Augur is a prediction market that, especially in these times of the Coronavirus, might prove to be very useful: but how does it work?

Predicting or preventing the spread of a contagion and reacting correctly by filtering the noise of bad information, incompetence and spread of supranational sources, is not easy and never will be. How could technology help us in the future?

Thanks to a concept related to crowd psychology, a very useful way to get information about a future event, is to submit the question to a large number of people.

This means that in most cases the average opinion of the crowd is much closer to reality than the opinion of an expert.

How does Augur work

At the bottom of the article, we will briefly describe the features of the new version 2 (v2) of Augur which is currently being launched.

Although there will never be the presumption to predict the future or to solve such delicate problems as a pandemic, let’s try to understand what the Augur project is and how it could be useful in similar cases:

- Augur is a protocol for the creation of what are defined as “prediction markets“, markets capable of employing the oracle function within a specific context.

- Augur is an architecture of contracts written in Solidity capable of interacting with the Ethereum blockchain and combining the theory described above to create a platform that can be used by everyone in a secure and decentralized way without an intermediary.

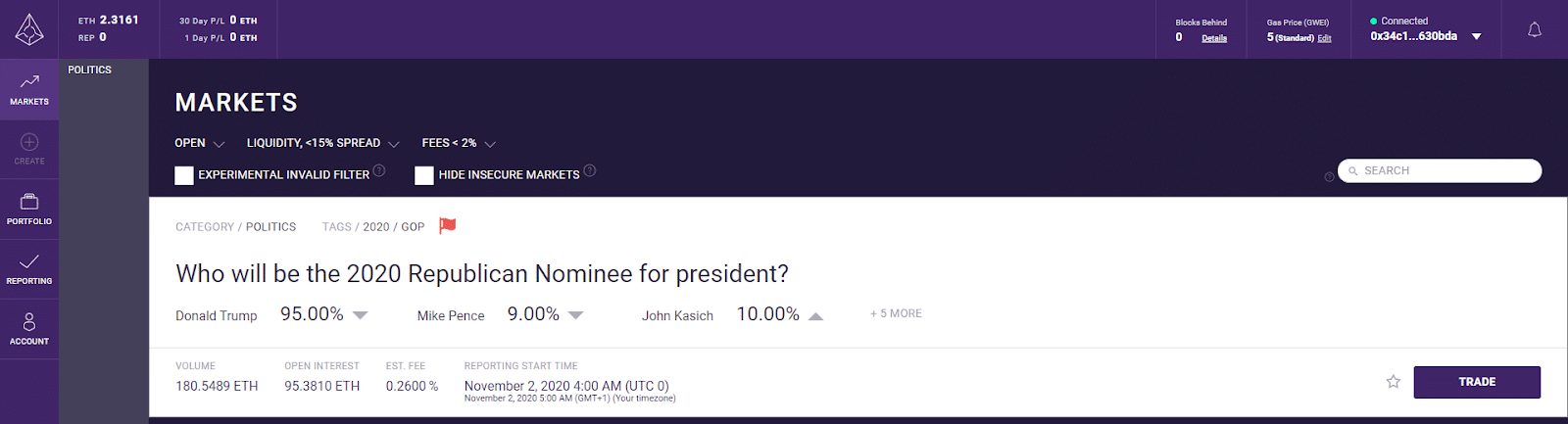

- Augur is a platform where anyone can create a market for a future event, regardless of the event itself, the initial funding and liquidity for the shares must be made available.

The creators of the prediction market, or more simply of the bet, receive a monetary incentive from the fees generated by the market itself, as users buy and sell shares related to the event being monitored.

It is not a new idea, prediction markets have been around for some time but Augur is the first to be decentralized.

Needless to say, thanks to Ethereum there is no need to trust a central authority to report on the outcome of the events inserted in the blockchain, the immutability of the data will be guaranteed.

With Augur, thousands of REP token holders will verify this result, making manipulation or error virtually impossible.

Augur and the 4 parameters

There are many internal functions and a plurality of parameters, but we can summarize in a simple way four fundamental points to understand the system in its assumptions:

- Assuming that the value of each “share” (bet) amounts to one euro or one dollar, if a negative market share is worth 50 cents and if a positive share is worth 50 cents, there is a 50% probability that the event according to the system is true or false.

- If it is proven that the event has been confirmed, the shareholders who have given a positive answer to the question related to the event will receive one euro or one dollar for each share entered.

- The market price of a share during a trade is an estimate of whether an event is likely to occur.

- Users are not obliged to block a price until the event takes place, as the shares can be freely traded within the Augur code until the last moment indicated as the maximum time by the creator of the predictive activity.

To analyze a practical application, one could, for example, imagine betting for an underprivileged political candidate.

