A bearish movement for Bitcoin and a step backwards for the crypto market, which in less than 24 hours cancels the rises it had built in the first ten days of the month.

Already in the early hours of yesterday, a weakness was evident after the attempt to overcome the resistance of the last few days. Bitcoin was trying to rise above the $10,000 threshold.

A weak trend then became evident shortly after 2 PM (UTC+2) and then exploded in the early evening with a bearish movement that saw negative double-digit figures.

This was due in particular to the profit-taking and the fear that the repeated attempt to go beyond the resistance of the last few days had not been successful.

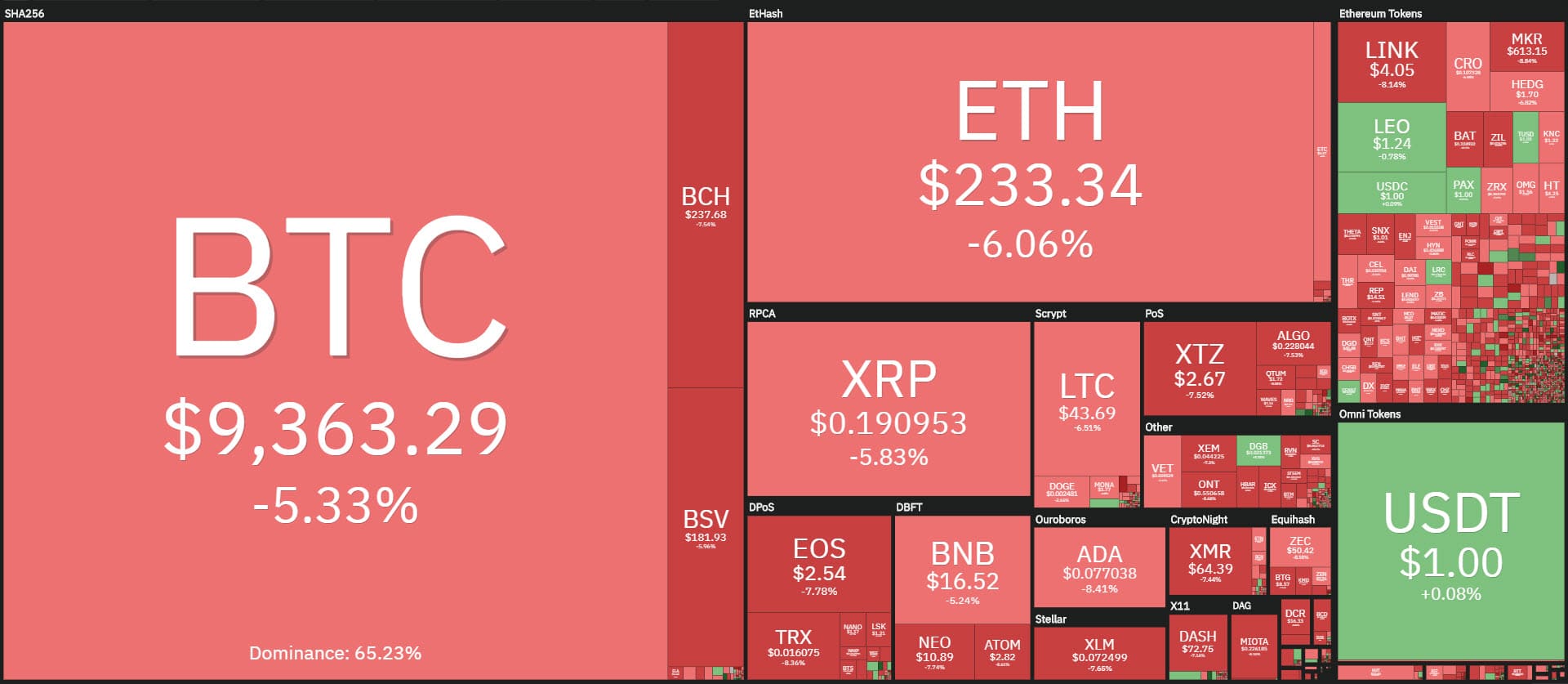

Today’s openings only reflect the weekly sentiment with a prevalence of negative signs: more than 90% for the first 100 are below par.

