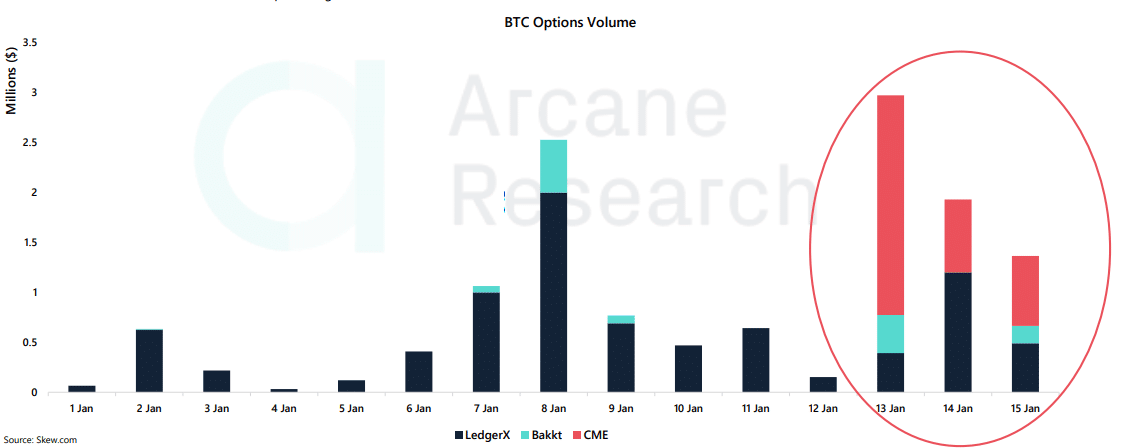

A report by Arcane Research shows that the volumes of CME’s bitcoin options have outperformed those of Bakkt’s equivalent contracts.

In fact, the research reveals that the trading volumes of Bakkt bitcoin options on the New York Stock Exchange is still very modest, even lower than those of LedgerX contracts.

By contrast, the volumes of CME bitcoin options trades on the Chicago Stock Exchange, launched just a few days ago, are already much higher.

Actually, in the first three days analyzed, namely January 13th, 14th and 15th, 2020, CME’s volumes were overall higher than those of the other two competitors, with Bakkt in third position behind LedgerX.

However, it is worth mentioning that these volumes are extremely small compared to those of bitcoin futures, for example. Looking at data from the CME, it can be seen that the trading volumes of futures, which have been on the market since December 2017, are now decidedly high, while those of options are still very low.

Last Friday, January 17th, 2020, 122 CME bitcoin options contracts were traded, while the first day of trading, January 13th, they were 55. These contracts represent the right to purchase bitcoin futures contracts worth 5 BTC each.

As a result, the total volume traded on Friday on the Chicago Stock Exchange was 610 BTC, or about $5.3 million, while on the New York Stock Exchange the volume of options traded was about $178,000.

It should not be forgotten that Bakkt futures only landed on the market in September 2018, more than a year and a half after the CME, so it is possible that the immediate success of CME options is also partly due to the fact that operators have been trading bitcoin futures on the Chicago Stock Exchange for much longer than on the New York Stock Exchange.

According to Arcane Research, institutional investors seem to be preferring CME for the time being, though it is not clear why.

Nevertheless, the volumes of options traded on the exchange are still significantly lower than those of bitcoin options traded on crypto exchanges such as Deribit or OKEx, and the latter has been growing sharply since late 2019, although they are still below September levels.