- A user can buy shares for the alleged loser in the election round at a cheap price, e.g. 10 cents;

- As the campaign progresses, the opposing candidate loses the electorate due to a legal issue;

- The price of that share will certainly increase given the movement caused by the emergence of new evidence;

- It is now possible to sell the share for a higher price, say 60 cents, with a profit of 50 cents per share sold.

After the elections, thousands of users will report the result using the Augur (REP) token, which means that the result of the event is not reported by a central authority, but by a large group of people participating in the Augur system.

The ICO of Augur

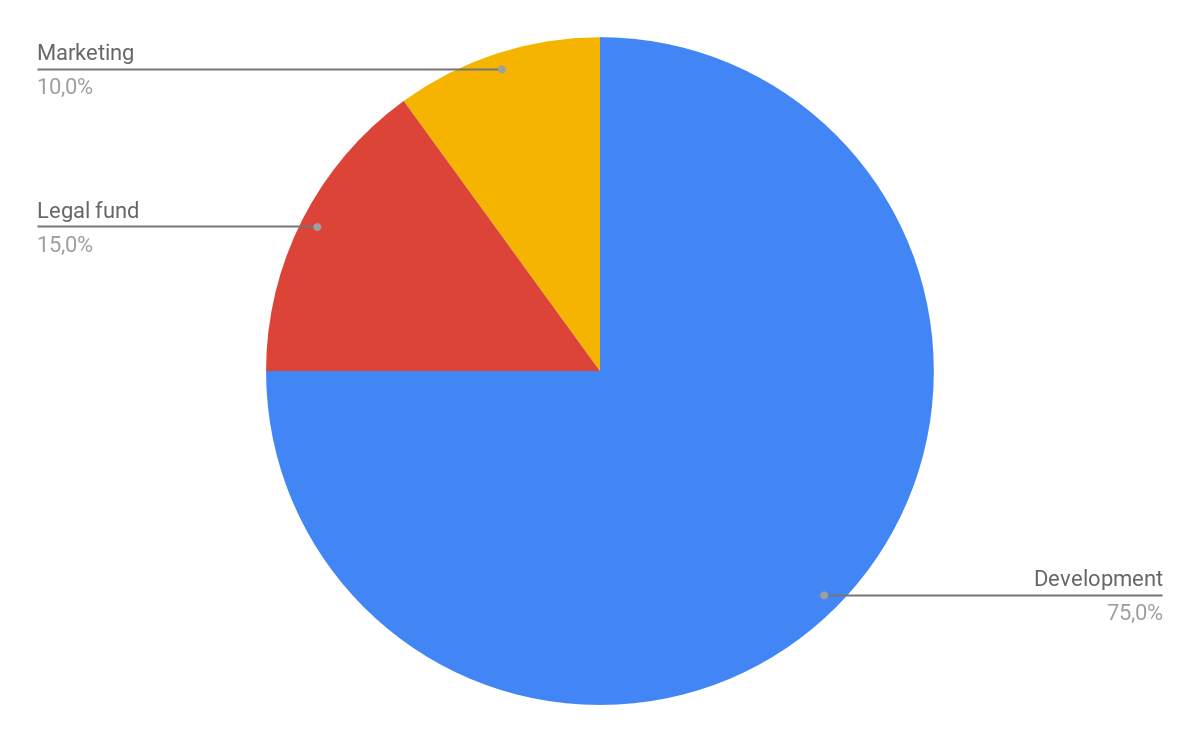

According to the whitepaper, the token distribution is as follows:

- 8.8 million, 80% of the 11 million tokens produced, were sent to investors during the ICO.

- 2.2 million tokens, 16% of the total, were distributed to the team and consultants,

- 0.44 million, 4%, to the Forecast Foundation, a non-profit organization that is formally responsible for managing the project maintenance, improvement and promotion of the platform.

During the Initial Coin Offering, Augur raised 19053.92000 BTC and 1176816.43 ETH, for a total of USD 5,318,331.63 (average exchange rates of the last 24 hours following the ICO).

The proceeds from this ICO will be used primarily to finance the development of Augur beyond its initial version.

The Augur Foundation

Markets and bets on Augur are created by individual users of the Augur protocol. But in order to be able to direct the launch of a decentralized platform without a real owner in the early stages, it was necessary to set up a foundation.

The Foundation consists of a group of developers and technology professionals who are passionate about the potential of decentralized applications.

The Foundation does not manage or control, nor can it control, which markets, bets or shares people execute and create on the Augur protocol.

People who create a market using the Augur protocol must ensure that they comply with all laws, rules and regulations of the local jurisdiction in which they reside.

The Augur protocol markets are generated and established using Ether (ETH).

The fees on the Augur protocol directly go to the market creator and the REP holders who report and contest the results.

The Foundation receives no commissions from shares, transactions, markets created or revenues generated by the use of the Augur protocol.

