When it comes to decentralized finance (DeFi) an important aspect is that of stablecoins such as DAI and USDT and, with these, significant profits can be generated.

One of the most famous and interesting subsets of DeFi is that of loans that allow lending or borrowing crypto assets in exchange for very advantageous interest rates when compared to traditional systems.

There are several protocols that allow lending, such as Compound, Aave, Curve and so on.

The projects are many and very different but some are better than others because they allow the integration of different protocols or to move funds from one protocol to another depending on the best interest rate.

How to make profits with DeFi

In this context, we will analyze an Italian platform that is achieving incredible success among people who want a passive income thanks to stablecoins. We are talking about Idle Finance.

Idle Finance is a platform with an integrated smart contract for each stablecoin, which moves funds according to where the annual rate is more convenient.

How does Idle Finance work?

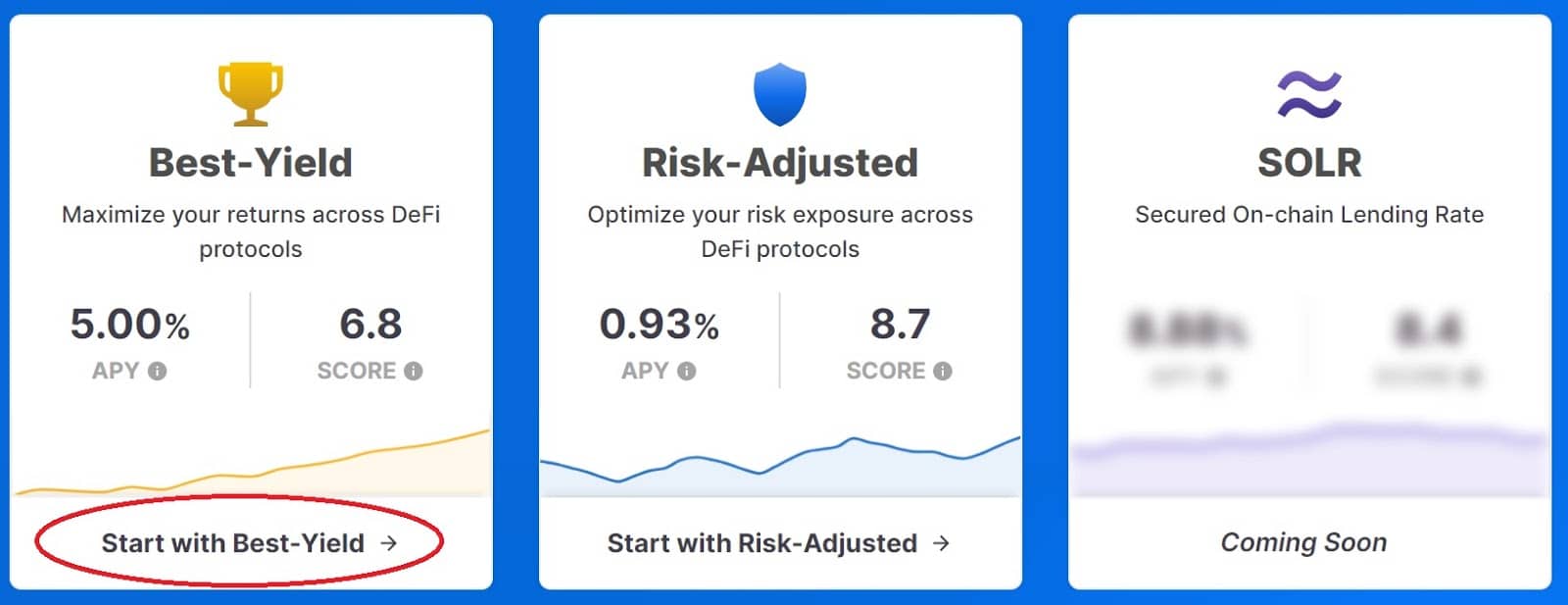

The platform comes with 3 options (although only 2 are active for now) that are:

- Best-Yield to get a good ratio between annual rate (APY) and optimal score (taken from Defiscore);

- Risk-Adjusted provides a score compared to the annual return, and therefore has a higher level of security;

- SOLR, which is Secured On-chain Lending Rate.

Most users want to get the most out of their crypto assets and so will probably choose the Best-Yield option.

Before we start using this platform we need to have a few things.

