How is the adoption of bitcoin SegWit transactions growing?

There is a chart that displays this growth. It is a chart published on Woobull.com that calculates and displays the percentage of SegWit transactions in relation to the total on a daily basis.

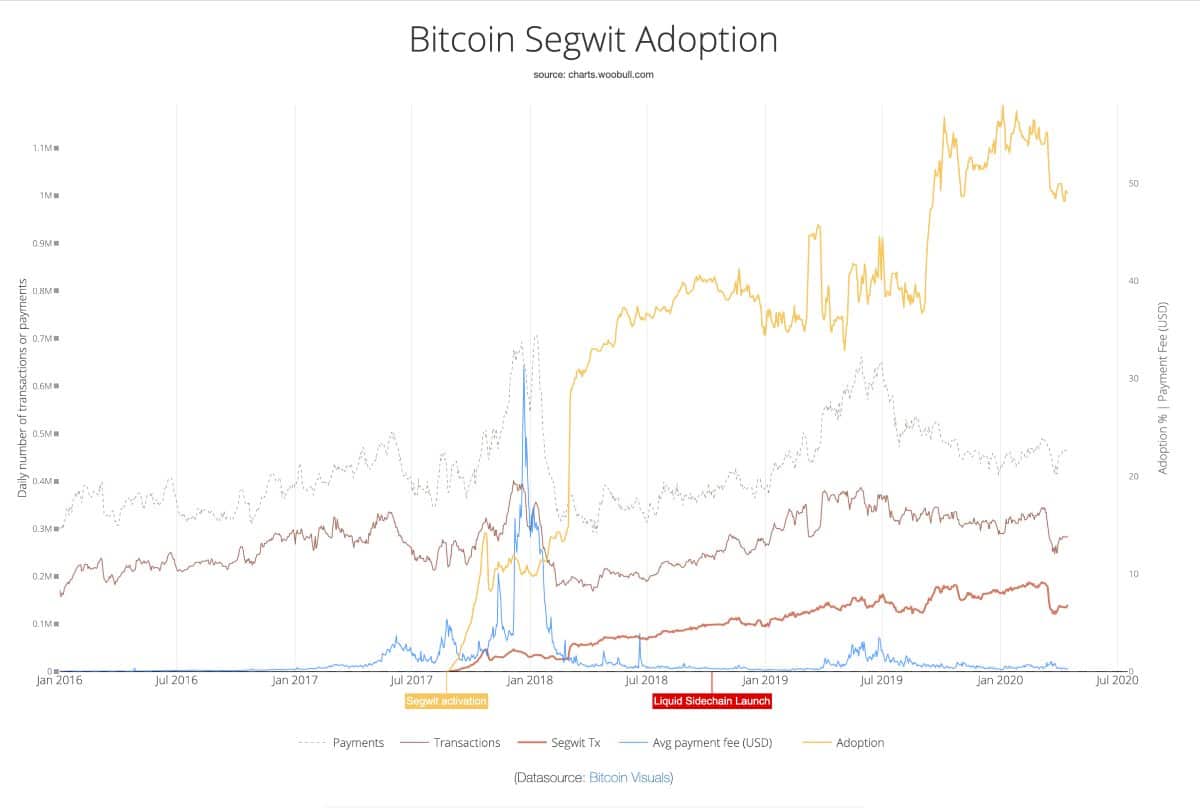

The chart actually starts in January 2016, when SegWit had not yet been released.

In brown, the graph shows the curve of the number of daily transactions recorded on the Bitcoin blockchain, which reveals a growth lasting on average throughout 2016 and 2017, a collapse in early 2018 due to the bursting of the speculative bubble, and then a new rise from April 2018 until June 2019.

Since then, the number of daily transactions has remained relatively constant until March 11th, 2020, the day before the collapse of global financial markets, but it has then recovered.

In August 2017, with a special fork, the optional SegWit mode was introduced in the Bitcoin protocol, which reduces the weight and therefore the cost of transactions.

The dark orange curve of the chart shows the number of transactions which since then have been carried out day after day with this new mode.

Until February 2018, the number of transactions using SegWit had grown little, and the first surge took place in March 2018.

It must be said that initially very few exchanges supported SegWit and only during the next few months they started using this new cheaper standard.

Since March 2018, growth has been almost constant, temporarily interrupted only by the collapse of the markets in mid-March 2020.

But the most interesting curve is the yellow one, i.e. the percentage of SegWit transactions in relation to the total. In fact, the use of SegWit does not seem to have generated an increase in transactions, but simply a reduction in costs.

This yellow curve shows that until March 2018, the percentage of SegWit transactions in relation to the total number of transactions had never exceeded 15%, with more than 85% of transactions using the old standard.

By March 2018, this percentage had suddenly doubled from 15% to 30%, and has continued to grow since then, albeit not steadily.

For example, by October 2018 it had reached 40%, and then fell back below 35% in March 2019. Until August 2019, it fluctuated between 35% and 40%, and then made another sudden leap to over 55% in October 2019.

Since then it had remained fairly constant until the collapse of the financial markets, which probably led some old BTC owners to move them from their old non-SegWit addresses, thus bringing this percentage back below 50%.

Now the percentage is still around 50%, but if the crypto markets were to return to the way they were before the mid-March crash, it is possible that the percentage of SegWit transactions could rise again.

The blue curve of average transaction costs is also very interesting.

As of February 2017, when SegWit was not around, it started to grow significantly, with extremely high peaks in mid-December of the same year, when BTC’s price hit an all-time high.

Although it began to fall after the peak, only the significant increase in SegWit transactions in March 2018 produced a significant decline in transaction costs to reassuring levels.

In fact, by the end of 2018, the cost had fallen even lower than it had in February 2017, when it began to rise, despite a total number of transactions exceeding the number recorded during the first half of the previous year.

This cost skyrocketed again in mid-2019, but after the new leap in the percentage of SegWit transactions in August 2019, it fell again at the end of the year to the levels reached in late 2018.

Since then, it has remained low, but increased when the financial markets collapsed in mid-March 2020 when the number of non-SegWit transactions increased.

It is therefore fair to say that there is a correlation between the average bitcoin transaction cost and the percentage of daily SegWit transactions.