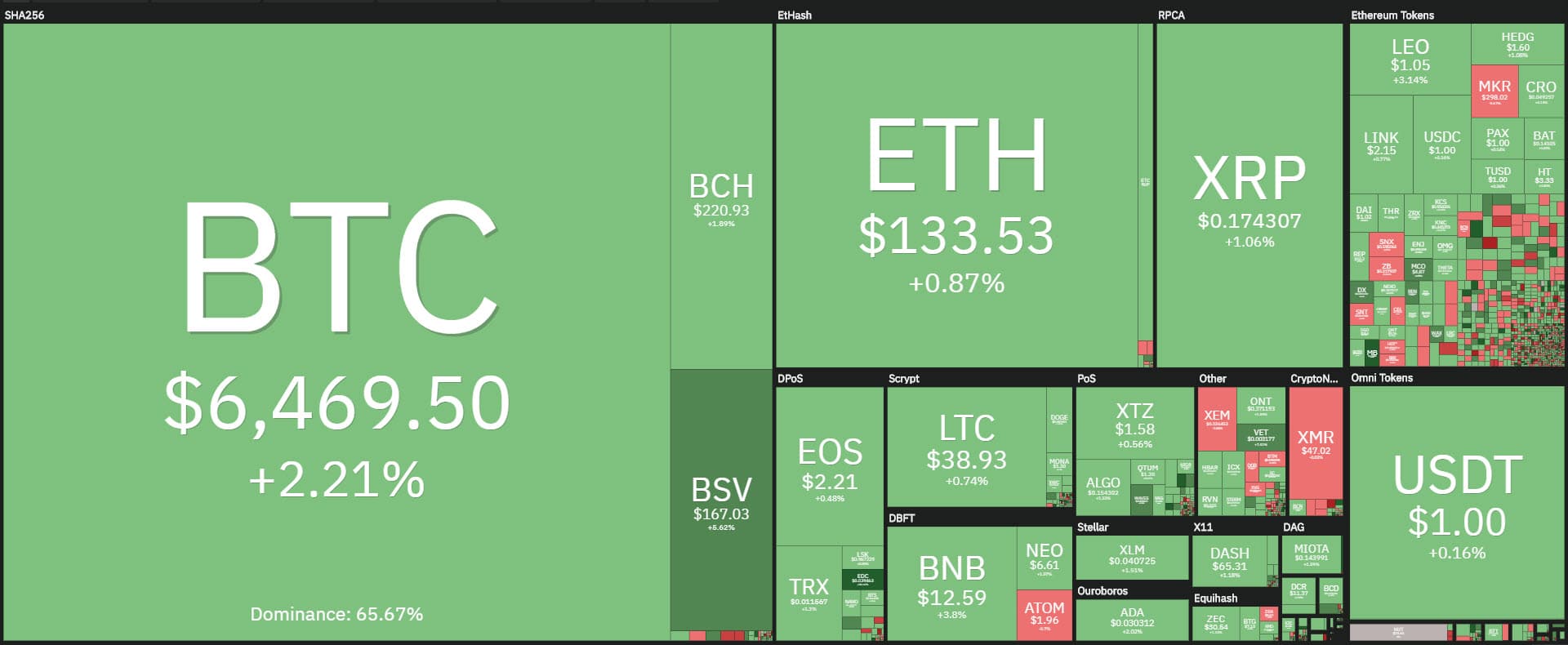

In the cryptocurrency world, March 2020 ends with the second consecutive day showing a clear prevalence of green signs. This, however, does not erase the strong negative performance, which has been recording double-digit declines since the beginning of the month.

Among the big ones, it is necessary to go down to the 21st position occupied by the Crypto.com Chain (CRO) token, which manages to mitigate the damage with a -8%.

The only one that stands out with a positive performance is Leo (LEO) which, with the performance of recent days, recovers the 1$ value, which corresponds to the launch value last year.

Leo is the only one among the main altcoins that closes with an increase on a monthly basis of 9%.

This March 2020 cancels the rises of January and February, thus ending the third consecutive quarter with a red sign.

Such a long trend was not recorded from 2014-2015, highlighting how the bearish movement that has been characterizing the entire sector for over a month now reports concerns and doubts about the trend in the coming months.

The only positive note is that the second quarter of the year is statistically the period with the best increases.

On a quarterly basis, however, there are positive performances, with increases that go beyond the double-digit figure for privacy coins.

Dash (DASH) has been earning over 55% since the beginning of the year. Also ZCash (ZEC) and Monero (XMR) rise, the former close to 10% since the beginning of the year, while Monero, with the increases of the last few days, is able to rise more than 3%.

Among the big ones, Bitcoin recorded a negative performance, -10% which somewhat hides the declines that characterized the movement in the second half of March. In the week from March 7th to 13th, BTC saw its value fall by more than 55%.

The same negative performance also for Ripple (XRP) that with a -10% returns to 17 cents, levels that had not been recorded for over 2 years.

Ethereum is able to limit the damage and closes just above parity, +1% on a quarterly basis, although the strong movement that has characterized Ethereum in recent weeks makes it lose all the gain accumulated during the first two months and a half that had given rise to hope for a return of glory with prices returning close to $300 with the double maximum in mid-February, from which began the slow and then inexorable decline that ended with the lows of March 13th.

The rebound of the last days alleviates the damages, causing the prices to go up by some percentage points (for example BTC over 50%, for ETH and XRP and other altcoins even over 70%), but it’s not enough.

In order to put behind the collapse of the first part of March it is necessary to go up again above the previous levels of support, now become strong resistance.

Returning to the daily context, the green sign prevails today. Among the biggest rises of the day, there is Iota (IOTA) that with a jump of 7% recovers the threshold of 15 cents.

Not even IOTA was immune to the last month’s declines, which with the low of mid-March has seen the lowest point since the launch in autumn 2017.

The other best of the day is the Crypto.com token with an increase of over 5%.

Among the worst, there is no particular downward movement. Maker (MKR) stands out with a 3% loss.

The market cap remains above $180 billion, trying to lay the foundations for a recovery of $200 billion in the coming days, a level that the capitalization has abandoned with the mid-March declines. The last time prices broke the $200 billion threshold was on March 12th.

Volumes remain low. Yesterday, after the break on Sunday, trading on Bitcoin returned to a counter value of $1.3 billion.

Bitcoin dominance remains above 65%. Ethereum’s is back down to 8%. A break below this level would project Ethereum to a market share close to the beginning of February when for the first time in over three months it was back below the 8% threshold. XRP also retreats, staying above 4.1%.

Bitcoin (BTC)

Bitcoin is now approaching the end of the bi-weekly cycle, a positive signal would come with the break of the $6,800 threshold within the next two to three days.

A break below 5,800, the lowest levels of the last week and the previous weekend, would give bearish indications and would open space for a drop below $5,500.

Ethereum (ETH)

Ethereum continues to fluctuate around $135, giving no particular signs of recovery as the oscillations are accompanied by low volumes, now reduced for a week.

For ETH, it is necessary to return as soon as possible above 140-145 dollars because in case of a drop below 120 dollars, support that coincides with the lowest point of the last two weeks, it would open dangerous spaces to test the psychological threshold of 100 dollars.