The Chinese New Year, which will take place tomorrow, January 25th, is a festive period that statistically sees volumes shrinking for the cryptocurrency sector.

In fact, despite the bans, the Chinese market remains one of the most attractive countries for cryptocurrency trading. In reality, the shrinking has already occurred when considering how the daily volumes on a daily basis amount to just over 75 billion dollars, far from the 150 billion dollars exchanged during the bullish phase of a week ago.

The Coronavirus issue should not be overlooked either. In short, the mix of news coming from China could push trade away from the Asian country, where the Chinese bypass trading bans by relying on exchanges from South Korea or Japan.

The data these days are leading to a price retracement that is not worrying at the moment. Comparing the movements that have developed from January 2nd-3rd to last week’s highs, there is a 30% of Fibonacci retracement. This does not suggest a worrying correction, however, it is important to be careful that this does not happen with an extension that would see prices reach alarming levels.

Bitcoin remains the reference market in the positive and negative phases, confirming itself as the crypto queen driving the whole sector. So eyes are on Bitcoin that in these hours is testing the $8,300 support.

The first bearish week of 2020 is therefore coming to an end after two weeks of strong increases with an intensity that had not been recorded since last October.

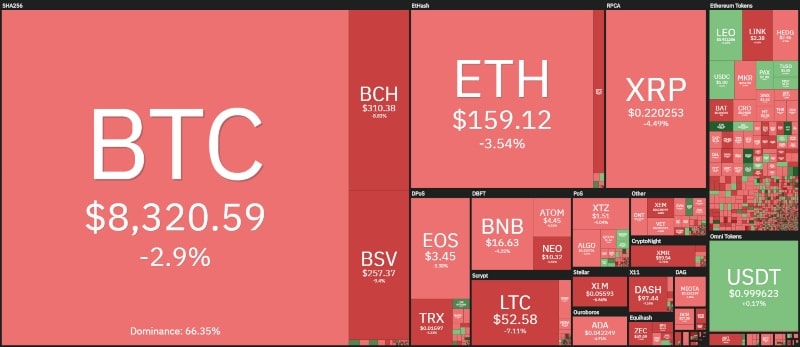

On a general level, today the red sign continues to prevail. More than 80% of the first 100 cryptocurrencies are in negative territory. To find the only positive signs among the top 50 it is necessary to go down to the middle of the ranking. Leo Token (LEO) is up by 1% and Cosmos (ATOM) is around parity.

The highlights include the 52nd position of Lisk (LSK) climbing 7%, and Nervos Network (CKB) rising 13%. Nervos Network, despite the strong climb of the positions, is a new token launched last fall that represents an open-source blockchain ecosystem. Nervos climbs to 53rd place with over $90 million in capitalization.

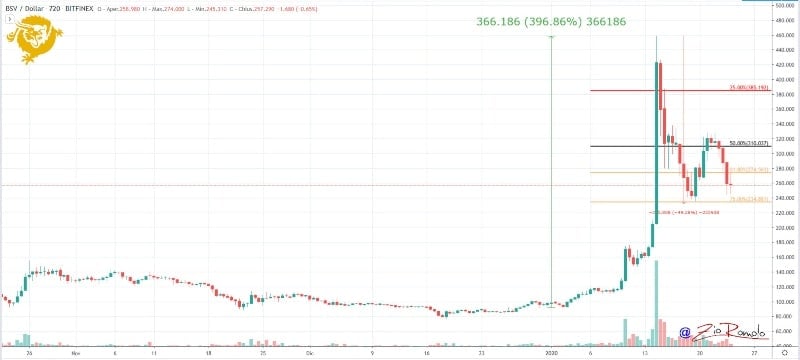

Bitcoin Satoshi Vision (BSV) after last week’s strong upward volatility today loses ground with a decline of almost 10%. After last week’s strong growth, BSV remains in the speculative wave with both upward and downward double-digit movements.

The weekly balance for most cryptocurrencies, with a few exceptions such as Stellar (XLM) and Tezos (XTZ) above parity, returns to red. The first three lose with the same bearish intensity, -7% from last Friday’s levels.

After last week’s sharp jump to almost 250 billion capitalization, the market cap is now below 230 billion, highlighting how this week is coming to a negative end after two strong bullish weeks.

Bitcoin remains clinging to 66% dominance. The market shares of Ethereum (7.5%) and Ripple (4.2%) remain unchanged.

Bitcoin (BTC): shrinking volumes

Bitcoin is still in a short term bearish phase on a weekly basis, looking for support to end this retracement now underway after last Sunday night’s tops.

A bad week for Bitcoin but nothing to worry about if prices don’t go below $8,000. There remains this range between $8,000 and $8,300 where prices will be able to move over the weekend without any particular fluctuations due to the fact that on Chinese New Year, as mentioned, volumes usually shrink.

As far as the return of positivity for BTC is concerned, it is necessary to go back to $8,800 to move to the attack of $9,100-9,300, which coincides with the bearish dynamic trendline.

Ethereum (ETH)

Ethereum tries to create a support base in the 155-dollar area.

Only a drop below this level would set off a wake-up call that would then start to worry with extensions below $150.

Ripple (XRP)

Ripple continues to show greater weakness than the rest of the industry. After having stretched prices to 25 cents last week, they are now looking for support above 20 cents.

Ripple, which still remains at a disadvantage compared to the rest of the industry, would see a first positive sign with a return to last week’s high at 25 cents. Conversely, a fall below 19 cents would lead to a new downward speculation for the third token per capitalization.