All financial markets and the cryptocurrency sector today are characterized by downturns, caused by tensions and fears due to the uncertainty of the upcoming US presidential elections and the fear of the second wave of lockdowns that could follow as tests in Europe increase, as well as fears of further closures that would strongly affect the global economy.

The $2 trillion money-laundering scandal involving two financial giants, Deutsche Bank and JP Morgan, is also a major concern.

Yesterday the stock markets closed with one of the worst sessions since the beginning of the month that only in the US saw the S&P 500 recover.

Gold closed the day with a decline of more than 2%, reaching levels abandoned in mid-July. There was a strengthening of the dollar against the euro.

Cryptocurrencies experienced double-digit declines, as in the case of Ethereum, with losses of over 10%.

A series of events that brought to mind what happened in March with the Covid outbreak that brought down all the world markets.

An increase in tensions that can also be seen from the volatility of both the VIX on the S&P 500, which has risen for the third time in the last two months above the threshold of 30 points. The volatility of Bitcoin and Ethereum rises by 2% daily on a monthly basis.

This is a movement that will have to be carefully assessed in the coming days and which differs from that of March because there is not a real sell-off but a liquidity crisis due to medium and long term repositioning on commodities and stocks.

To the extent that yesterday, on such a tense day, trading volumes on BTC and ETH doubled the average of the last few days and weekends.

When there is this strong increase in volumes on a negative day, it confirms a reallocation of portfolios due to the closing of positions to cover losses recorded on other assets.

The same happens on Bitcoin and gold, as happened in March, emphasizing this theory confirmed by financial operators.

This is reflected in almost all of the first 100 crypto assets in negative territory, precisely like in March.

Only two are in positive, Orchid (OXT), +18% and Hyperion (HYN), which rises by 5% trying to reverse again the trend that last week saw it take the scene for three consecutive days among the best rises of the day.

Among the top 20, the worst falls of the day were Polkadot (DOT) and Binance Coin (BNB), which lost more than 11%.

Bitcoin is down 4%, Ethereum is worse with -8%. Ripple scores a -5% with prices that, unlike BTC and ETH, go back to the end of July.

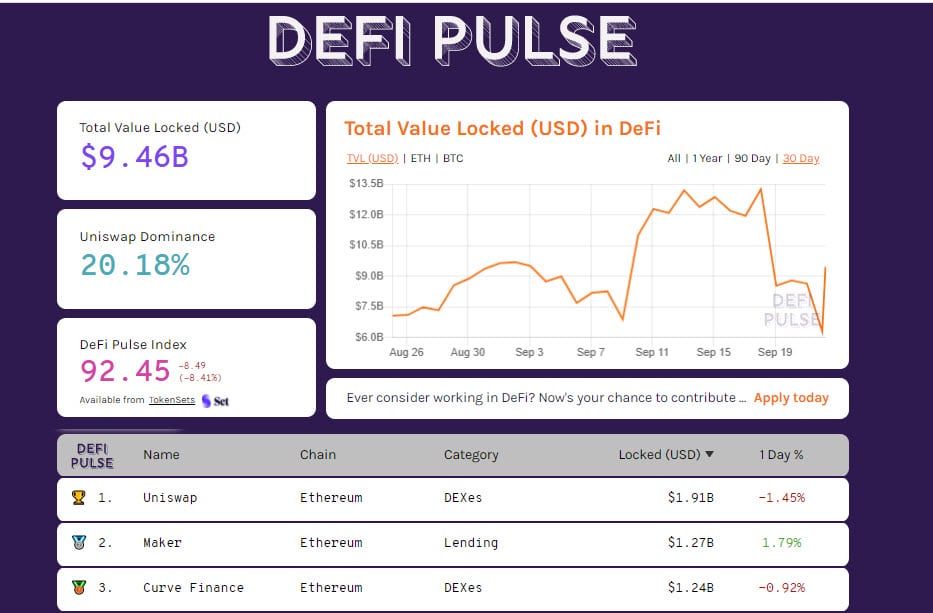

In this context, DeFi seems to ignore the downturn, even though the last 24 hours have seen strong liquidations as far as Ethereum is concerned.

In spite of this, TVL is still registering over 9.5 billion dollars. Uniswap‘s position remains strong with less than 2 billion dollars. Maker is on the rise, a lending and financing platform that regains the second position while Curve Finance remains stable in third. Aave drops to 4th position with more than $1 billion locked in decentralized dApps.

