The tensions of the last few days and the fall in prices trigger the coverage of loans collateralized in smart contracts and so in the last few hours, there has been a sharp contraction in the collateral locked for lending and operations in decentralized finance (DeFi).

ETH fell from 8 to just over 5 million, as did tokenized BTC from 174,000 registered on September 18th to just over 117,000 in the last few hours.

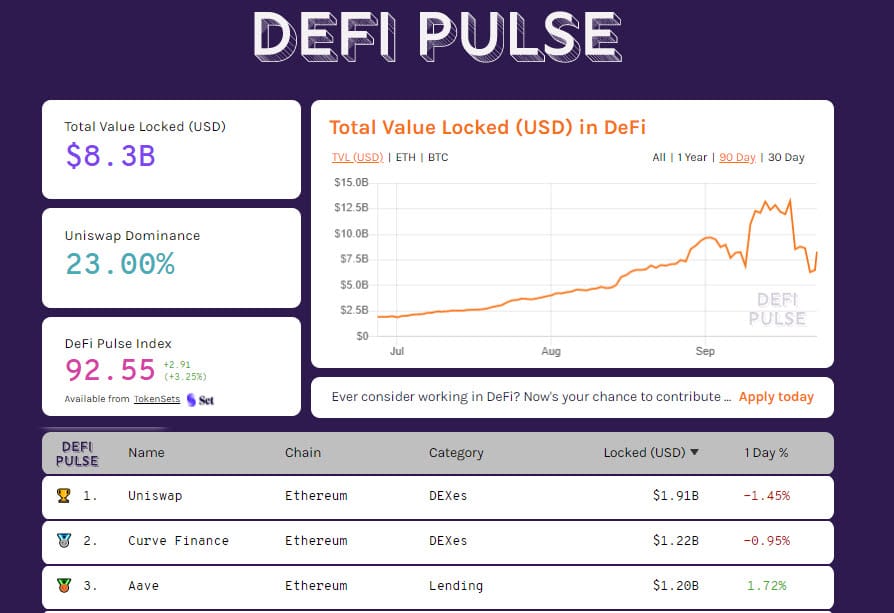

Meanwhile, a possible bug in the data provided to the DeFiPulse platform has plunged Maker’s TVL to below $18 million, down from yesterday’s $1.3 billion, which is affecting the total collateral locked in DeFi, which is now below $8.5 billion.

Overall, today shows a balance between positive and negative signs, with a slight prevalence of positive signs among the big names.

Scrolling the ranking from the top, the first red sign is that of Chainlink (LINK) with a -8%, among the worst falls of the day, continuing the trend downwards that began in mid-August. From the historical absolute highs of 20 dollars reached on August 16th, the value has lost more than 60% to date, revising the 8 dollar price at the beginning of August.

On the opposite side, the best on the top step of the podium is OmiseGo (OMG), with +20% celebrating the choice of rebranding with the new OMG Network.

Arweave (AR) follows with +11%, entering the top hundred for the first time, and Hyperion (HYN) with +10%, which continues to remain at the mercy of speculation with double-digit swings on both sides.

Total capitalization manages to remain above $330 billion with a further recovery of Bitcoin dominance rising to 58.5%.

Bitcoin (BTC)

The 10,500 USD area continues to remain a crucial level in the short term. In the last few hours, the 10,800 level, considered by derivatives operators to be the first one to overcome in order to give gasoline back to the bullish force, has been strengthened.

The protection of the area 9950-10000 rises to the lowest level. These are the levels to be monitored in the next few hours to assess the most likely trend in the coming days.

Ethereum (ETH)

The failure to exceed USD 390, which failed last week, highlighted the weak purchasing power. In the last few hours, the return to the area 340 USD raises the defences of the bulls.

In the event of a break, there would be room to test the USD 305-300, where in the last few hours the Put options have increased in defence of this medium-long term support, which coincides with the passing of the bullish trendline that combines the rising lows since mid-March.