On a weekly basis, in the top 20 there are only two positive balances, Leo (LEO) which gains 1%, while Crypto.com (CRO) does much better and thanks to the rises of the first days of the week, it achieves a rise of almost 10%.

To find more vigorous rises, it is necessary to go beyond the 20th position. In 25th Maker (MKR) sees an increase of over 40%, the same intensity also for VeChain (VET), in the next position.

Much of Maker’s rise is absorbed by the drop that today sees MKR slide more than 10%, relegating it to the worst drop of the day. Together with Maker, a double-digit drop is that of Theta (THETA) who, after the stellar rises of May, sees a particularly tough June due to the profit-taking.

Among the gains, today on the podium there is Kyber Network (KNC), which achieves an increase just under 10%.

In the DeFi universe, besides Maker and Kyber, Eidoo‘s (EDO) positive performance is back and yesterday afternoon it revised its 60 cents on the dollar, a level it hadn’t recorded since July 2019.

In spite of the bearish movement due to speculation and profit-taking that increased volatility, Eidoo is now at $0.55. With yesterday’s rise, EDO gains about 1500% from March’s lows, with the price more than doubling since the beginning of June, placing it among the best performances of the last two weeks.

As usual, today’s declines increase the trading volumes of the last 24 hours to $100 billion, an increase of 20% compared to the previous day. Bitcoin sees volumes fly over 3.5 billion yesterday, the highest level since June 2nd, another day with a strong price fluctuation.

On the subject of volumes, a significant movement of Bitcoin between wallets occurred yesterday. The services that monitor these movements have noted that around 6 AM (UTC+2), in the space of a minute, there were several trades for a total of over 132,255 BTC for a value of 1.25 billion dollars. This is one of the biggest shifts that have taken place in recent months.

At the moment no one has claimed this movement, so it is not known whether exchanges were involved. These transactions have seen a total commission of $2.

Yesterday’s crash cannot be called a real crash for Bitcoin. Looking at the volatility, after touching the lowest levels of daily volatility since the end of April, BTC has seen an increase in volatility that yesterday jumped to 160%. In June, there were already higher peaks of 210%.

Yesterday can be defined as a day with a strong bearish movement, with a loss of about 9% from Wednesday night’s tops, when Bitcoin attempted to climb above $10,000.

Yesterday’s drop stopped at $9,050, going to review the values of the last days of May. It’s a signal that, as usually happens, drags the whole industry behind it and leads again to re-evaluate the current trend on a monthly basis.

The market cap slips and loses more than 10 billion returning to 277 billion of total capitalization while Bitcoin returns to 173 billion, maintaining its market share that continues to fluctuate just below 65%.

Despite the slide of 4% of the price, Ethereum (like Bitcoin and Ripple) remains at the highest levels of the last two months with a market share just under 10%.

XRP continues to slide down to 3.18% dominance, the lowest levels since December 2017, confirming the difficulty of XRP to appreciate not only the value but also the development of the project.

Bitcoin (BTC) downwards

With yesterday’s bearish movement, Bitcoin breaks the dynamic support that accompanied the bullish trend of last mid-March. The break of $9,200 pushes prices to a step from $9,000.

In case of a break during the weekend, the next crucial support will be in the $8,800 area, levels of late May.

Bitcoin currently sees a movement that aligns with the closing of the half of the monthly cycle started exactly at the end of May. A price recovery will be needed over the weekend to confirm both the cyclical hypothesis and to restore confidence in the possibility of breaking the $10,000.

Otherwise, it is necessary to hold the $8,600-8,800. A possible break of this level, which is a crucial medium-long term support, would see the next target at $8,150, the mid-May lows.

Ethereum (ETH)

Despite the fall that yesterday saw prices return to test the $225, a level of support in the medium term and which coincides with the dynamic support of the lower band of the bullish channel, at the moment the bullish trend has not weakened for Ethereum since mid-March.

For ETH, it is necessary to confirm the holding of $225 to be able to return to review the $245-250 in the coming days. If the $225 breaks, the next most direct level of alarm is $215 and then the psychological level of $200.