Although Bitcoin continues to remain stuck, oscillating at yesterday’s levels in the $9,300 area, price of altcoins take off, for instance Cardano, and detach themselves from the correlation of the movements usually driven by BTC.

In these last 24 hours, scrolling the top 10, only Bitcoin is below par.

The best of all, which continues to impress, is Cardano (ADA), which also today is still up by more than 25%, bringing its price above $ 0.1386, the highest levels of the last two years, abandoned in August 2018.

This rise makes Cardano conquer for the first time in its history the 7th position, undermining Litecoin and even the 6th position, where a head-to-head with Bitcoin SV is underway. Cardano had never managed to climb so high in the standings.

XRP‘s move up by more than 7% is surprising, with its prices going above 20 cents, a level abandoned a month ago on June 11th.

XRP, despite today’s good rise, is once again seeing its prices hitting around 20 cents, which has been catalyzing attention from the bottom up since early April.

Looking at the list of the top 100 today, over 75% are in positive territory.

Among the best rises are Dogecoin (DOGE), which climbs to the top of the podium with an increase of over 50%. Next comes Cardano, +25%, third VeChain (VET) which gains 17% in 24 hours.

There are also the rises of the tokens of the DeFi universe such as 0x (0X), Chainlink (LINK), Ren (REN), Synthetix Network (SNX), Zilliqa (ZIL), all with rises of more than 10%.

On the opposite side, the worst descent is KuCoin Shares (KCS) -6%. Compound (COMP) continues its phase of extreme uncertainty, similar to Kyber Network (KNC) and Loopring (LRC), all falling more than 4%.

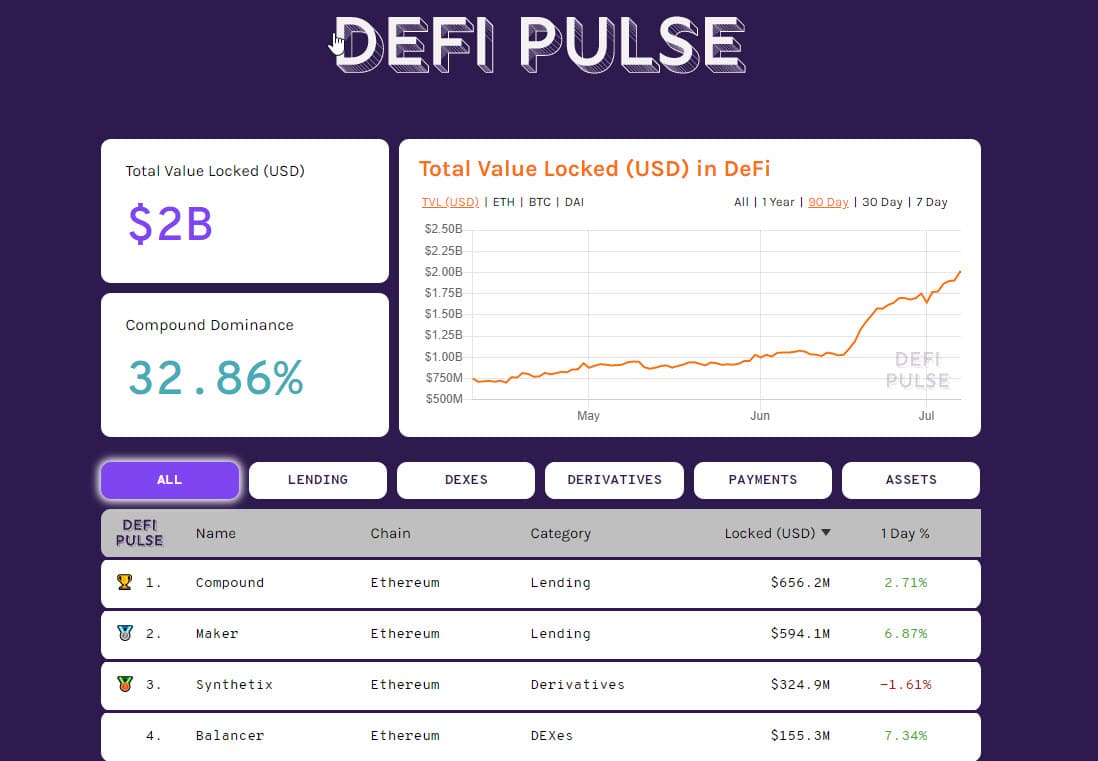

The DeFi sector continues to attract attention with deposits and locked tokens which continue to rise to over 2.1 billion, new absolute records, with an exponential upward trend.

Compound continues to hold the leadership even though its dominance drops to 32%. Maker is rising again. Between the two is a difference of about $70 million locked.

Trading volumes are contracting again with a decrease of more than 15% from yesterday. In the last 24 hours, Bitcoin has recorded one of the days with the lowest volumes of the last month, just over a billion dollars in value.

The market cap is back above 270 billion dollars, thanks to the altcoins that see the capitalization rise above 100 billion dollars, levels not recorded since last February. This indicates the possible beginning of an altseason, given that the dominance of Bitcoin falls below 63% in these hours. For Bitcoin, these are the lowest levels since the end of February.

Ethereum returns to its 10% of market share. Despite the excellent rise of Ripple, its dominance hardly moves and rises only a fraction, precisely to 3.04%.

This highlights how the altcoins are seeing other names shine, such as Cardano, Chainlink, Stellar, VeChain that rise by more than 10% and their better performances conquer the market.

Bitcoin (BTC) price

The price of Bitcoin continues to fluctuate around $9,300. These last 24 hours see the positions of professional traders monitoring the $9,350, where there is the highest exchange of put and call options.

The indication of the past few days remains valid. A break below $8,900 would test the $8,650-8,700, levels that coincide with the lows at the end of May.

For BTC to rise, the $9,600 recovery is necessary, which, in addition to being a technical resistance level, is where the first level with prominent call options is placed.

Ethereum (ETH) price

Ethereum tries to consolidate yesterday’s rise in the $240 area, levels where the prices of ETH have been fluctuating in recent hours.

To give a real bullish signal, Ethereum should go above the highs at the end of June at $245-250. This would give the possibility of finding the confidence to break the highs of early June, the tops of the last 4 months, in the 255 dollars area.

Conversely, a return of prices below the double low recorded between mid and late June at $215, which coincides with a former resistance, would open a bearish phase for ETH with the possibility of increased volatility. The 215 dollars are in fact a level that sees a high number of put positions opened by professional traders to defend this threshold.