- A wallet that supports the Ethereum blockchain, such as MetaMask;

- Some ETH to cover the cost of the transactions;

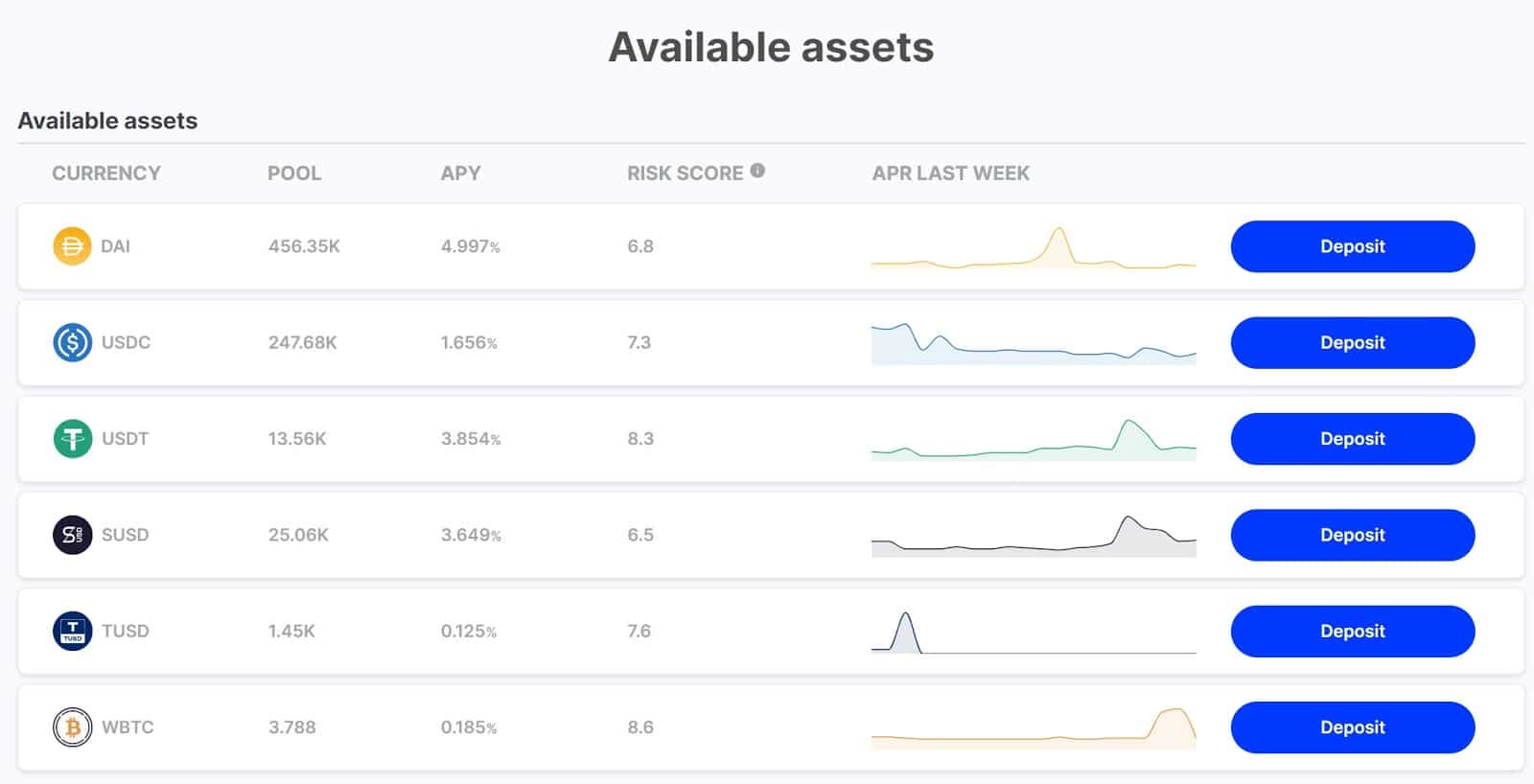

- One or more stablecoins including USDC, USDT, SUSD, TUSD, DAI and even wBTC.

The first step is to unlock the wallet and connect to the official platform by clicking the “Start with Best-Yield” button.

By connecting the wallet we will be faced with all the available assets and we can see both the size of the pool and the current APY as well as the risk score.