The market cap drops to $330 billion, the lowest level since early September, when Bitcoin’s strength was highlighted during the crisis with traders opening hedge positions on the digital gold.

Bitcoin’s dominance, as happens in these phases, rises over 58%.

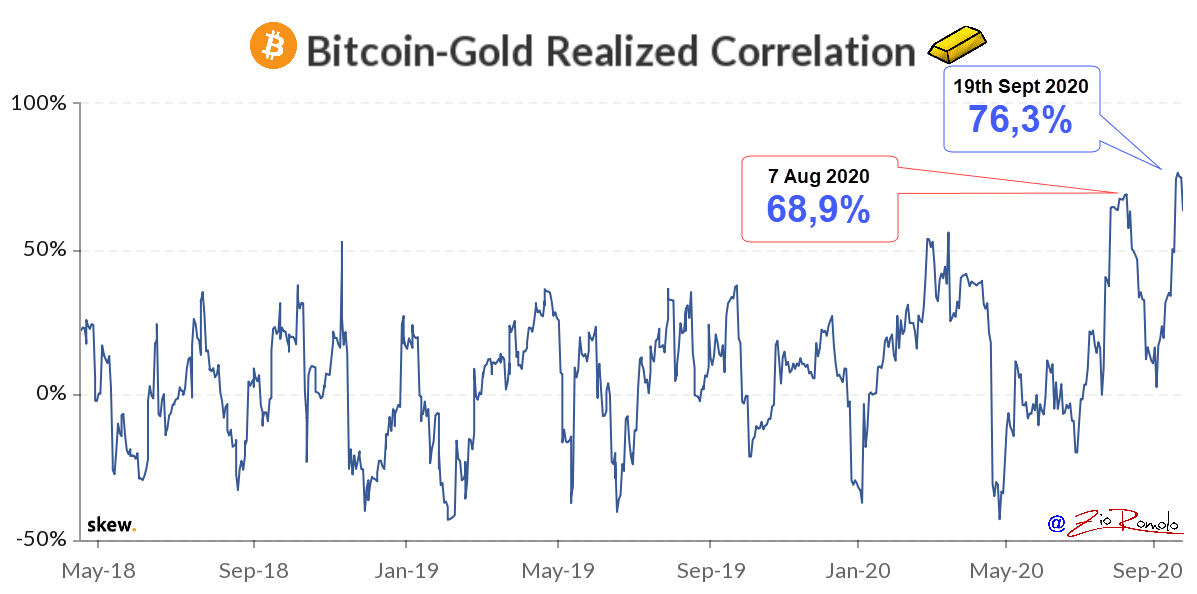

In this last week, the theory that Bitcoin is very much correlated to the movements of gold is strengthened. After the peak of the correlation, reached last Friday, between bitcoin and gold on a monthly basis, the value falls back to the absolute highs of the last year with more than 63% from the 75% recorded between Friday and Saturday.

The correlation with the S&P 500 remains stable just over 50% and this is definitely a signal that enhances the correlation between digital gold and physical gold.

Declines also for Bitcoin (BTC)

Bitcoin returns to test the $10,300, levels that in case of breakage would open up space to test the lows at the beginning of the month in the $9,800-10,000 area, which continue to be protected even by operators in options that keep this as a crucial area so that prices do not sink further to lower levels.

In the event of a break, there would be ample room to test the early summer lows at $9,000. After having failed the climb above the dynamic trendline of 11.000 dollars, it will be necessary to understand if in the next few days the strength will return to regain the threshold of 11.000 dollars.

If not, it is necessary to observe the holding of the $10,300 and then the $10,000.

Ethereum (ETH)

Ethereum unlike Bitcoin continues to give bullish signals in the medium to long term. This can be said to be a downward movement in line with the period of weakness, but it does not trigger panic precisely because the trend that unites the lowest rising levels since mid-March continues to be bullish.

However, what stands out is the weakness that is part of a long-term bullish phase.

For ETH, it is necessary to sweep away all doubts and tension with the return to the 390 dollar high, which in recent days has twice rejected attempts to rise. It is important not to break below $330, yesterday’s low, which coincides with the support base that rejected the tensions at the beginning of the month.

Otherwise, there would be room to test $300-305, an area well defended by professionals in options.