The weekend saw the price of Ethereum (ETH) rise, which in the first part of the day on Saturday broke the resistance and the maximums of the last month, $175 area, reaching the levels that already in recent days had been indicated as the second target of the current bullish movement that has dragged the rise of the other altcoins gaining a few decimal points over the entire sector.

The recovery of the cryptocurrencies continues after the strong decline suffered in mid-March in parallel to what was happening due to the impact of Covid-19 on the international financial markets, which did not even spare cryptocurrencies.

For the 5th week in a row, the cryptocurrency sector ended with higher closures than before, a condition that had not exactly been recorded for about a year, since May 2019.

Even the weekend, unlike the last ones, recorded tempting movements, with increases that at certain times on Saturday and Sunday saw increases that were close to double figures.

In addition to Ethereum, in recent days the upward movement of ZCash (ZEC) has been noted, which, with the rises of the last few days, also marks one of the largest weekly increases from last Monday’s levels.

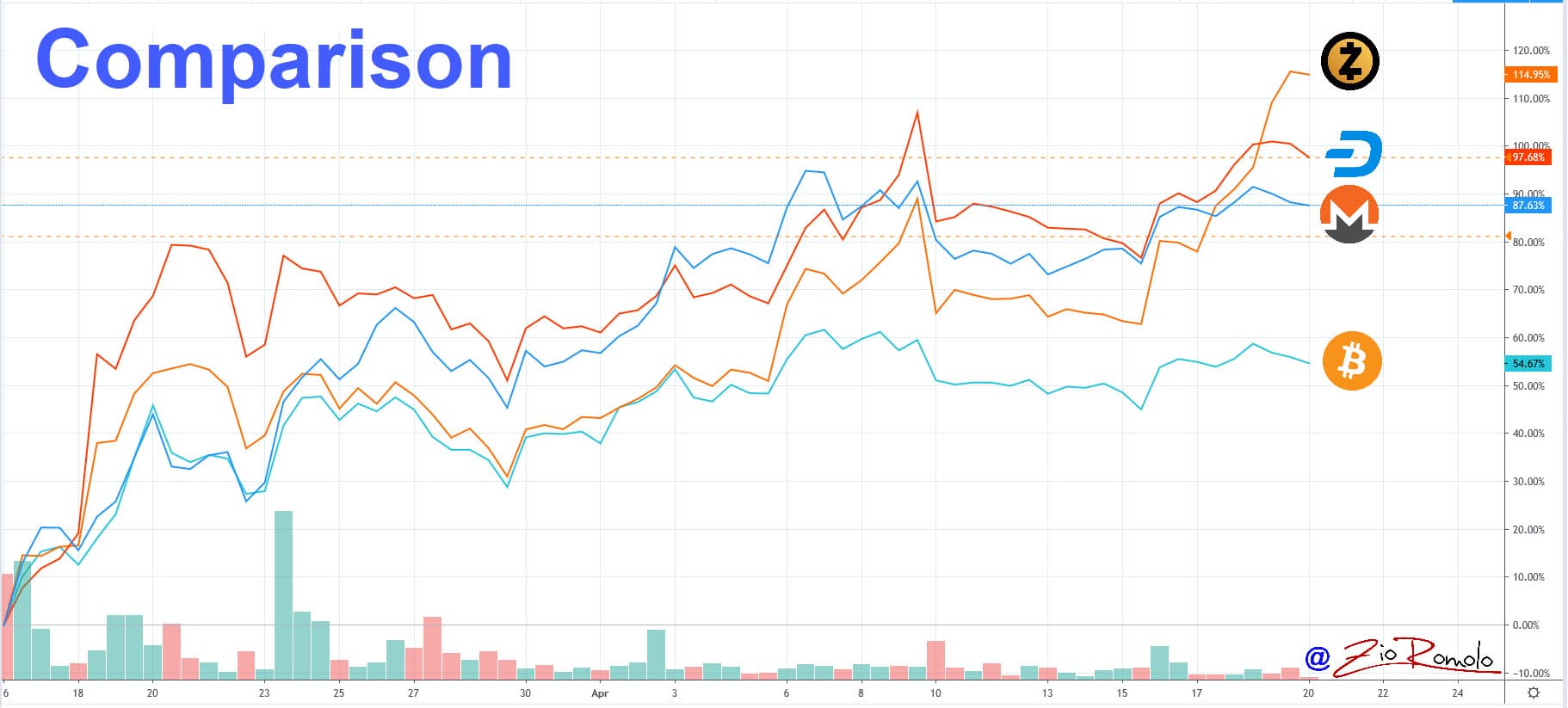

ZCash, from Monday’s levels, gains more than 30% and is the best on a weekly basis among the top 50 of the ranking: from the lows of March 16th, with the increases of the last few hours, it achieves a recovery that goes beyond 115%.

The other two privacy coins par excellence also do well: Dash (DASH) doubles its value from the lows of the recent flash crash in mid-March, achieving a recovery of 100%; not far away but with a respectable rise follows Monero (XMR), with an increase of about 90%.

These are performances that have outpaced the recovery of Bitcoin (BTC), which from the same lows gains “only” more than 50%.

A good performance on a weekly basis thanks to the rise of the weekend for Ethereum that gains 20% from last Monday’s levels.

Among the big double-digit +10% increases, there’s also Binance Coin (BNB) which has anticipated in recent days the choral increase of the weekend. BNB, with the movement of last Saturday, has decisively cancelled all the decline that had begun on March 10th.

Other double-digit increases on a weekly basis are those of Tezos (XTZ), +17%, which continues to give confirmation of its excellent momentum. Chainlink (LINK) also earns about 10%, as well as Cardano (ADA), which rises over 10%.

The increases keep the market cap above 205 billion dollars in total. Bitcoin’s dominance falls back to 63.5%, abandoning the 64% level maintained throughout the past week.

Ethereum consolidates and holds levels of dominance just below 10%, the highest levels reached last week, which had been abandoned since early March.

Ripple unchanged at 4.2%, which loses ground both for interest but also because of the increasingly lower trading volumes.

On a daily basis, in the last few hours, Ripple has been overtaken by the volumes of Chainlink and Binance Coin. XRP is becoming less and less attractive not only in terms of prices, which remain low.

From the mid-March lows, it is the one earning less than the other two big ones, with a rebound of over 40%. Bitcoin does better, earning 55%, but the best is Ethereum that with the rise of this last weekend achieves a recovery that goes beyond 70%.

Trading volumes remain very low and this is an indication to follow carefully in the coming days because the rises supported by low volumes are not a sign of security.

Bitcoin (BTC) price

Bitcoin, over the weekend, returned to test the $7,200, below the levels of early April.

This is a sign of how Bitcoin in recent days is struggling to push above previous period highs. This is currently not a positive sign in the short term.

It is necessary for BTC to push as soon as possible in the 7,400 area, otherwise, in case of downturns, it is best to hold the 6,800 in the short term.

A drop tof $6,500 in the next few days would begin to give a bearish signal for Bitcoin, validating the hypothesis of being at the end of the monthly cycle started in mid-February and expected within the week just started.

Ethereum (ETH) price

Ethereum performs much better, and the rise of the last weekend almost completely cancels out the bearish movement recorded in mid-March. The recovery of $190, an area of resistance that in recent days had been indicated as a likely target level reached, was an opportunity for short-term traders to take advantage of the profit-taking that in these hours is pushing prices below $180. Nothing worrying after the break of $175 last Saturday, which is now becoming an important level of support.

In the medium term, ETH has ample room for manoeuvre. Only a fall below $160 would show a first sign of weakness, a signal absent from the mid-March lows.