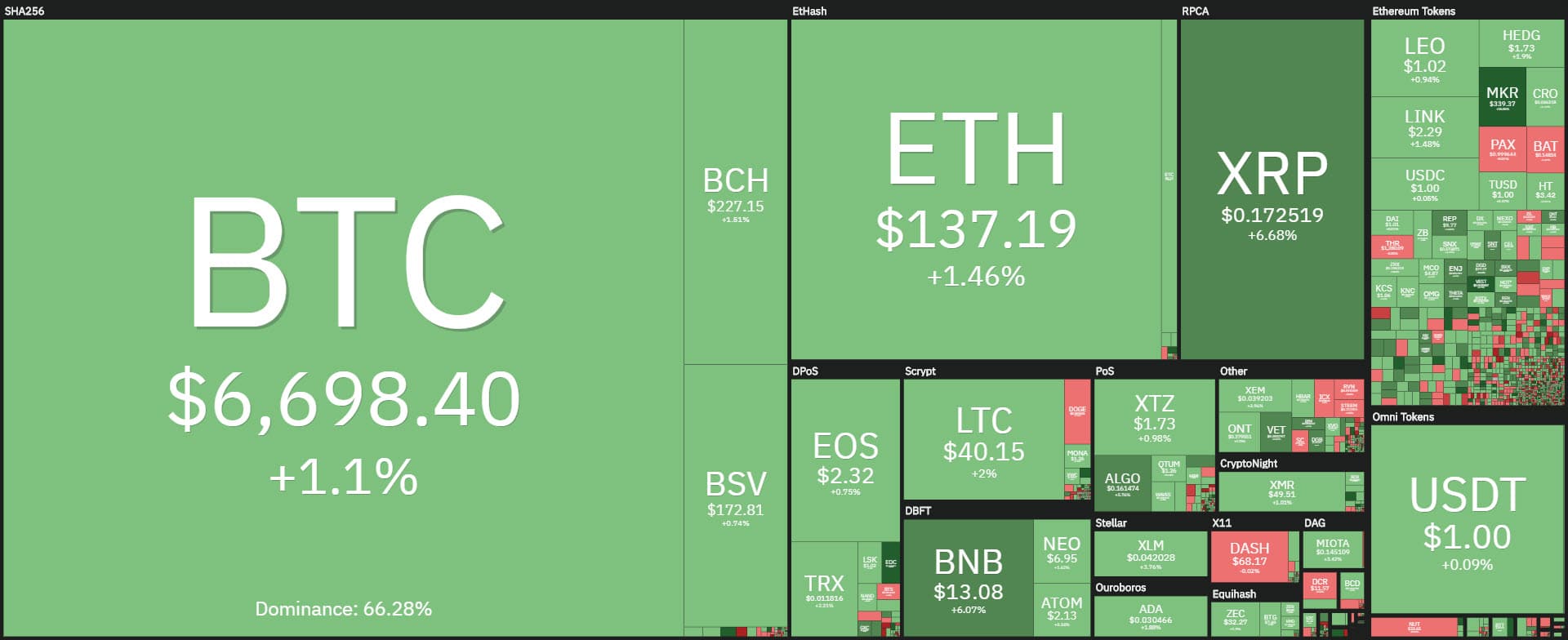

Among the top 20 cryptocurrencies, the best of the day is XRP whose price, along with that of Binance Coin (BNB) rises by more than 7%. For the second time this week, the day sees XRP registering a bullish move.

For XRP, it is the best day of the week after a good increase at the beginning of the week. It looks like the period is about to end with a further leap that makes it the best of the top 20. XRP finds itself close to the 18 cents which last Friday were a cap that rejected the rebound it had developed after the mid-March lows.

Overall, the week is about to end for the second time with a good balance and a strong recovery. There is only one red sign these days: Wednesday’s setback which did not bring any particular tensions despite the weakness.

On a weekly basis, the sales alternate with a decided setback of Ethereum (ETH) which, from last Friday’s levels, loses about 7%.

Noteworthy is the 12% recovery of Monero (XMR), which in these days has been characterized by performances that see the price recover 100% after the sinking of March 13th which pushed prices to the lows of summer 2017. Monero doubled its value in 14 days.

The week continues to stand out for its very strong and lively volumes for Bitcoin. The same cannot be said for the rest of the industry, which today sees a total trading volume of around $90 billion. Whereas yesterday Bitcoin closed the day with volumes over a billion dollars, the lowest levels since last March 8th, though still significant.

The capitalization is just under 190 billion dollars. Bitcoin’s dominance is unchanged from yesterday’s levels at 65.5%. Same dominance for Ethereum at 8.2%. Today’s leap makes Ripple recover dominance, which returns above 4% after more than a week in which this threshold had been abandoned. Ripple’s market strength remains close to the lows of recent years.

Bitcoin (BTC)

Bitcoin continues to struggle, trying to break the $6,900 resistance. In the last few hours prices have returned close to this level, which coincides with the former support area that between late 2019 and early 2020 had been a support where, after three major tests, resumed the uptrend that characterized the trend from mid-December/early January until mid-February.

As a result, prices are close to a very important technical area, being a former support that has now become crucial resistance.

On a cyclical level, prices are close to the end of a weekly cycle. At the moment the rebound that has developed from the lows of March 13th-16th has led to a recovery of about 55%. This also corresponds to the 60% pullback when considering the levels that characterized the decline with the highs of March 12th and the 24-hour lows after March 13th.

Ethereum (ETH)

Ethereum shows less rebound strength and has been trading around $135 since the beginning of the week without giving any particular signals.

ETH is also close to closing a cyclical two-week level. The lack of recovery of $145 is worrying. Over the weekend, it is important not to go below the $120 threshold. A positive sign would be a recovery of $145 with an extension beyond $155.