bZx is a DeFi protocol regulated by a set of smart contracts on Ethereum that enable lending and margin trading.

It consists of two products, Fulcrum & Torque.

- Fulcrum is a DeFi trading platform for beginners and professionals that does not require deposits to start and also offers lending.

- Torque handles more complex tools and allows borrowing assets like some of the other DeFi protocols on the market.

Earlier this year bZx suffered two major attacks due to the introduction of the “Flash Loans” feature in the protocol without a proper security audit and the use of Kyber Network as a price oracle. The team had also attempted to negotiate the bounty with the hacker team that discovered the attack, which turned out to be profoundly wrong.

The attacks resulted in a total loss of approximately USD 1.3 million, but it is important to note that the losses did not involve platform users.

Subsequently, the team humbly acknowledged their mistakes with a public post explaining the reasons for the hack and the measures they would take to revive the platform. From the need for external security audits to the constant release of code, all interventions at the level of procedures that should prevent the recurrence of a situation such as the one that occurred during the attacks.

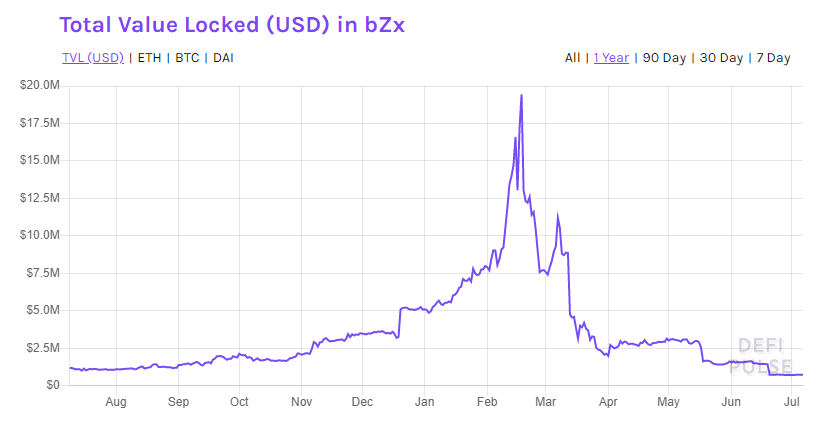

The use of bZx in constant decline

After the hacker attacks, investors preferred to exit the platform, generating a steady decline in its use, bringing it back below launch levels. Currently the bZx protocol has dropped to 26th place in the DeFiPulse ranking, with a value of $733.6K managed by its smart contracts.

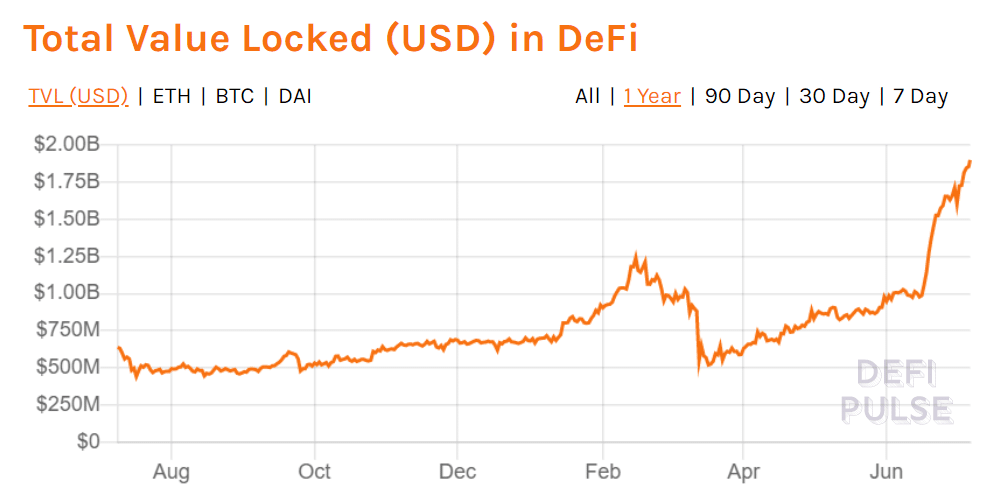

This decline is not only due to attacks but also to a market that is in a constant evolution like DeFi, so users have preferred to move their assets to other platforms. Nevertheless, the value of the assets invested in DeFi has continued to grow, also thanks to the recent phenomenon of farming.

