PRESS RELEASE

David Waslen was finance first, then tech and, in the latter, he was influenced by his good friend and co-founder of HedgeTrade, Peter Danihel.

David has studied in the States as well as in the UK, taking a number of economic degrees. His background is venture capital and private equity with extensive experience managing growing businesses. He holds a BA from Dartmouth College and an MBA from London Business School.

As a Canadian, he’s travelled extensively and now lives in Singapore. When asked how he became involved in blockchain and crypto, he points to his experiences while traveling:

“I was moving from country to country and discovered how hard it was to open bank accounts and then transfer my money – both into different currencies and bank accounts. Oftentimes, the transfer would fail and I’d have to do it again. Plus, there were the fees associated with it. When I discovered Bitcoin, it all made sense,” he says.

His co-founder Peter is a self-taught programmer and experienced options trader. He has a breadth of experience with app development and building tech companies, including the sale of several internet businesses.

David first discovered Bitcoin in 2015/2016 and promptly ‘went down the rabbit hole’. He was blown away by the technology and cryptocurrency. “I knew the whole world is going to change, I knew that this was going to disrupt everything. It is still a nascent industry, but it is growing fast.”

David’s experience with traditional personal finance had not always been positive. When he looked at Bitcoin, he felt it was a no brainer:

“Having a digital currency that is seamless, frictionless and borderless across the world makes sense. We use our mobiles for everything so why not for payments? And then I learned about smart contracts and that was equally mind blowing. I could see how smart contracts would disrupt the financial sector, the accounting sector, and the legal sector. If you can automatically execute software without human error, then this has to be an improvement.”

David and Peter initially set up Rublix Development, which is headquartered in Singapore with offices in Canada and Europe. Rublix is a software development company that develops automatic high frequency trading engines. The direction of the company is both B2C and B2B.

In addition to blockchain and cryptocurrency, Rublix is focused on AI and machine learning. David confesses to not objecting to having online content curated for him.

“I know the big companies do it such as Facebook, Amazon and Google, but it makes sense to me. I would prefer, to be honest, to receive content based on what I am interested in, rather than randomly generated data.”

Using AI and machine learning is also critical to trading. The best traders, according to David, are those that do not have emotion – which becomes possible when using AI tools. And this was how the HedgeTrade project was conceived.

“We were working through the whole AI and trading idea when Peter came to me. He showed me how his trades were performing – which were doing really well. He said he might build a website and post these predictions so that people could follow him if they wished.”

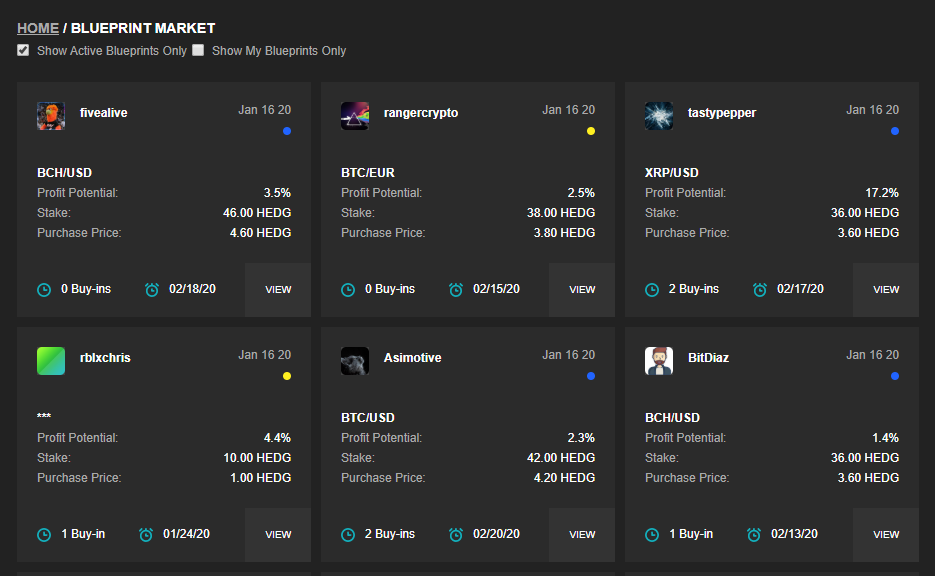

From there, the two founders began to tease out an idea which was to later become HedgeTrade. What if, they said, traders could post their predictions – blueprints they called them in the end – and people could follow them? Sure, the blueprints would be recorded on the blockchain so there’d be no room for cheating or deletion, but how could they make it truly interesting and potentially profitable?

“So we came up with this model where a trader posts their blueprints. They invest a stake – so they need to take it seriously. Other, less experienced traders can then choose to follow these traders and, for a small fee, see their predictions. If the trader is right, then they keep the fees. If they are wrong, the fees are returned to the purchasers. If a user likes the trader, buys the blueprint, and follows their advice and wins, then everyone is happy. And, since it is all on the blockchain, people cannot game the system.”

HedgeTrade is built using blockchain technology, so the blueprints made are immutable. However, despite choosing to develop on Ethereum, David is very clear that his project is blockchain agnostic.

“I imagine that better, faster, cheaper platforms will emerge, so the actual name of the blockchain is immaterial. For us, the certainty that trading predictions on our platform are true is crucial. The same goes for historic blueprints – they can’t be tampered with.”

HedgeTrade is already proving popular in its beta version. There are over 500 traders on the platform with hundreds of prediction blueprints. The team has plans to introduce new features to make it more optimal for traders, including a Leaderboard, a follow feature, and chat rooms.

“2020 is going to be the year of crypto trading,” predicts David.