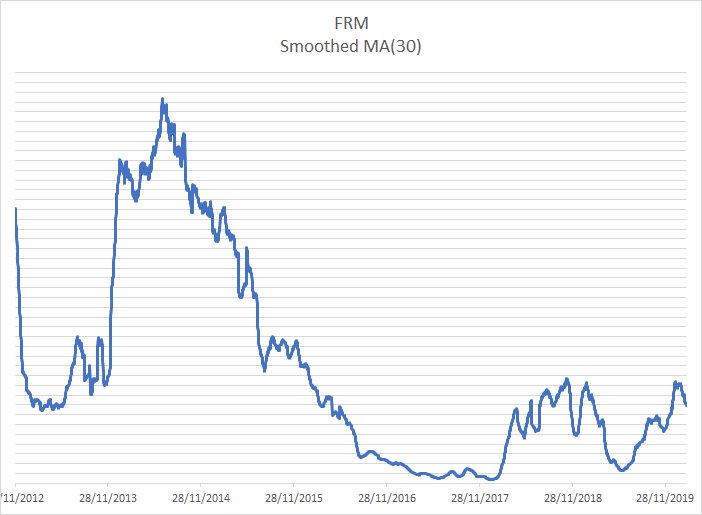

The Fee Ratio Multiple (FRM) is a sort of security index which helps to understand how safe the blockchain will be after a halving lowers the block reward, for example on the occasion of the next Bitcoin halving in May.

The security of a blockchain can be measured in different ways and by reading the public and transparent data of the Bitcoin chain it is possible to detect a trend.

Based on a metric devised by Nic Carter, a couple of years ago researcher Matteo Lebowitz suggested using the relationship between the miner’s reward (block reward together with transaction fees) and transaction fees to assess the security of a blockchain.

Using these values it is possible to understand the performance of network fees related to the profitability of mining.

A low FRM suggests that the revenue generated by network fees can provide a sufficient and profitable level of safety for miners to continue their operations without having to rely on the block reward. A high FRM, on the other hand, makes it clear that without block rewards, miners’ operations are not sustainable in the long run.

This metric can be applied across the periods between the two halving events on November 28th, 2012 and July 9th, 2016, using the freely downloadable data provided by blockchain.com.