The new bZx arriving on July 13th

July 13th should be the date of the protocol update, provided that the 2 independent safety audits and the formal verification for the relaunch have been successful.

It was also chosen not to perform a rebranding of the protocol, which has been redesigned from scratch, and the team states that the new bZx is much superior and more advanced than the current version.

bZx has put a lot of emphasis on modularity in the DeFi ecosystem, working with MyEtherWallet, KyberSwap, DeversFi, etc. to provide a certified trading solution, unlike their main competitor dYdX which chose a hybrid DEX instead.

In recent months the team has published a series of posts on their blog with which they intend to revitalize the platform.

First of all, with the update, bZx has thought well to reward investors who contribute to the lending pool of iETH. At the moment it is impossible for app.fulcrum.trade lenders to withdraw their ETH.

To avoid further attacks, the open liquidity of ETH pool has been reduced, and the team manually refinances loans to lower their debt rates gradually.

ETH lenders can leave the pool immediately, with the possibility of receiving BZRX at a discount using their own iETH. These tokens would be locked into a 4-year vesting contract.

Otherwise the lenders can leave their ETH in the pool, which will be refinanced with half of all fees collected from loans, trading and debt will be converted to ETH on a weekly basis and sent to the iETH pool, creating free liquidity for the lenders. This will continue until the remaining debt in the iETH pool is repaid or the bZxDAO votes to change this. In addition to this, a separate pool will be created from which borrowers can access open liquidity.

As far as the oracles are concerned, the team already uses the Chainlink feed. The developers of bZx have preferred not to use an average between the prices of Chainlink, Band Protocol and Uniswap V2 as stated in Mea Culpa’s post, since it is technically complex with no obvious advantages in terms of security.

The BZRX token

The BZRX token was originally sold in an ICO in September 2018 at a price of 0.000073 ETH. In the public sale 15% of the total token supply of 1,030,000 BZRX was distributed.

The distribution of the remaining tokens will not take place with a new ICO but will take place in a 4-year vesting contract from the moment the token is released.

