A 16% growth has led the price of Ethereum (ETH) to recover a good chunk of the losses incurred during the panic sell from Coronavirus, but why is it rising now?

Some traders are predicting that Ethereum is going to test the $200, with a resistance level above $230.

While the US stock market is showing significant strength, with the Federal Reserve preparing to buy stocks as a last line of defence to prevent a further decline, the cryptocurrency market is also in a strong position to drive prices up.

Why Ethereum is rising: the fundamental numbers

The reasons why some cryptocurrencies perform better than others lie in their fundamentals and in their ability to impose themselves with the underlying narrative.

The Ethereum network, in terms of numbers, is growing rapidly.

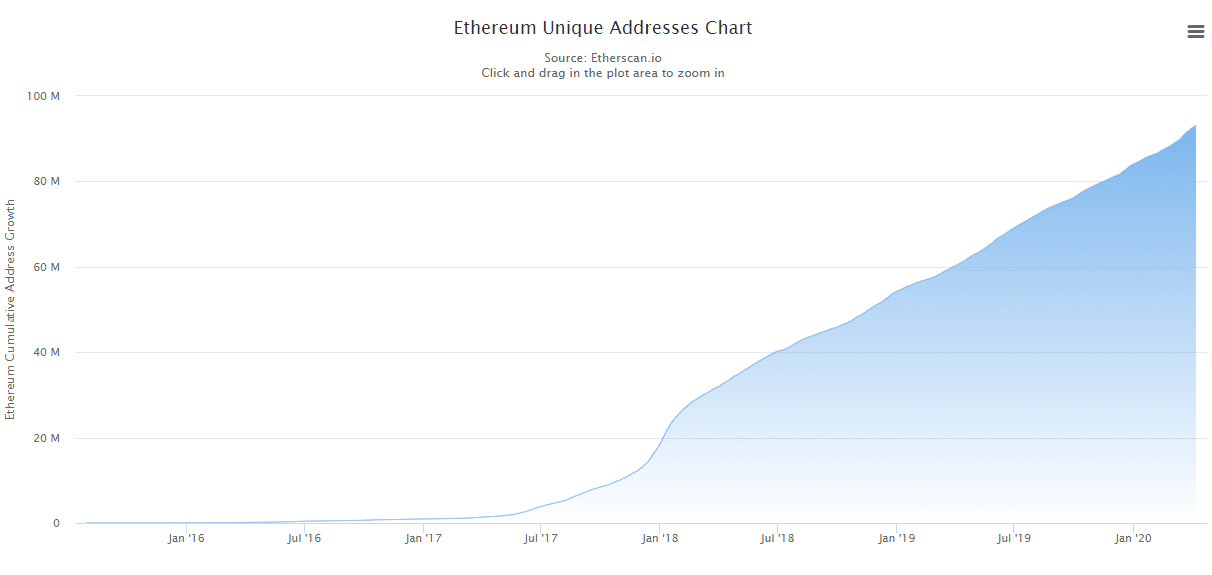

The new number of requested addresses and products is not a parameter to underestimate, it determines the concrete demand for interaction with a blockchain beyond the speculation on exchanges.

Every platform that activates a service or user that operates an interface must generate a new address. Addresses can be activated and abandoned, or remain active and interface continuously with the Ethereum mainnet.