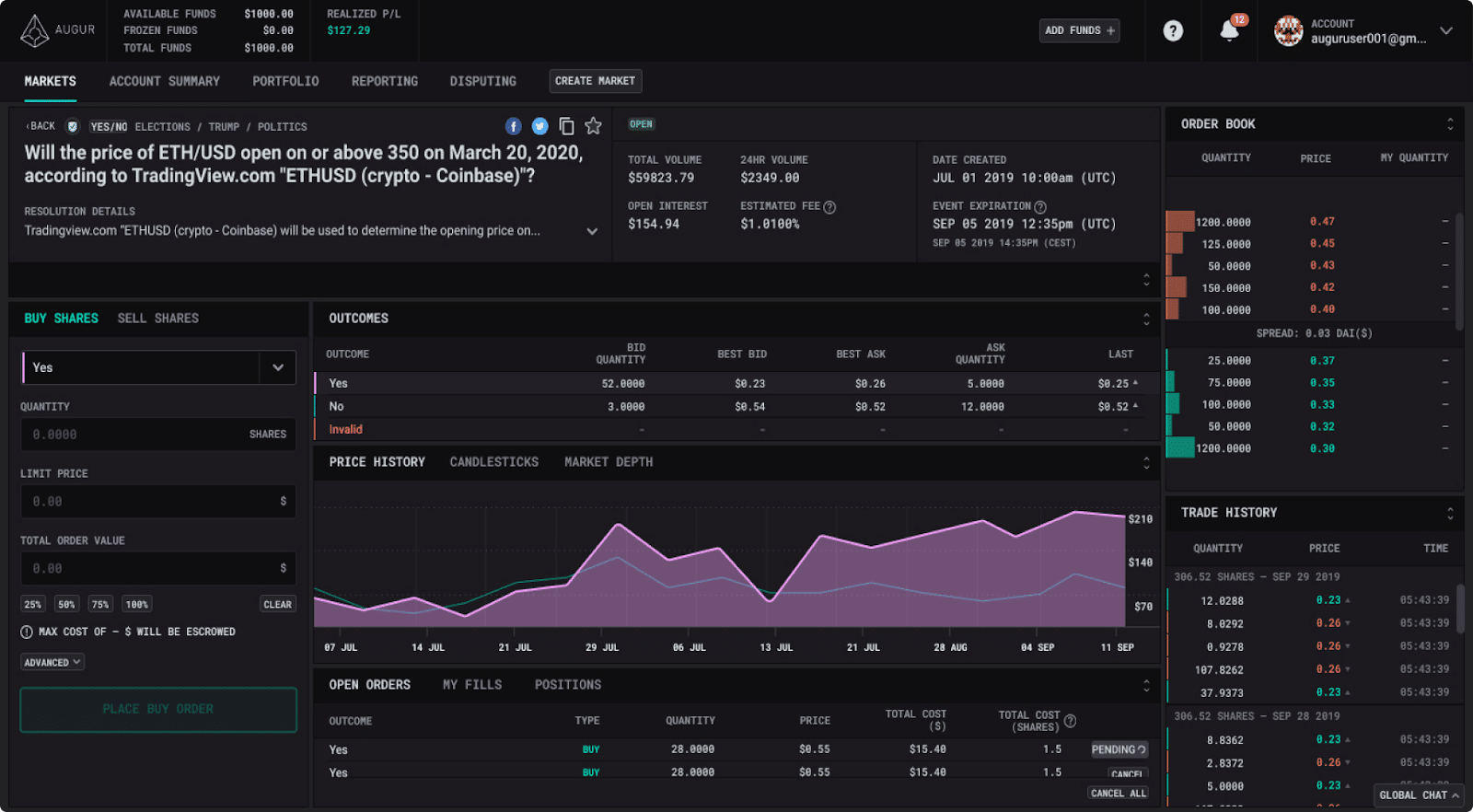

Augur Version 2

The launch of the new version is very close, in the last few days, 501 issues have been closed on GitHub and only 61 remain open.

Augur v2 Deployment Detailshttps://t.co/XekHvjG4ro

— Augur (@AugurProject) April 2, 2020

This is what the new version will look like:

- New interface: the entire trading app has been redesigned from scratch and is available in both desktop and mobile versions. Increased speed and easier interaction;

- Removed limits: No upper limit on betting amount. No general limits or limitations on the platform as a whole.

- DAI (USD) betting: DAI is a stable currency pegged to the dollar value. 1 DAI equals 1 USD;

- Better odds and lower commissions: Augur’s trading fees are the lowest ever available (~ 1%) without withdrawal fees;

- Community discussion: Augur v2 provides a social experience, with a chat and comments present on the portal. Augur is managed and owned by its own community of users;

- Universal access: no matter who or how much money a user wins or where they are, they will always be able to access Augur on the Ethereum blockchain.