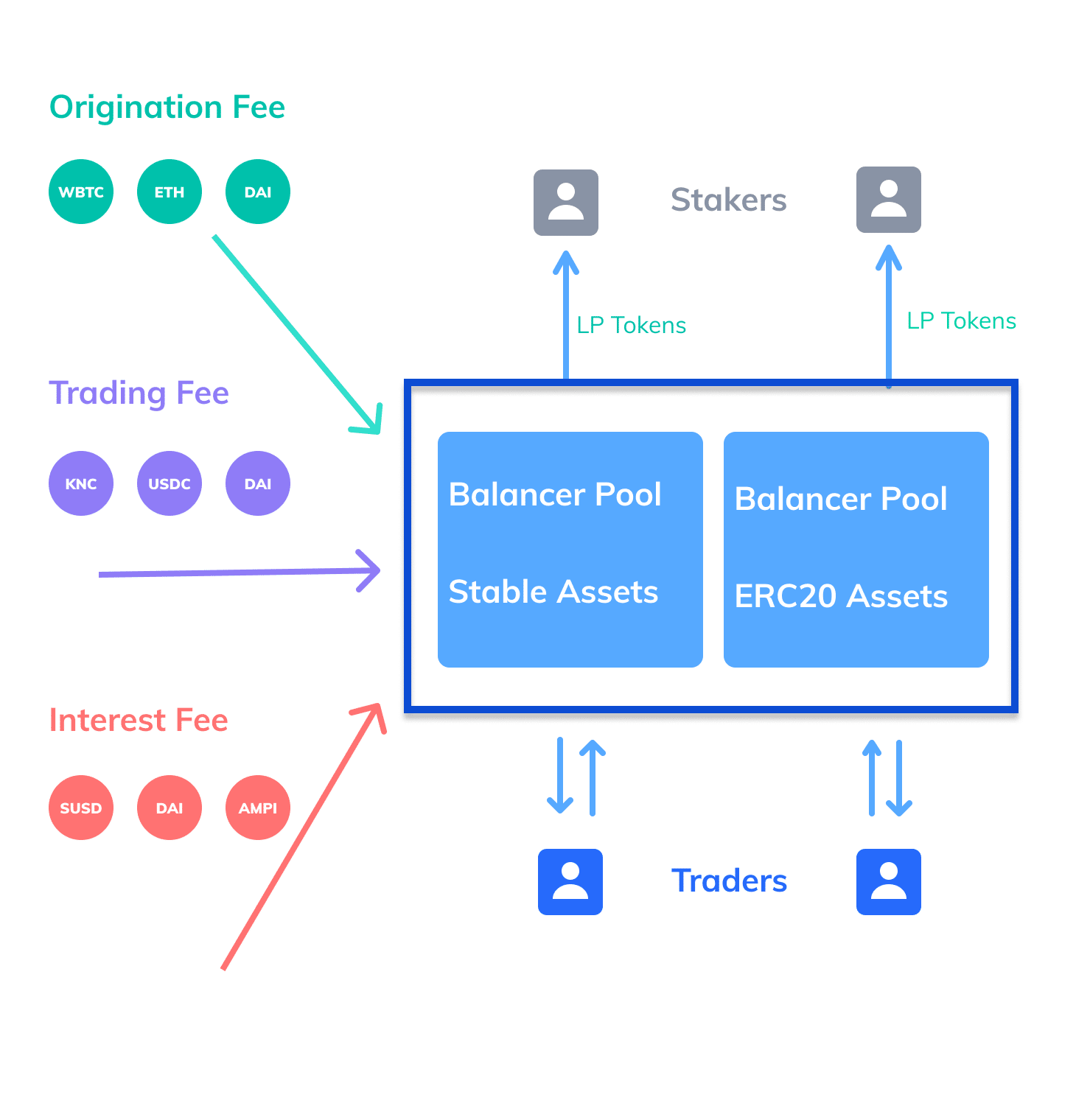

In addition to offering a reward to lenders impacted by the lack of liquidity in the iETH pool, the new version of bZx takes advantage of the fees generated by exchanges, loans and debts generated on the platform to pay users. The three key commissions are broken down as follows:

- Source commission: 0.09%.

- Negotiating commission: 0.15%.

- Interest rate commission: 10% of interest paid

Commissions are paid in their original assets, without requiring an extra swap. The commissions are directed to two Balancer pools, and those staking their assets on bZx will receive Balancer Pool Tokens (BPT) which represent a right to the assets in the pools. In this way the new bZx takes advantage of the modularity of DeFi protocols and generates interest in investors who can receive BPT tokens.

When an individual stakes their BZRX to a representative, they are entitled to new commissions generated by the protocol in proportion to their staking.

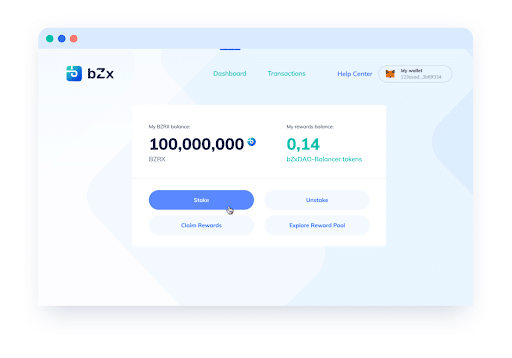

Withdrawing commissions and staking BZRX will be made easy with the introduction of a new portal, with which every transaction is just a click away.

There will also be a commission-generated insurance fund, designed to offset any losses for credit institutions or users in the event that the return on the settlement system is insufficient. In addition, tokens are redeemable for the insurance fund and constantly accumulate capital support while the protocol locks more assets.

The BZRX DAO

20% of the token supply has been allocated to reward users who use the protocol. Each time a user pays a commission, 50% of the commission value is refunded in the form of BZRX, with an initial price of .0002 ETH for BZRX. Chainlink will provide a price feed when the token is unlocked and there is sufficient liquidity.

During the first three months, 0.25% of the BZRX token supply will be paid to users each week based on the fees generated, in order to start the protocol business by compensating the first users for the risks they run.

In this way all users will start acquiring ownership of the protocol. The BZRX token will be used to participate in the BZRX-DAO that will be launched during this year, and will allow to manage the governance of the protocol:

- maintaining the margin covered by the insurance fund,

- the assets supported by protocol,

- the percentage of interest raised by the lenders,

- the coefficients of the interest rate model,

- etc.

Conclusions

Whilst DeFi farming has never been so popular, bZx relaunches its protocol by focusing on commission rewards and the BZRX token for those using the platform. The latter could also be listed shortly on Uniswap or some centralized exchange, helping to generate hype around the price.

In the short term we will be able to see whether this new version of bZx will be a liquidity catalyst for DeFi as was recently Compound, and whether it will be able to bring bZx back to the top of the DeFi charts.