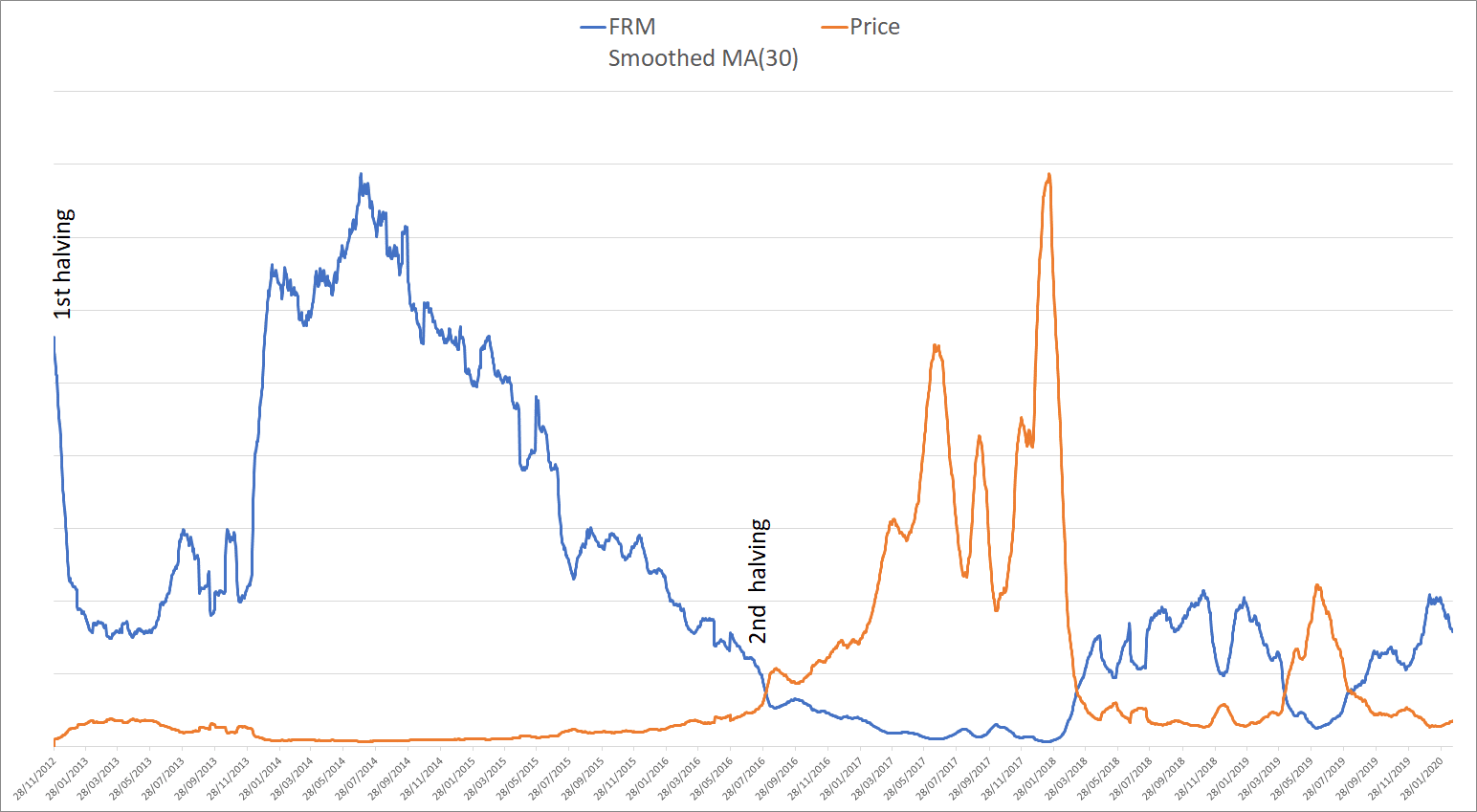

Cross-referencing this chart with the historical values of the bitcoin price it is possible to see a coincidence of the increased security with the price increase (the values are scaled to allow an easy comparison of trends).

There is a decrease in the FRM when the bitcoin price goes up. In other words, when the price of the underlying increases, the fees earned by miners also increase and so does the profitability of mining operations. However, when looking closely there is a downward trend from the peaks of mid-2014 as the FRM gradually drops.

The next halving is scheduled for May 12th, 2020 and although most investors expect a race to the top, it is not clear exactly what influence it will have on the price of bitcoin. The interest of the miners seems to be on the rise despite the halving, as is also shown by the continued growth of the hashrate.

If the FRM of bitcoin continues its further decline, the network will continue to be safe as it is supported by mining operations even when the block reward will disappear (almost) completely.

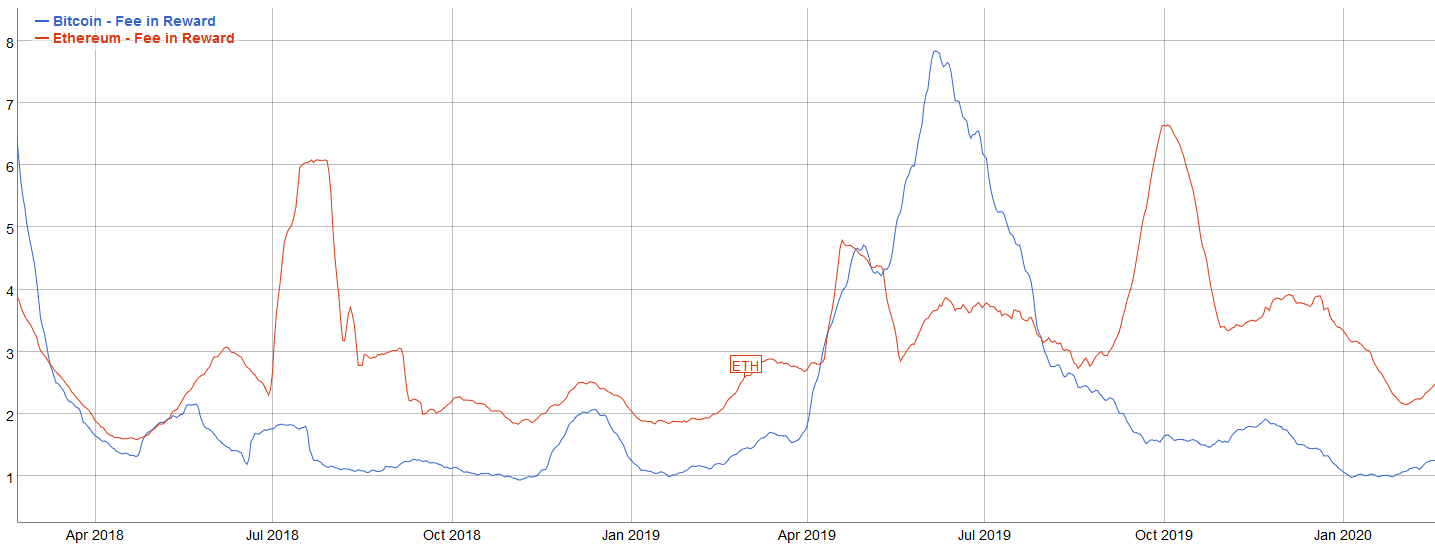

What is the Fee Ratio Multiple of Ethereum?

Ethereum has a better perspective than Bitcoin, as network fees make up a higher percentage of the miners’ rewards.

Data: https://bitinfocharts.com/comparison/fee_to_reward-btc-eth-sma30.html#2y

From the chart of the last two years, it can be observed that Ethereum, despite the Bear market, maintains a fee ratio almost constant and almost double that of bitcoin, excluding last June’s peak price period. This suggests a network is more profitable for miners regardless of the block rewards.