms such as Ethereum, Rootstock, R3 Corda, Hyperledger Fabric and EOS via an agnostic protocol which doesn’t care which blockchain it connects to, providing any data source such as the common web API of the Internet. The solution developed by Provable™ makes it easy to prove that the data retrieved from the source is authentic and not tampered with, by accompanying the data with a document called proof of authenticity. Authenticity proofs can be based on several technologies such as verifiable virtual machines and Trusted Execution Environment solutions which have already been seen with pTokens.

Real-world data is fundamental and if oracles are centralized they become a potential weak point as well as a key intermediary in the operational process. Without decentralized data feeds, dApps can be considered centralized. Thanks in part to the ongoing development of DeFi, there will be a great deal of attention in 2020 to projects that provide decentralized data oracles.