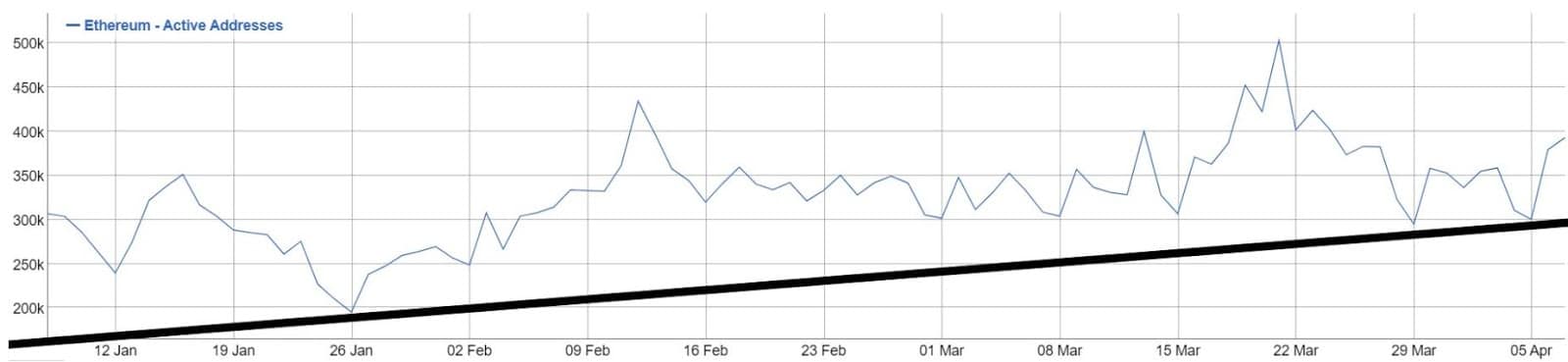

Active Addresses

Whether it’s a wallet, a decentralized exchange or the activation of a contract, if a public and private key are being generated then an address is involved.

Adoption inevitably passes through this indicator.

Addresses created

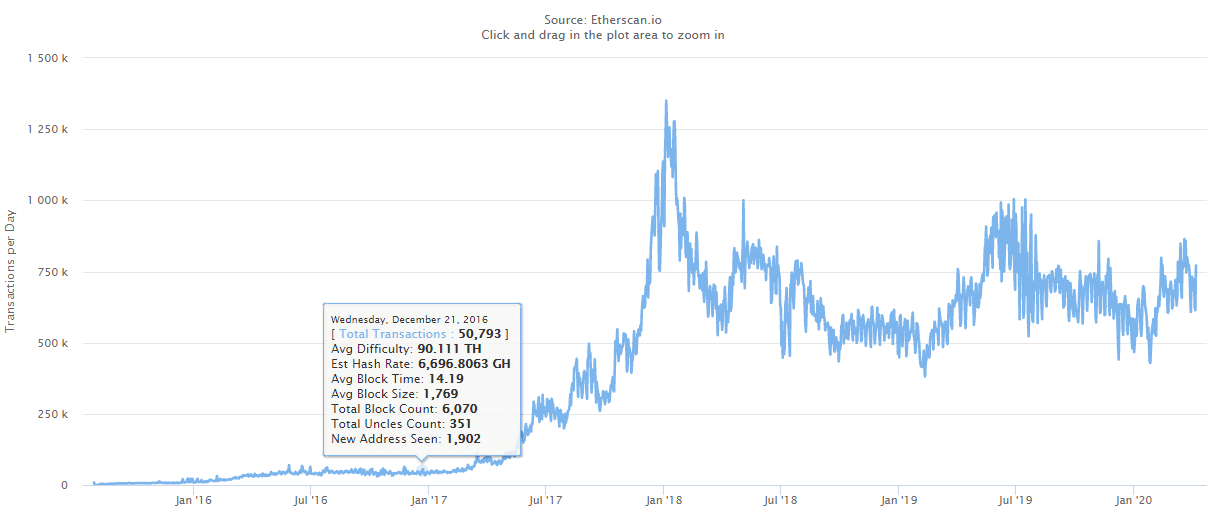

However, the accumulation of new addresses could be misleading without linking it to the number of transactions that the blockchain handles and even here there are positive growth factors.

The trend, after the peak caused by the rise in price in January 2018, is seeing transactions lateralize to an important level and generate a minimum threshold below which they are not falling, leading to an upward trend.

The ability to increase the number of transactions is also related to the technological improvements made to the basic protocol.

Without them, the scaling would not be able to respond quickly to the demand for use by users, who would migrate to other blockchains or abandon the ecosystem.

This is one of the most delicate dynamics to which the whole sector is trying to pay attention through research and development.

The DeFi movement

Decentralized Finance (DeFi) has experienced exceptional growth in developments and enthusiasm.

Some compare this phenomenon to that of the ICOs as far as the impact on Ethereum’s narrative is concerned.

Recently, giants such as Coinbase have become interested in this sector, and many startups have received funding and enhanced their platforms.

However, this has not prevented Covid19 from unleashing and bringing to light some ecosystem issues. In doing so, the panic has pushed capital out of the addresses that had been accumulating millions of dollars in DeFi for months.

In recent weeks, it seems that confidence and funds have returned to the platforms. This means that the number of ETH locked in DeFi is growing again, decreasing the supply available on the market.

Even Bitcoin, thanks to numerous technologically avant-garde initiatives, will join the club bringing new liquidity to the Ethereum network and the DeFi environment.