Bitcoin’s attempt to go above $11,000 failed, the first after the sharp drop at the beginning of the month that in two days had lowered the prices by more than 15%.

Yesterday’s rise saw Bitcoin move against the trend of the rest of the sector which is in the red. Despite the increase in volumes above $2.2 billion, the highest peak since September 8th, and the rise above $11,100 USD, the new purchasing volumes remain modest.

Like yesterday, the red sign continues to prevail among the top 100 cryptocurrencies. Unlike yesterday, today’s rise in Bitcoin (+0.5%) drags the rises of both Ethereum over 3.5% and Ripple (XRP) +2.5%.

The best of the day is Synthetix Network (SNX) +7.6%, followed by Kusama (KSM) and Blockstack (STX) both over +6%.

After three days of strong increases, today Hyperion (HYN) drops more than 10%.

Sushiswap collapse

Sushiswap performs worse, with a drop of almost 20%. The fork of the Uniswap DEX loses its appeal. The reason? In the last few hours, Uniswap has launched its own UNI token which allows participating in the protocol’s governance vote, bridging an important gap.

And that’s not all. All users of the decentralized exchange can claim about 400 UNI tokens that at the current exchange rate are around 1200/1500 US dollars. A decision that in these hours is leading many traders and liquidity providers to claim the token by increasing transactions on the Ethereum network by more than 30%. This again makes the cost of gas rise to a new record 650 Gwei (about $5.20 at the exchange rate) from yesterday’s 152 Gwei.

Also contributing to the euphoria is the listing of the UNI token on the Binance, Huobi and OKEx centralized exchanges.

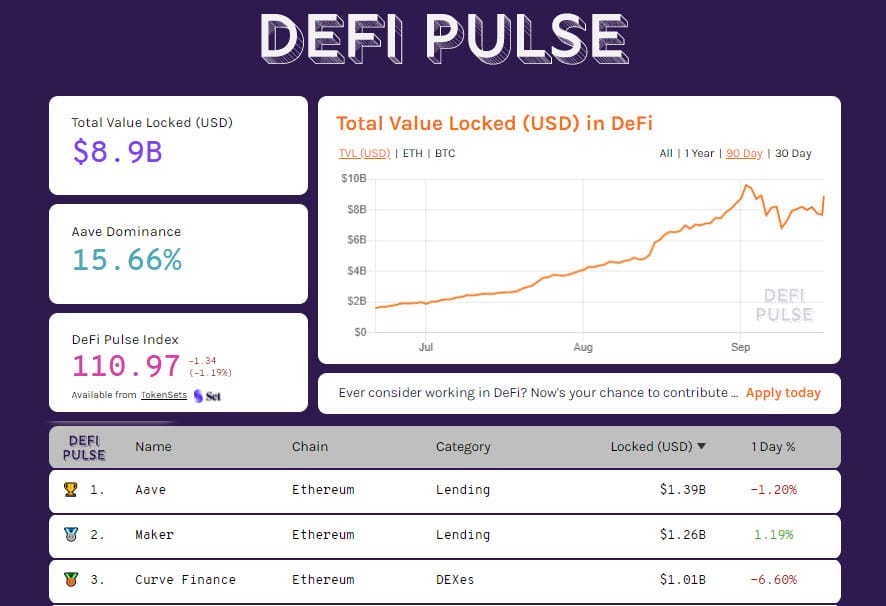

DeFi, market cap and dominance

The total value locked in the decentralized financial protocols rises just above $9 billion with the number of Ether locked just one step away from the absolute record of 7 million reached on September 5th.

The number of tokenized BTC is stable above 1100. Aave, the lending dApp with over $1.4 million of locked collateral remains in first place, while the two DEX Uniswap and Sushiswap continue to attack the third position of Curve Finance, another decentralised exchange.

The slow recovery of the market cap continues and today it is gaining just over $1 billion, bringing to a total capitalization of $347 billion. The dominance of Bitcoin remained stable at just under 58%, whereas Ethereum is at 12.3% and XRP at 3.3%.

Bitcoin (BTC) fails to stay above $11,000

The defences placed on the Call options make themselves felt. Yesterday’s rise cannot go beyond 11,100 USD, the first level of defence protecting the long-term resistance at 11,890 USD.

The bullish trendline that has united the rising lows since last March until the beginning of the month becomes an area of equilibrium for the recent oscillations. It remains important to have confirmation of the 10,500’s resilience in the coming days.