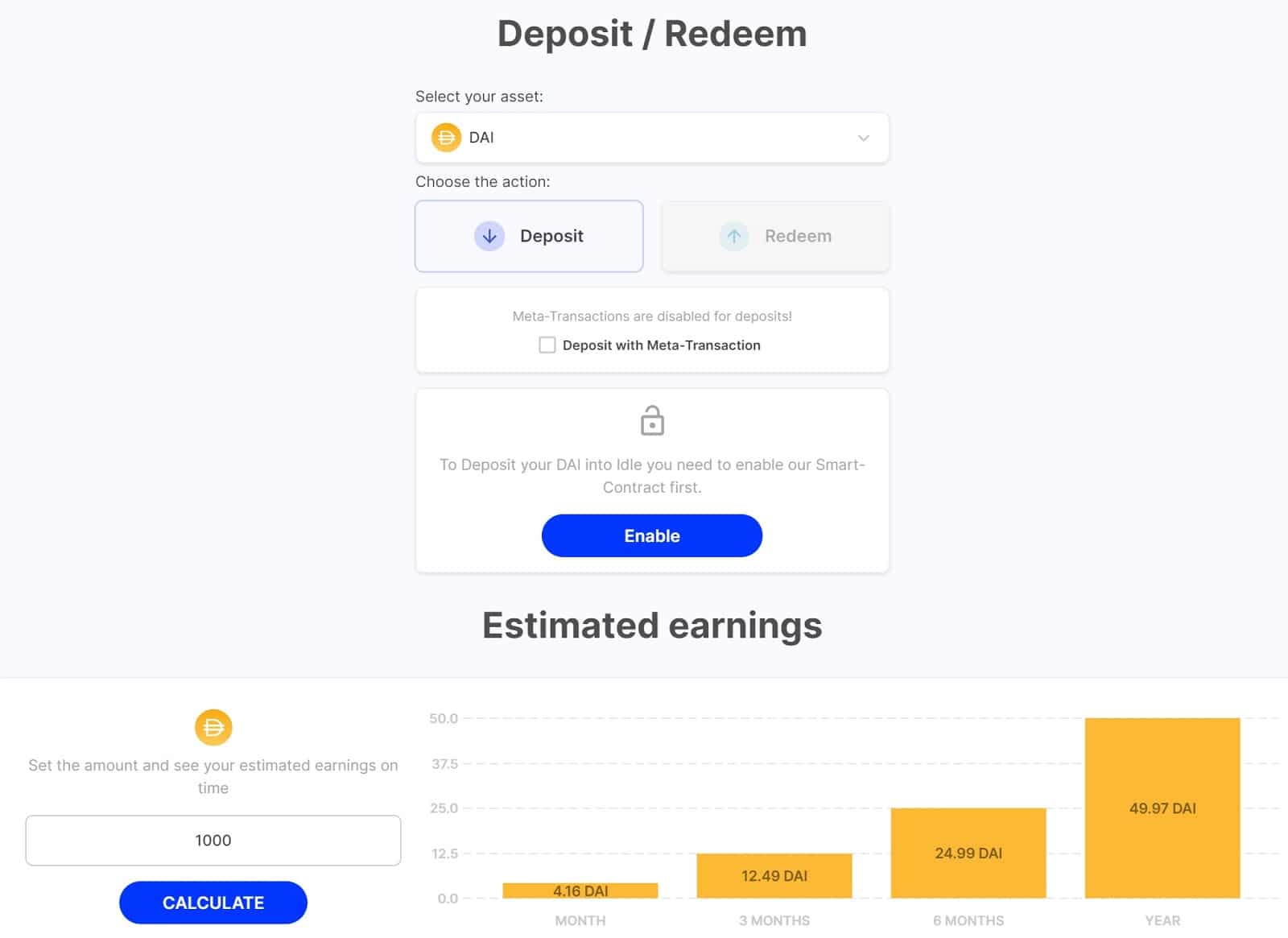

Depending on the APY we want, we will have to click on the “Deposit” button, lock the smart contract by confirming the transaction and choose the amount to deposit.

Next, the transaction must be confirmed.

It should also be noted that we are also given a projection of the profits that we can generate based on what we deposited.

