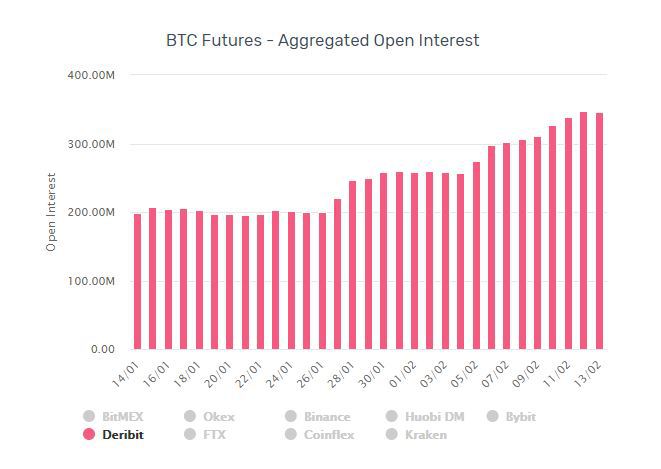

Bitcoin BTC options on Deribit peaked with monthly trading volumes of over $1.5 billion traded in January 2020.

In 2017 – during the last bull run – the first rumours about the possibility that traditional finance was interested in listing Bitcoin, brought the price to its highs.

Shortly after, following the listing of futures on the CME Group, great pressure on the market dragged it into a sad winter that lasted two very painful years marked by the bear market.

Today, as this chart shows, interest in new realities such as Deribit is growing, offering the market derivatives whose underlying assets are cryptocurrencies like Bitcoin and Ethereum.

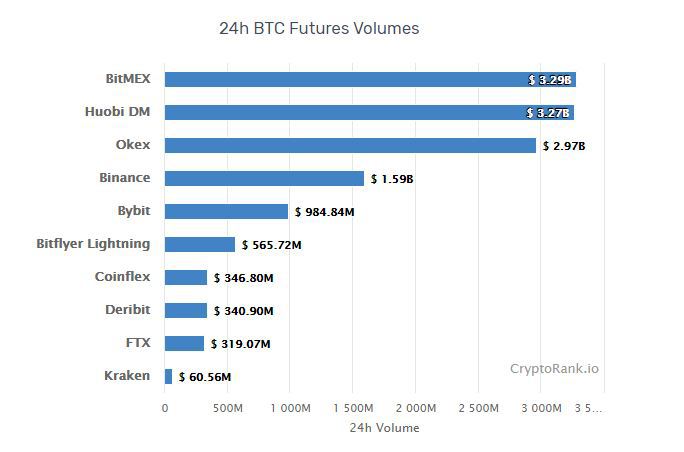

Deribit is just one of many platforms offering Bitcoin futures besides institutions such as CME Group and Bakkt.

Many operators not belonging to the old finance sector, but born as organizations dedicated to crypto, are offering derivatives to their users.

Here are the major ones with their volumes expressed in billions of dollars.

The derivative instrument in finance is an asset that derives its value from another financial asset or from an index called the underlying.

Derivatives are mainly used to hedge a financial risk or to speculate on the price of an asset.

Derivatives are traded in many financial markets, and mainly outside official stock markets, i.e. in alternative markets to the actual exchanges, known as over-the-counter (OTC) markets.

Cryptocurrencies as the underlying is a new type of OTC market that can be speculated on.

Do derivatives increase the adoption of Bitcoin?

Bitcoin adoption is not an easy matter to assess, it depends on what we expect from this tool.