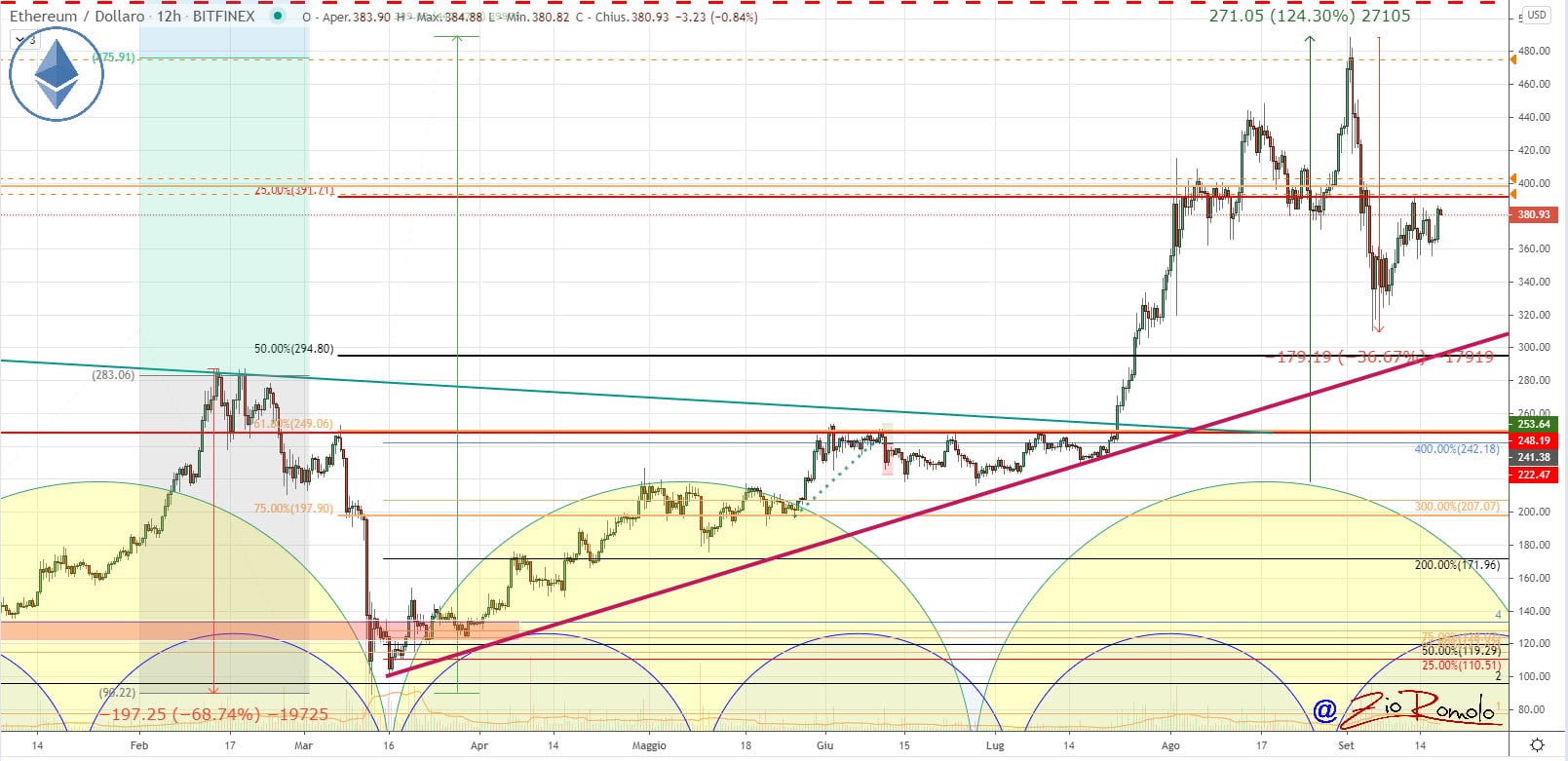

Ethereum (ETH)

For the fourth time in a week, prices return to attack the static resistance in the 380-390 USD area. Like the previous times, this time too the volumes are not providing the right support for an upward momentum.

A positive bullish signal comes from the surpassing of the 380 USD that has triggered the covers in options of the first wall to protect the rise, not reaching the 405 USD area at the moment, which will decree the eventual end of this rise.

On the contrary, a further leap upwards accompanied by volumes will inaugurate a new medium-term bullish phase.