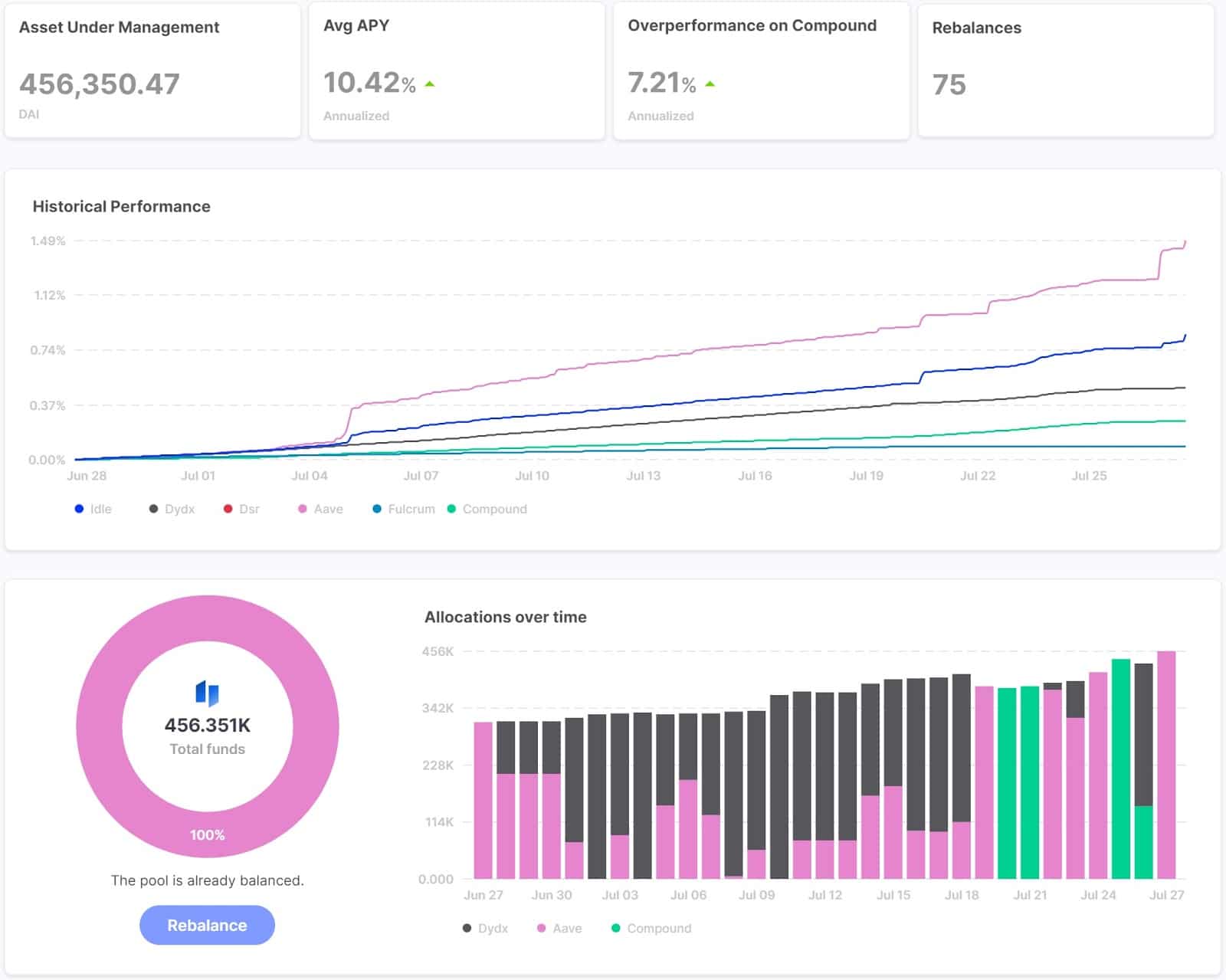

Here we can see the average APY, the total interest that gradually increases, the risk score, the composition of our crypto portfolio and its performance.

If we move to the side menu of the statistics we can see the performance of the pool, where all the funds of a certain stablecoin are located and analyze over time which has achieved the highest return.

Let’s not forget that the various protocols are dYdX, DSR, Aave, Fulcrum and Compound.

Throughout time, interest rates have also reached 3-digit peaks.

How to open positions?

In the side menu you can find the option “Tools” from which you can select the following items:

- Token Migration: to move the relevant tokens we have on Idle;

- The Add Funds function allows to buy crypto assets by bank transfer or credit card;

- Token Swap is a DEX that provides the ability to convert the tokens in our address and convert them into various stablecoins.

What are the risks of such a platform?

The security risks are minimal as the team does not have access to funds.

Idle has also passed several audits for its smart contracts, so there is a high level of security, but of course, like all smart contracts, nothing is infallible.

How much profit can be made?

The profit is directly proportional to both the amount we are going to deposit and the interest, which as we have seen is variable (between 2% and infinite).