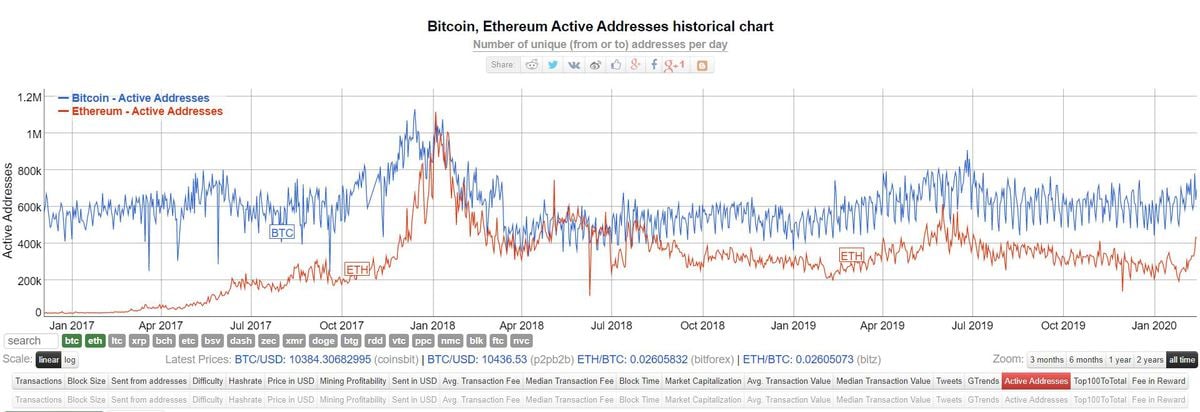

Looking at the active addresses on its blockchain there is a clear and irrefutable indication of its use as a trading tool. It is worth recognizing that we are experiencing a very worrying stagnation, as indicated by this graph where Bitcoin’s active addresses in blue are compared to those of Ethereum in red.

It must not be forgotten that the increase in trading volumes of these tools does not take place on the blockchain but mainly on the databases of exchanges.

From the end of 2016 to date, the increase of active addresses on BTC has been practically zero.

Much of the demand for transactions inside the market has been absorbed by other chains while from the outside the interest in using this blockchain as a means of exchange is not particularly lively.

What this chart does not tell, however, is related to BTC’s narrative as digital gold: slow, expensive to move and very useful as a store of value for its resilience and controlled inflation characteristics.

The only index capable of providing a concrete indication of this instrument’s ability to provide a store of value is the price. To date, its volatility still sees it as a speculative asset rather than a reserve. However, the chances of the market perceiving it as such are increasing.

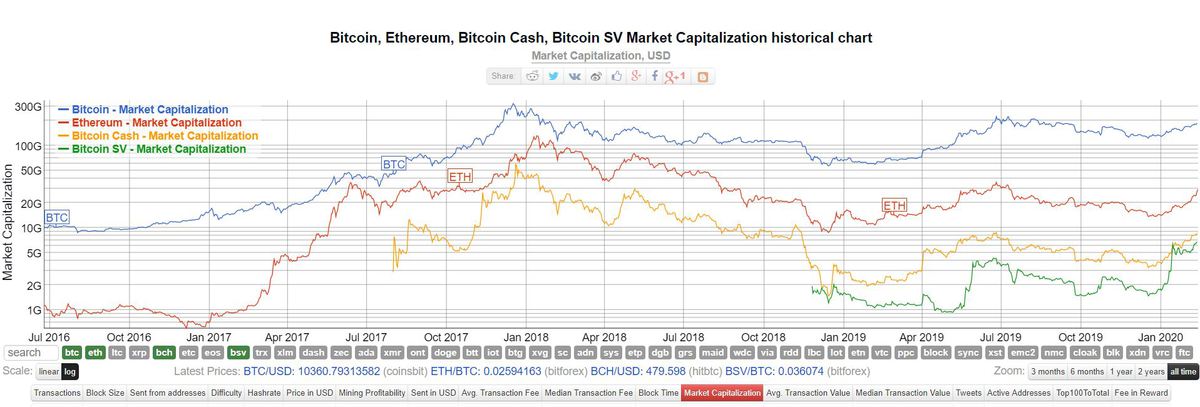

BTC is not the only cryptocurrency to demonstrate good price-performance, some of its most famous forks have achieved positive trends even though they suffered the most during the bear market.

The characteristics of Ethereum and an inflationary policy which differs from that of BTC, have always put it in the background as a store of value. Whereas BCH and BSV are criticized for making transactions cheaper and faster by centralizing mining.

One thing is certain: the use and increased adoption will be perceived as a positive indicator by the market also in relation to the function of store of value. Speculation increases but the fate of these instruments does not depend only on it.